In today’s rapidly evolving financial markets, having access to accurate and real-time data is essential for making informed decisions. This is especially true for developers working on applications that require precise market pricing. The German Power Baseload Calendar Month Futures API provided by Commodities-API stands out as a vital tool for developers seeking reliable and up-to-date information on futures pricing.

What is Commodities-API?

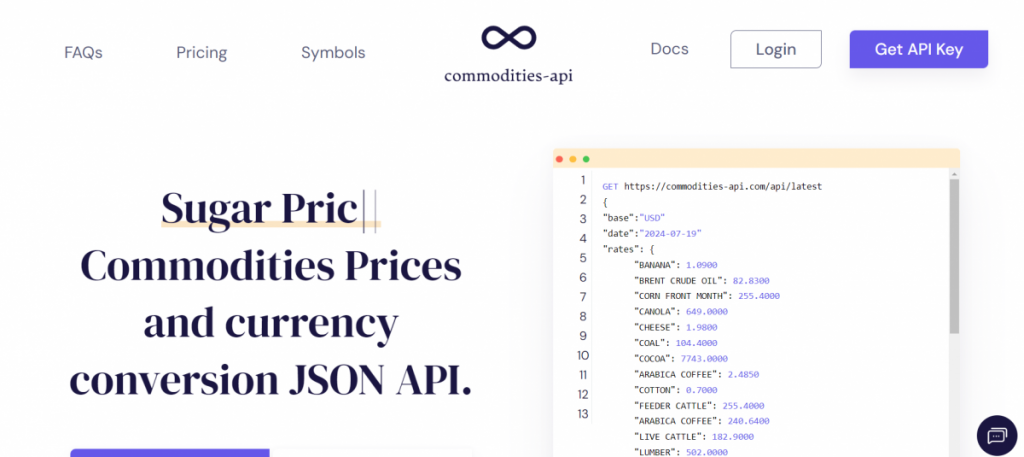

Commodities-API is a powerful tool that offers real-time data on various commodities. Its primary function is to provide developers with access to accurate market prices for various commodities, including metals, agricultural products, and energy resources. This API aggregates data from reliable sources and delivers it in a format that is easy to integrate into various applications.

One of the standout features of Commodities-API is its focus on accuracy. In financial markets, even the slightest deviation in data can lead to significant losses. Commodities-API ensures that the data provided is as precise as possible, allowing developers to build applications that can make well-informed decisions.

German Power Baseload Calendar Month Futures API

Among the various offerings of Commodities-API, the German Power Baseload Calendar Month Futures API is particularly noteworthy. This API provides developers with the latest pricing information for German Power Baseload Calendar Month Futures, a crucial market segment for those involved in energy trading and financial analysis.

Why German Power Baseload Calendar Month Futures?

German Power Baseload Calendar Month Futures are contracts that represent the average price of power delivered at a constant rate over a specified calendar month. These contracts are essential for hedging and trading in the energy market. Accurate pricing information for these futures allows traders and analysts to make better decisions, manage risks more effectively, and optimize their portfolios.

Features and Benefits

The API from Commodities-API offers several features that make it an excellent choice for developers:

Real-Time Data: The API provides real-time pricing information, ensuring that developers have access to the most current data available. This is crucial for applications that require up-to-date market information.

{

"base":"USD"

"date":"2024-07-19"

"rates": {

"BANANA": 1.0900

"BRENT CRUDE OIL": 82.8300

"CORN FRONT MONTH": 255.4000

"CANOLA": 649.0000

"CHEESE": 1.9800

"COAL": 104.4000

"COCOA": 7743.0000

"ARABICA COFFEE": 2.4850

"COTTON": 0.7000

Historical Data: In addition to real-time data, the API also offers access to historical pricing information. This allows developers to analyze trends and patterns, helping them make more informed decisions.

Comprehensive Coverage: The API covers a wide range of commodities, with a special emphasis on German Power Baseload Calendar Month Futures. This makes it a versatile tool for developers working in various sectors of the financial markets.

Ease of Integration: The API is designed to be easy to integrate into existing applications. With comprehensive documentation and support, developers can quickly implement the API and start using it in their projects.

Conclusion

In the competitive world of financial markets, having access to accurate and real-time data is paramount. The API from Commodities-API offers developers a powerful tool for obtaining precise market pricing information. With its focus on accuracy, real-time data, and ease of integration, this API is an excellent resource for developers looking to build robust and reliable financial applications.