In the fast-paced world of trading, having access to real-time market data is crucial. The FTSE Bursa Malaysia KLCI Price API offers traders accurate and timely information about market indices, particularly the KLCI. This API enhances trading strategies by providing essential data, enabling traders to make informed decisions and respond quickly to market changes.

How to Use the FTSE Bursa Malaysia KLCI Price API

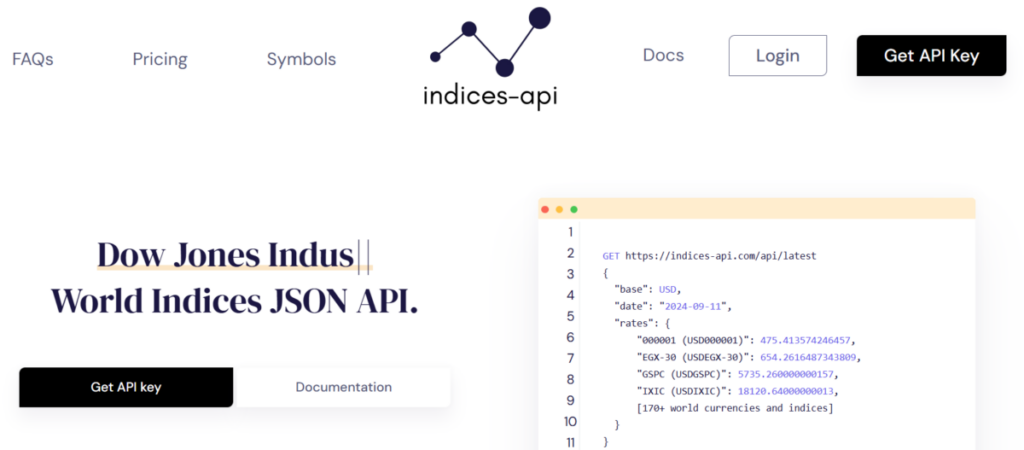

Using the FTSE Bursa Malaysia KLCI Price API is straightforward. Traders can integrate the API into their trading platforms or applications with minimal effort. The API provides various endpoints that deliver real-time prices, historical data, and key indices. To start, traders need to obtain an API key from the provider, which ensures secure access. Once set up, they can query the API to retrieve the latest KLCI prices and other relevant data.

The API allows users to specify parameters like date ranges and data types, making it customizable for individual trading needs. By implementing this API, traders can automate their data retrieval processes, ensuring they always have the latest market information at their fingertips.

The Importance of Real-Time Market Data for Traders

Real-time market data is vital for traders aiming to capitalize on price movements. In a market that can change in seconds, delays in receiving data can lead to missed opportunities and significant losses. With the FTSE Bursa Malaysia KLCI Price API, traders gain access to up-to-the-minute information that can significantly enhance their trading strategies.

Accurate data enables traders to identify trends and make better predictions. For instance, if a trader sees a sudden drop in the KLCI, they can react quickly by selling their positions to minimize losses. Conversely, if the index shows a bullish trend, traders can jump in to capitalize on potential gains.

Enhancing Trading Strategies with Indices API

The FTSE Bursa Malaysia KLCI Price API is part of a broader category known as Indices API, which provides essential information on various market indices. These APIs help traders to track performance across multiple sectors, allowing for more diversified investment strategies.

By using the Indices API, traders can analyze patterns over time and assess the health of the Malaysian market. This data can inform decisions about portfolio adjustments, risk management, and entry and exit points for trades. The more informed a trader is, the better their chances of succeeding in the volatile trading environment.

Benefits of Using the FTSE Bursa Malaysia KLCI Price APIs

One of the key benefits of the FTSE Bursa Malaysia KLCI Price APIs is its accuracy. The data provided is sourced from reliable exchanges, ensuring that traders can trust the information they receive. Additionally, the API is designed to handle large volumes of data, making it suitable for both individual traders and institutional investors.

Another significant advantage is the speed of data delivery. The API offers low latency, meaning traders receive updates almost instantly. This quick access allows for real-time decision-making, which is critical in a market that can be highly reactive to news and events.

Finally, the FTSE Bursa Malaysia KLCI Price APIs is user-friendly. Whether you’re a seasoned trader or a beginner, the API’s documentation provides clear instructions on how to integrate and utilize the data effectively. This accessibility ensures that traders can focus more on strategy rather than the technicalities of data retrieval.

Conclusion

In conclusion, the FTSE Bursa Malaysia KLCI Price APIs is an indispensable tool for traders seeking real-time market data. Its ability to deliver accurate and timely information allows traders to enhance their strategies and make informed decisions. By incorporating this API into their trading practices, traders can improve their performance and stay competitive in the dynamic world of finance.