Are you seeking for up-to-date price information on metals? Learn why using APIs is the fastest and safest method by reading this article.

Iron ore, copper, aluminum, and nickel are base metals that are essential for building and industrial production worldwide. Indicators of changes in the world economy, influenced by the whims of supply and demand, can be found in them as well.

There is no question as to which way the winds have been blowing lately, driving the metals. Since 2011, prices have gradually decreased. Despite the fact that oil prices have also decreased, the metal prices downturn has been more recent and abrupt. However, in both instances, the price pressure is typically the outcome of a large production when it is a period of high prices.

The decline in Chinese consumption and the energy crisis in Europe has shaken up the demand for iron ore, and analysts have revealed what they predict for the metal commodity markets throughout the upcoming months.

1. The performance of iron ore prices this year has been adversely affected by the confluence of declining Chinese demand and the possibility of a worldwide economic slowdown.

2. Due to severe structural issues in the Chinese real estate market, the energy crisis in Europe, slowing global development, a generalized increase in inflation, and issues with global supply chains, the outlook for the iron ore market in the short to medium term stays unstable.

3. This quarter will see a decrease in European steel production. This is due to the fact that production plant margins will be further compressed in the upcoming months as a result of declining demand and rising input prices, as demonstrated by the Purchasing Managers’ Index (PMI).

International conflicts have significantly impacted the market for metals. For instance, if we look at how these raw materials’ prices have changed since the commencement of the conflict in Ukraine, we can see that nickel, aluminum, and copper have taken the worst hits. And since then, the iron ore has fallen by 33%.

While there is little question that the Russian invasion of Ukraine directly contributed to the spike in nickel prices, the same cannot be said for iron ore, which has lost value as a result of declining Chinese demand.

Discovering An API

The metals market is known for its high level of volatility. The metals market is constantly influenced by the complexity of the global situation, the industrial processes that drive metal exchange, and the climatic conditions that permit metal extraction.

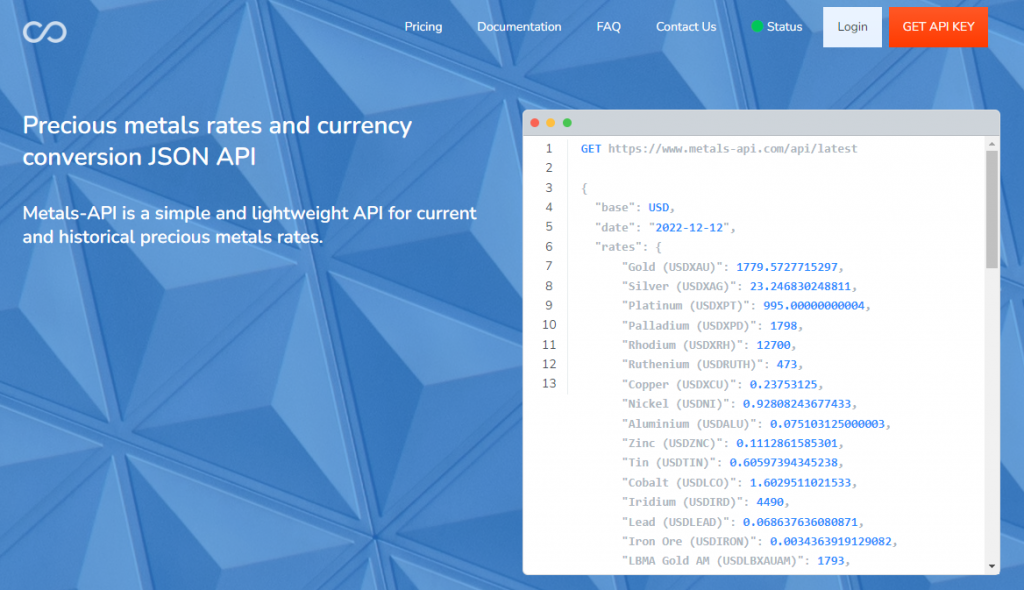

Metal extraction and commercialization are of international significance since they have an impact on the global economy and industrial chain. Because of this, you need to be aware of the market’s conditions and pricing ranges if you run a relevant business. To save time and money, there is a way to do it. To find prices from anywhere in the world, we suggest using Metals-API.

Why Metals-API?

Most programmers favor the professional tool Metals-API. It enables the integration of data in a wide range of computer languages, including Python, JSON, JQuery, PHP, and many others. You will be able to include data from the world’s most significant financial markets, such as the World Bank and LBMA, into your website or platform.

Additionally, you may choose the currency in which you want the metal data to be displayed, and you can depend on it constantly being updated in real-time. The ability to compare current information with previous data about value changes is another crucial feature of this API.