With the Cr symbol and atomical number 24, this shiny base metal is one of the 21st most common elements on Earth.

Every year, roughly 20,000 tons of chromium metal are generated, with about a billion tons of huge reserves that aren’t unexploited yet.

It’s a steely-grey transition metal that’s glossy, hard, and fragile. In stainless steel, chromium is the principal additive and carries its anti-corrosive qualities. Chromium is also prized for its ability to be finely polished while remaining tarnishing-resistant.

Uses

Metallurgical Industries: frequently added into steel to create a corrosion-resistant alloy. It is implemented in the refinement of stainless steel.

Chemical Industry: Chromium salt is used for electroplating, tanning, printing, and dyeing, as well as medicine, fuel, catalysts, oxidants, matches.

Refractory Materials: Chromium can be utilized in a variety of ways to preserve heat due to its high melting point.

Automotive Industry: for brake pads that need to be resistant while it rotates and rubs with other car parts.

Chrome vs Chromium

When chromium is electroplated over another metal, it is called chrome. It frequently contains chromium oxide, which prevents corrosion of the underlying metal.

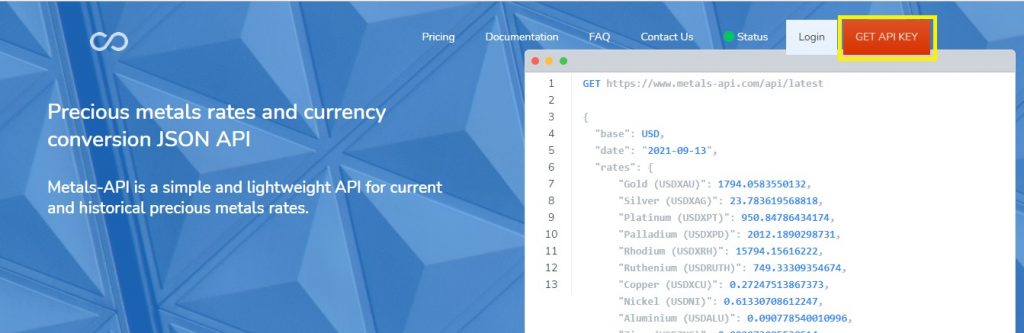

Thus, Metals-api.com provides a free API for anyone interested in knowing historical and real-time rates of Chromium, gold, silver, palladium, platinum, or any other metal.

Metals-API.com allows users to get precious metals market data via an API with a precision of 2 decimal points and a minutely refresh rate.

Metals API Key Features

Indeed, hundreds of businesses rely on this reliable API to access institutional-quality real-time precious metal pricing.

Real-time metal prices are simple to add into spreadsheets, websites, mobile apps, and other commercial applications.

Reduce the time required for apps that rely on precious metal prices to reach the marketplace.

Also, using cloud APIs, you may avoid the difficulties and complexity associated with legacy feeds.

Top Benefits

First, this API gives you historical, real-time, and quick data on metal prices in a variety of currencies.

Secondly, in graphs from the past and present, spot and expected prices for gold, silver, palladium, and platinum are displayed.

Last, Metals-API collects market data prices in a range of formats and frequencies from a variety of trade sources and international bodies. Commercial sources are given a higher weighting, especially for major currencies and metals, because they more accurately reflect market exchange.