Inflation, defined as the continuous rise in the average price level of goods and services, is a crucial economic indicator that drives decision-making in a variety of industries. Companies, governments, economists, and investors must update about inflation patterns. Fortunately, technological improvements have provided us with useful tools such as the Inflation Rate Tracking API, which delivers accurate and up-to-date information on monthly and yearly inflation rates. This API provides access to a plethora of data, allowing users to gain insights, make educated decisions, and manage the complicated environment of inflationary pressures.

The Applications Of An Inflation Rate Tracking API

- Economic analysis: The API may be used by researchers, economists, and analysts to track and study inflation rates as important indications of an economy’s health. They can use this information to examine price stability, evaluate monetary policy, and obtain insights into economic trends and patterns.

- Central banks and policymakers rely on reliable inflation statistics to make educated choices about interest rates, money supply, and other monetary policy measures. They may design and alter effective policy measures by using the API to receive up-to-date inflation rates.

- Current inflation rates can be incorporated into investing models and plans by investors and financial organizations. This information assists them in assessing inflationary risks, adjusting asset allocation, managing portfolios, and mitigating possible inflationary losses.

- Businesses across sectors use Inflation data to estimate price trends, alter pricing strategies, and forecast expenses. Businesses may use the API to remain up to date on monthly and yearly inflation rates, allowing them to make data-driven choices about product pricing, budgeting, and resource allocation.

- Risk management: Inflation has a direct influence on a company’s profitability and long-term viability. The APIs are used by risk managers to monitor inflation patterns and identify possible hazards connected with price volatility. This knowledge enables them to devise effective risk mitigation and hedging methods for dealing with inflation-related issues.

- International comparisons and benchmarking: The API allows analysts to compare inflation statistics from other nations, allowing them to examine relative economic trends and benchmark different economies against one another.

Overall, an Inflation Rate Tracking API is a useful tool for many stakeholders, including researchers, economists, policymakers, investors, businesses, and risk managers. It provides them with precise and fast inflation statistics to help businesses make decisions, manage risks, and obtain insights into the economy.

What Is The Best Inflation Rate Tracking API?

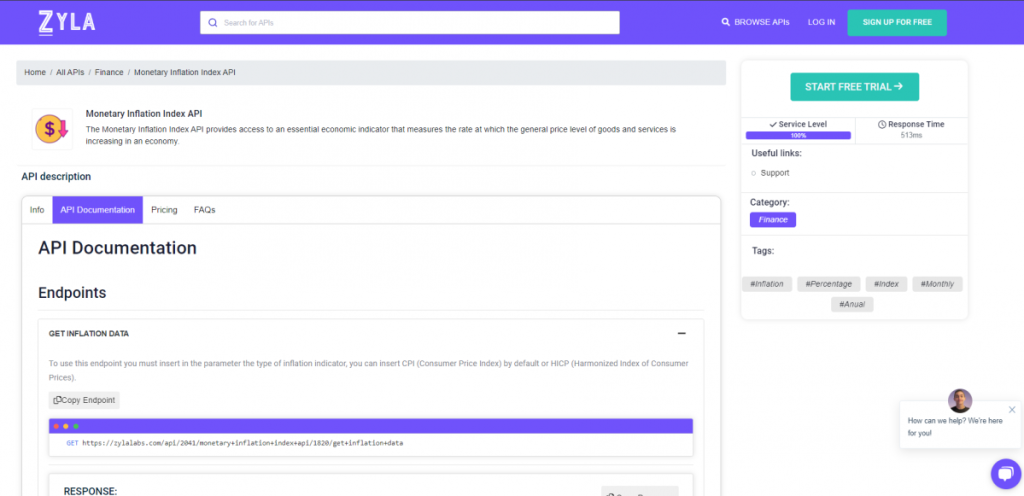

After testing a number of choices, we can confidently state that the Zylalabs API is the most user-friendly and gives the greatest results: API for the Monetary Inflation Index

In addition, the findings is supplying in JSON format!

For example, entering CPI (Consumer Price Index) or HICP (Harmonized Index of Consumer Prices) into the “Get Inflation Data” endpoint will provide the following result:

[

{

"country": "Austria",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": -0.023,

"yearly_rate_pct": 8.704

},

{

"country": "Belgium",

"type": "HICP",

"period": "may 2023",

"monthly_rate_pct": 0.217,

"yearly_rate_pct": 2.722

},

{

"country": "Czech Republic",

"type": "HICP",

"period": "april 2023",

"monthly_rate_pct": -0.135,

"yearly_rate_pct": 14.253

}

]Where Can I Find The API For The Monetary Inflation Index?

- To begin, go to the Monetary Inflation Index API and press the “START FREE TRIAL” button.

- After joining Zyla API Hub, you will be able to utilize the API!

- Make use of the API endpoint.

- Then, by clicking the “test endpoint” button, you may send an API call and see the results shown on the screen.

Related Post: How To Leverage An Inflation Rate API For Decision Making