If you are looking for one that will help you with all the payment process, you are at the right place. We are going to tell you about the best API to make online payments and how it can help you in your business.

BINs can be used for many different things. The main goal is to give businesses the ability to analyze and evaluate credit card transactions. Additionally, they enable businesses to determine whether issuing banks are located in the same nation as the device being used to complete the transaction and to identify originating institutions along with their location and phone number. Additionally, it confirms the customer-provided address.

Payment Gateway Integration APIs are used by developers who want to accept online payments on their websites or applications. They are also used by businesses who want to integrate payment processing into their existing systems. There are many different payment APIs available, each with different features and capabilities. Some APIs are better suited for specific use cases than others. It all depends on the needs of your business.

Online payment refers to an electronic money transfer through the internet, typically between a customer and a business. There are other ways to make these payments, including using credit and debit cards, banking apps, or websites.

When using a debit or credit card to make a purchase, BINs are also utilized to speed up and streamline the checkout process. The merchant’s payment processor scans a customer’s card’s BIN as they swipe it to verify their account with the card issuer. This establishes if the transaction is legitimate and in accordance with any applicable national laws.

BIN IP Checker

Webmasters that want to carefully review credit/debit card transactions that occur on their websites can use this API, which was created with their needs in mind. It is an obvious example of how risky the transactions are. Anyone is free to use this API anyway they see fit on any platform, with their own set of limitations.

What purpose serves this API? The user will enter their credit/debit card’s BIN (Bank Identification Number) or IIN (Issuer Identification Number) in order to get as much information as possible. Additionally, it will calculate the transaction risk score, match the BIN information to the IP information, and return details on the IP address if the request contains an IP address. Online businesses gain from letting customers make informed decisions.

The BIN IP Checker API cannot be used until you register. To start the risk-free trial, click “START FREE TRIAL”. After that, you may begin running API queries. Select “test endpoint” to call the endpoint after providing the BIN number. The response will contain all pertinent data relating to that number. You can use it for development now that you know how to use it!

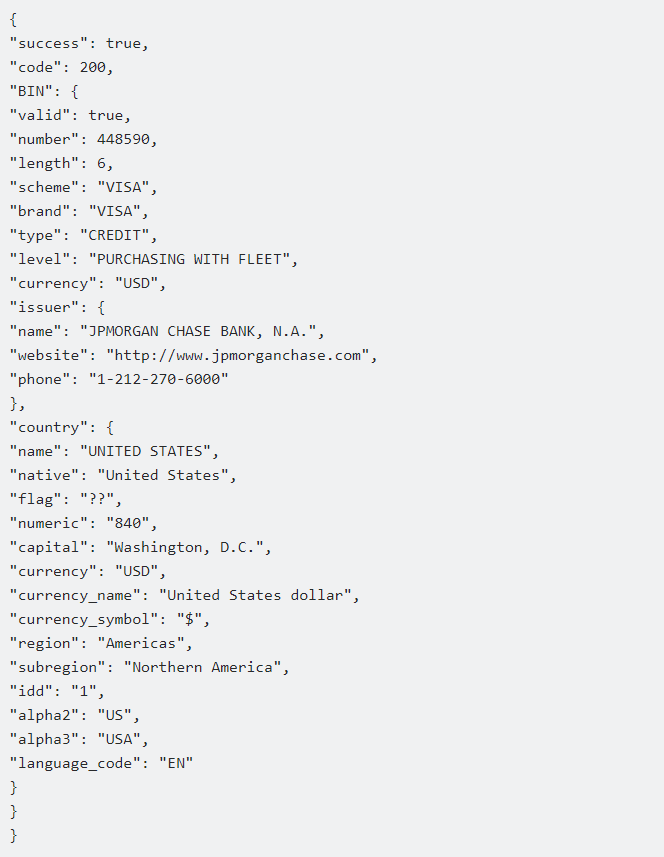

Every credit card’s BIN is its first six to eleven numbers, and this service will verify them before returning a complete JSON response. You can avoid losing money on bogus transactions by using this API. Your call will receive a response from this API that resembles something like this:

If the user only provides the BIN number, they will have access to all of the BIN’s information. If the user enters both the BIN and the IP address of his client, the system will provide all relevant information about the BIN and IP address along with a risk score.