In this post, we will give an API for collecting CME Group metals futures prices to decide the best moment to trade.

The metals complex had a difficult year in 2021. This year, the prices of the four main precious metals have fallen. Gold has tumbled as demand for capital safe havens has declined and the US Federal Reserve has gotten more active.

Metal costs are influenced by a variety of supply chain restrictions, ranging from severe manufacturing of electronic shortages to shipping capacity constraints. You can anticipate prices in 2022 after a difficult year in 2021 with the right tools.

What Is the Current Metal Situation?

Gold sought to recoup some of the ground it had lost earlier in the year in the fourth quarter of 2021, as mounting fears about the impact of a new omicron variant of the coronavirus on the international economy boosted safe-haven demand. Positive condition retail sales in key regional markets stimulated investment.

As a consequence, gold gained 4.4 percent in value over time, reaching $1,820 per ounce in 2021. Despite a solid fourth-quarter result, gold-finished 2021 fell 6.3 percentage points. Silver also finished the fourth quarter of 2021 in the black, but with a far better quarterly result, growing in value by 7.2 percent compared to 4.4 percent for gold.

Silver’s underperformance in comparison to gold was mostly owing to its robust and durable core. (Because pure global supply amounted to more than 60% of physical consumption, silver is officially classified as a precious metal)

Several reasons hampered the much-anticipated increase in global factory output, and hence commercial consumption for silver, last year. It implies that supply recovery outpaced demand recovery, resulting in higher metal availability.

The majority of metals investors are in Chicago. As a result, if you’re considering investing in this metal or one of its related businesses, you should remain up to date on market metal pricing. If you want to be in the investment stage, you must pay attention to CME Group, the company’s beating heart.

Because it is a very busy market, you must pay close attention to the hearts of investors. If you want to engage in this item, look at current and historical pricing. It enables you to keep track of the factors impacting the value of your chosen metal. If you want to be an investor, you need to keep a watch on CME Group rates API.

CME Group Inc. is a multinational commodity trading company headquartered in Chicago, Illinois. It trades agricultural items, currencies, energy, interest rates, metals, stock indexes, and digital currency futures, among other asset classes. You will need the right API equipment to obtain this data.

About APIs

An API is a method for allowing one device in one area to deliver data to another or more machines in another location. You may watch videos and share them with your friends and family. The API response can be included in the structure of a website or app.

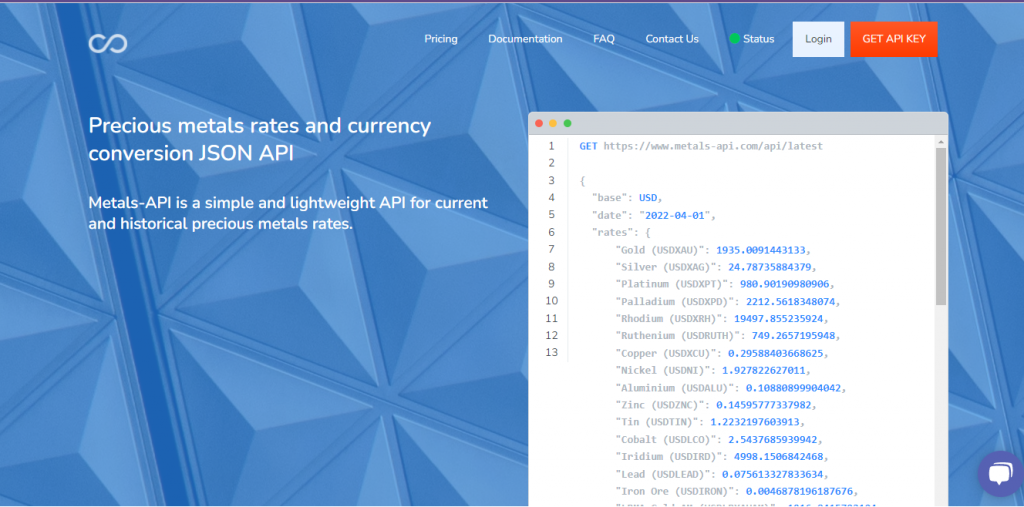

Metals dealing is only possible if you have access to current data. As a result, to determine the best time to invest, they must monitor its market price activity. We recommend utilizing the Metals-API service to retrieve this information.

Why Metals-API?

Metals-API is the best API available. Its technology makes use of a variety of precious and non-precious metals, including lithium, gold, platinum, palladium, copper, and silver. All of this with current data and updates in under a minute! That is, you will be able to decide the optimal time to buy this metal based on its characteristics. This sort of information might save you a lot of time and work.