Do you want to get metal prices for your page? Here we explain how to obtain everything you need with an API. Furthermore, some comes with an incredibly simple plugin to integrate.

Due to investors’ increasing desire to save money and track increases in precious metals’ value, the world market for precious metals is booming. It also has to do with changing lifestyle tastes and the demand for more discretionary cash. The significant usage of jewelry in wedding rituals has an impact on several countries, like China, India, and other South Asian countries.

At the moment, this metal holds the greatest market share in the Asia-Pacific region. May be it do so at least until 2028. China, Japan, and India are some of the region’s emerging superpowers.

China, among these, has the biggest market impact on the precious metals sector. The nation is the biggest user of PGM and gold as of 2021. One key factor fueling demand is the nation’s robust domestic manufacturing sector.

Additionally, North America can expand at the second-fastest CAGR in terms of volume. The region’s precious metals industry may grow as a result of the ready access to silver deposits in Mexico and the presence of robust industrial hubs in the US and Canada.

The Impact Of The War On The Metal’s Market

We must keep in mind that the current high level of metal prices has its roots primarily in the pre-war period. Due to COVID-19, its price saw a severe decline followed by a comeback to extraordinary heights.

Consider how the price of copper, the primary metal responsible for the energy shift by weight, increased from 5,000 dollars/t in the epidemic to approximately 11,000 dollars/t in 2021.

Looking specifically at the Russian situation, palladium prices exhibit a similar pattern if we compare them to levels that existed before the conflict. With a 40% market share, Russia leads all producers globally.

However, it has been demonstrated time and time again that palladium and platinum are somewhat interchangeable, thus both methods are being tested by the industry to mitigate the consequences of any supply constraints.

Since it is seldom ever employed in electric vehicles, its major application in historic cars as a required component for pollution control will be what slows down pricing in the medium future.

You Can Start Using An API With Metals Data

An API code is particularly flexible since it controls how a program that moves data from one part of the software to another operates. Programs can communicate with one another thanks to API rules.

In essence, the API enables a program to extract data or files that are already present within a certain software component. They transfer to a different software module or level, where the programmers will put them to use.

Later, operating systems, web platforms, or databases will be built using these computer protocols.

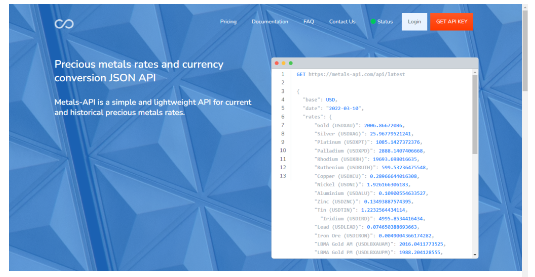

Here, we would like to suggest Metals-API. The API can respond fora lot of endpoints, like in the following example:

About Metals-API

Metals-API will update your information about the metals market second by second. You will be able to see the values of the metal you want in the currency you want. You can incorporate it with the programming language you want and also simple plugins.

With this API you will be able to analyze all the factors that influence the metals market. This way you will become a professional investor and you will be able to advise others. Your customers will appreciate the fact that you share all this valuable information.

With it, you and your target will know when is the best time to invest.