In today’s fast-paced trading environment, having access to real-time market data is crucial. The EURO STOXX 50 Rates API is a powerful tool designed for traders and investors seeking accurate and timely indices. This API provides essential data on the EURO STOXX 50 index, which tracks the performance of 50 major companies in Europe. By using this API, traders can enhance their strategies, make informed decisions, and respond swiftly to market changes.

How to Use the EURO STOXX 50 Rates APIs

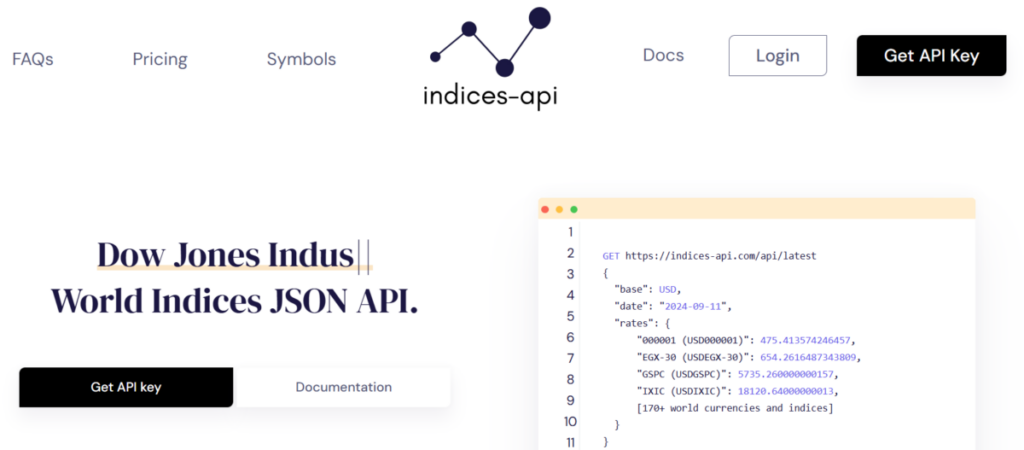

Using the EURO STOXX 50 Rates API is straightforward. After signing up for access, users can easily integrate the API into their trading platforms or applications. The API delivers live data feeds, including current index values, historical data, and market trends. Traders can set up alerts for specific index movements or changes, ensuring they never miss critical information. This integration enables users to create automated trading strategies, optimize their portfolios, and analyze market conditions in real-time.

Importance of Real-Time Market Data

Real-time market data is vital for successful trading. Markets are dynamic, and prices can change within seconds. Traders need accurate data to make quick decisions. With the EURO STOXX 50 Rates API, users receive timely updates that reflect the latest market conditions. This feature helps traders stay ahead of the curve, react promptly to market shifts, and reduce the risks associated with delayed information.

Benefits of the Indices API

The Indices API, which includes the EURO STOXX 50 Rates APIs, offers numerous benefits for traders. First, it provides high-quality data that enhances trading strategies. Access to accurate and up-to-date indices allows traders to identify trends, forecast movements, and make informed choices. Moreover, the API supports a range of programming languages, making it versatile for developers and traders alike.

Another key benefit is the API’s reliability. Market fluctuations can cause misinformation or delays in data delivery from traditional sources. With the EURO STOXX 50 Rates APIs, traders can trust that they are receiving real-time data directly from reputable sources. This reliability can significantly impact trading outcomes, as decisions based on outdated information can lead to losses.

Additionally, the EURO STOXX 50 Rates API facilitates backtesting. Traders can analyze historical data to refine their strategies before executing live trades. This feature is particularly useful for those who employ algorithmic trading, allowing them to simulate different scenarios and assess their effectiveness.

Enhanced Trading Strategies

Incorporating the EURO STOXX 50 Rates API into trading strategies can lead to enhanced performance. Traders can leverage the API‘s data to spot patterns and correlations within the index. This analysis helps in developing strategies tailored to specific market conditions. Whether traders focus on short-term gains or long-term investments, having access to accurate indices is key.

Furthermore, the API supports various trading styles, from day trading to swing trading. Its flexibility allows traders to customize their approaches based on their risk tolerance and market outlook. This adaptability makes the EURO STOXX 50 Rates APIs a valuable resource for traders at all experience levels.

Conclusion

In conclusion, the EURO STOXX 50 Rates APIs is an indispensable tool for traders aiming to stay informed and make smart investment decisions. By providing real-time data, reliable indices, and support for diverse trading strategies, this API empowers users to navigate the complex financial markets effectively. Whether you’re a seasoned trader or just starting, integrating the EURO STOXX 50 Rates API into your toolkit can enhance your trading experience and improve your market outcomes.