The EURO STOXX 50 Prices API provides just that—accurate, real-time market data for the EURO STOXX 50 index, one of Europe’s most widely followed stock market benchmarks. This powerful tool empowers traders and financial analysts to automate the process of collecting and analyzing European market data, enhancing their ability to execute timely trading strategies and monitor market trends efficiently.

How to Use the EURO STOXX 50 Prices API

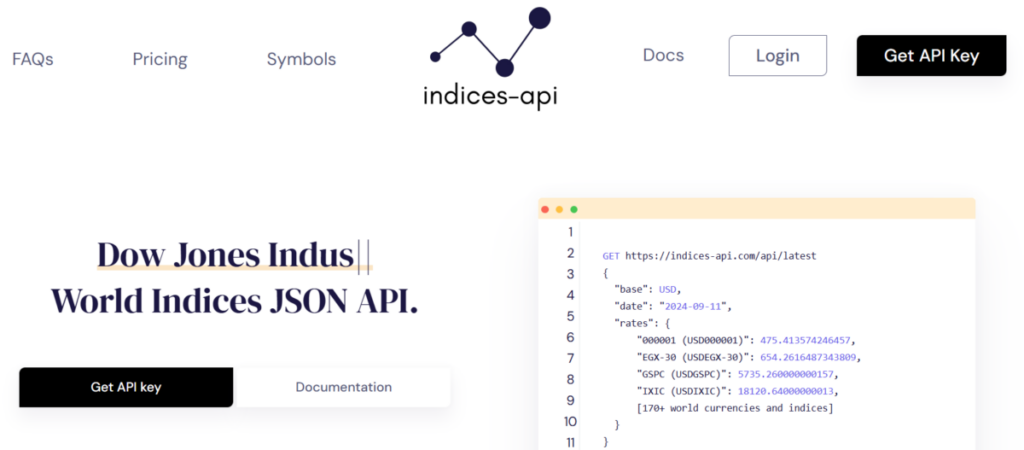

The EURO STOXX 50 Prices API is designed for simplicity and ease of use, making it accessible for traders and developers alike. To get started, all you need is an API key from your provider. Once you have the key, you can integrate the API into your trading system or application to start retrieving real-time data on the EURO STOXX 50 index.

The API delivers price updates, historical data, and key metrics for each of the 50 companies that make up the index. These data points are updated frequently, providing traders with the latest information to drive trading decisions. Whether you’re creating custom dashboards, setting up automated alerts, or backtesting strategies, the EURO STOXX 50 Prices API is a flexible tool that can easily adapt to your needs.

The Importance of Real-Time Market Data for Traders

For traders, access to real-time market data is essential for executing timely trades. In fast-moving markets like the European stock exchange, even a few seconds can make a significant difference in the price at which you buy or sell an asset. The EURO STOXX 50 Prices API ensures that you always have access to up-to-the-minute pricing, allowing you to make decisions based on the most accurate and current market information available.

Real-time data also enables traders to react to market shifts immediately. Whether you’re monitoring economic events, geopolitical developments, or corporate earnings reports, having access to live data ensures you can adjust your strategy quickly. In competitive markets, speed and accuracy are critical, and the EURO STOXX 50 Prices APIs provides both.

How the EURO STOXX 50 Prices APIs Enhances Trading Strategies

The EURO STOXX 50 Prices APIs is more than just a tool for tracking prices—it’s an essential resource for developing and enhancing trading strategies. By automating the collection of market data, traders can focus more on analysis and decision-making rather than spending time manually gathering information. This streamlined workflow can lead to more efficient, data-driven trading strategies.

With access to historical and real-time data, traders can backtest their strategies, fine-tune their trading algorithms, and track the performance of specific stocks or sectors over time. The EURO STOXX 50 Prices APIs makes it easier to understand market trends and correlations, providing you with a deeper insight into the behavior of European stocks. This helps in making more informed predictions and executing trades that align with market conditions.

Benefits of the EURO STOXX 50 Prices API

The EURO STOXX 50 Prices APIs offers several key benefits that make it indispensable for serious traders:

Accuracy and Timeliness: The API provides reliable, real-time data, ensuring traders are never operating on outdated information.

Flexibility: The API can be easily integrated into different platforms and trading tools, allowing for personalized data delivery.

Automation: By automating data collection, the API saves time, letting traders focus on strategy development rather than data entry.

Cost-Effectiveness: With subscription-based access, the API offers a more affordable solution than manually purchasing market data from different sources.

Conclusion

For traders seeking a competitive edge in the European stock market, the EURO STOXX 50 Prices API is an indispensable tool. With real-time access to the EURO STOXX 50 index, this API enables traders to make data-driven decisions faster and more accurately. By automating the data collection process, the API enhances the efficiency and effectiveness of trading strategies, helping traders stay ahead in today’s dynamic financial landscape.