Do you always feel behind the newest data on energy prices? Stay updated on the latest fluctuations concerning nuclear energy prices with a uranium price API.

The Ukrainian conflict has also impacted the price of raw materials like energy. Gas, oil and minerals are part of the confrontation too. Also, uranium, the principal element for nuclear energy production, is in the eye of the storm.

Above all, many countries want uranium because it’s a primary relevant material for energy. The incidence of energic nuclear production in the world energy production is three per cent. And it may doesn’t seem to you, but it’s a percentage of relevance.

Although its largest reserve is in Kazakhstan, Russia makes a considerable contribution to the production of this element. The latter country occupies the seventh position in the world production scale of uranium.

Over the last few days, multiple headlines are circulating around the chance that Russia forbids nuclear energy distribution. That phenomenon has many reasons: some countries stopped buying that energy like Germany with gas. Last month, the Czech Republic made public that their government won’t buy more nuclear material from Russia. All these sudden movements have an influence on the price. And not exclusively in the country that provoked the invasion, even in South America, this resonates hard.

How is it possible to follow nuclear fluctuation with a Uranium API?

It’s quite simple. The API is an Application Programming Interface. And it’s principal functionality is to connect a request and a specific database. Generally, you deliver a quest to the API, and then it obtains an answer and sends it back to you. Though it seems complicated, the whole process only takes a couple of minutes. You won’t need a particular device or much memory.

Probably, you’ll need to learn how to ask for the information you want. Most likely, you’ll find that explanation on any company’s website you choose.

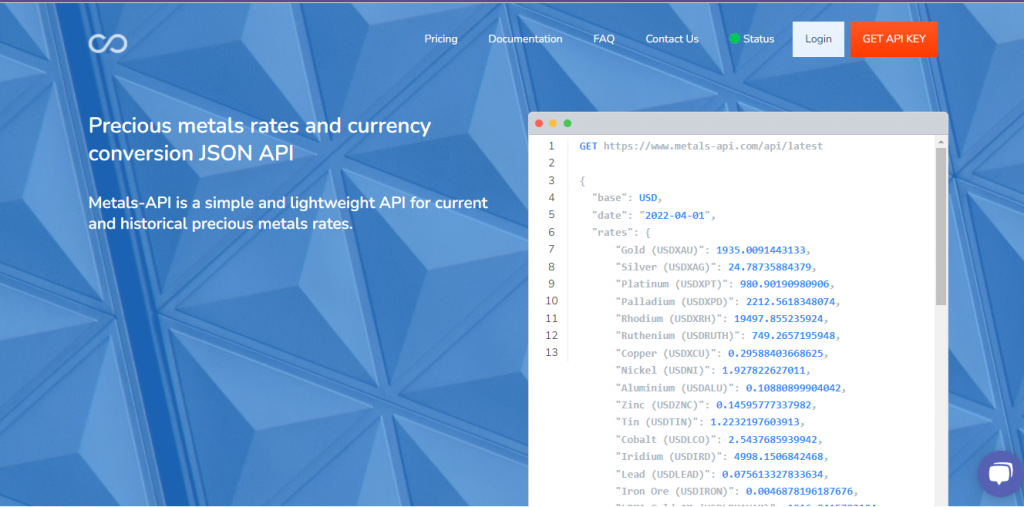

Get fluctuations rates with a uranium price API like Metals-API

This tool is a platform that brings together multiple features of the metals and foreign exchange markets. On its website, you’ll find a long list of around a hundred and seventy different international currencies and precious metals to request.

It also collects information from fourteen diverse sources, including global banks and stock exchanges. Even if not all of them are available concurrently, some of those sources can answer.

When it comes to utilising Metals-API, you’ll need to memorize the three-letter combination from the list. Every element has a code that the API requires to comprehend your request. And the currencies have their own identification too.

Furthermore, you can ask for fluctuation rates of precious metals in a specific currency. Only by clarifying the exact two dates in the API call, you’ll get data immediately. However, the maximum period between two dates you can ask for is a year.

Anyway, if you can’t picture how to start, you can check the complete explanation in the ‘documentation’ section. Go into this link to the Metals-API‘s site: https://metals-api.com/documentation#endpoints.

You might want to read this article:

https://www.thestartupfounder.com/5-invaluable-things-to-learn-from-a-fast-brass-rates-api/.