The Society for Worldwide Interbank Financial Telecommunications code, commonly known as SWIFT code, is a set of letters and numbers that identifies a bank and branch location in a particular country. It is used by international banks to identify each other when sending money across borders. It can be used to validate the bank’s address, ascertain the country of origin of the bank, and guarantee that funds are sent to the correct location.

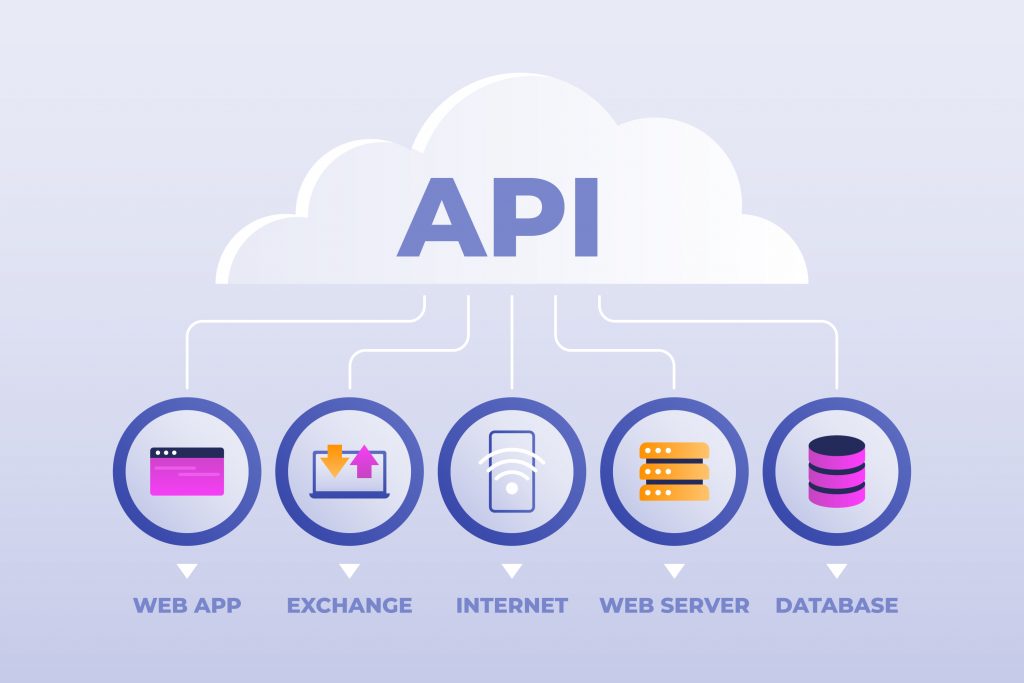

Obtaining Swift code-related information manually might be time-consuming. That is why you should utilize a banking information API. It will allow you to obtain this information in only a few clicks. Usually, these APIs have a large collection of information from which they can extract data and provide it to the device that requests it. If you need to check which bank is behind a particular account number, then using a banking information API is your best bet. However, not all APIs are created equal; some are untrustworthy and may provide incorrect data. As a result, we would like to recommend the SWIFT – IBAN – Routing Bank Checker API.

SWIFT – IBAN – Routing Bank Checker API

Not only does the SWIFT-IBAN-Routing Bank Checker API assist you in getting SWIFT code information, it may also retrieve data on routing bank numbers and IBAN codes. Most importantly, you can validate all these codes through the routing bank checker, the IBAN code checker, and the SWIFT code checker endpoints. Overall, it facilitates and expedites financial processes. To receive the information you require, just select an endpoint and input the associated code.

These APIs are an excellent resource for developers in addition to delivering straightforward banking information to their API clients. It aids in increasing productivity by providing access to technologies that would otherwise take months or years to build. As a result, developers can easily assist in validating different SWIFT codes and ensuring secure transactions.

How To Get Accurate And Efficient Banking Transactions With This API

Before integrating an API into a system, it is crucial to become familiar with it, and Zyla Labs understand that. So, testing the SWIFT-IBAN-Routing Bank Checker API is quite straightforward. The most important part, you need a Zyla API Hub account. After logging in to the platform, search for the Swift-IBAN-Routing Bank Checker API and choose “Try Free For 7 Days.” Now, you can start testing the different endpoints. So choose any and enter the necessary bank information (such as an IBAN, SWIFT, or routing number). Finally, click the “test endpoint” button to make the API call, and you’ll quickly receive all the data you need!

As an example, we chose the “SWIFT code checker – Endpoint,” and entered the SWIFT code “ADTVBRDF”. We called the API, and the following data was returned:

{

"status": 200,

"success": true,

"message": "SWIFT code ADTVBRDF is valid",

"data": {

"swift_code": "ADTVBRDF",

"bank": "ACLA BANK",

"city": "BRASILIA",

"branch": "",

"address": "Q SHCN CL QUADRA BLOCO E, 316,316",

"post_code": "70775-550",

"country": "Brazil",

"country_code": "BR",

"breakdown": {

"swift_code": "ADTVBRDF or ADTVBRDFXXX",

"bank_code": "ADTV - code assigned to ACLA BANK",

"country_code": "BR - code belongs to Brazil",

"location_code": "DF - represents location, second digit 'F' means active code",

"code_status": "Active",

"branch_code": "XXX or not assigned, indicating this is a head office"

}

}

}The SWIFT-IBAN-Routing Bank Checker API is a fantastic way to verify SWIFT codes and obtain bank information related to them. But the best part of this API is that you can do the same with routing numbers and IBAN codes. It also supports a wide range of computer languages, such as JavaScript, jQuery, the cURL text format, and others, which facilitate the integration of this API into other programs. Overall, with this API, you can ensure your clients’ successful and secure transactions!