Are you looking for a payment security system? You should try using an API to enhance the security of your payments. In this article, we’ll tell you more about it and which is the best one.

In the modern world, everything is digital and portable. All of us are constantly using our phones, tablets, laptops, and other electronics. This shows that using a credit card or cash is preferred over making payments online. However, not every website or app offers this option.

The payment process is one of the most important parts of any e-commerce. You need to make sure that your customers can pay for what they want and that their payment information is safe. This is why you should use a BIN Database Lookup API.

An API can tell you if an IP address is safe or not. It can also tell you what country the IP address is from. This can be helpful if you want to know where your customers are from. It can also help you block any unsafe IP addresses from accessing your website or application.

They are also simpler to use than other forms of payment. They may be implemented into your website or app with just a few lines of code. This implies that you don’t need to wait for developers to integrate anything before you start receiving payments. A few lines of code can incorporate APIs into any website or app, making them simple to utilize. They also provide a wide range of options that you may use to adapt your payment system to your needs.

BIN IP Checker

This API was created with the demands of webmasters who want to carefully study credit/debit card transactions that take place on their websites in mind. It is a clear illustration of how dangerous the transactions are.

Webmasters that want to carefully review credit/debit card transactions that occur on their websites should use this API, which has been created just for them. It gives a crystal-clear example of how risky the transactions are.

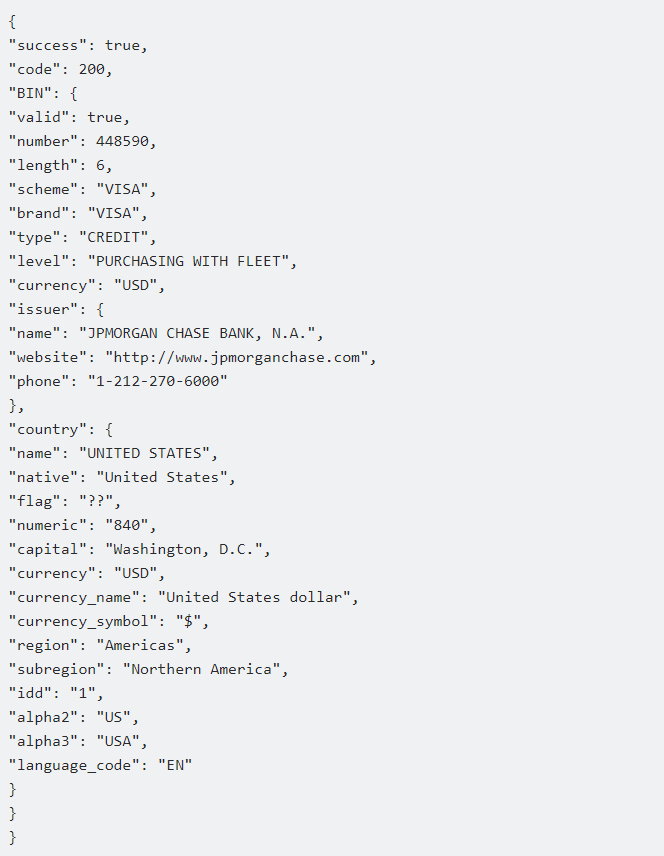

This API will verify both the BIN of the credit card and the user’s IP address who submitted the request. By comparing the BIN and IP information, it will determine whether the nation of the IP address and the card’s BIN match. This is a great way to stop fraudulent transactions right where they start. An illustration of the kind of response you will receive from this API is as follows:

If the user provides only the BIN number, they will be given all of the BIN’s information. If the user sends both the BIN and the IP address of his client, the system will return the complete data of the BIN and the IP address together with a risk score.

If your company handles a large volume of transactions, you are aware of how difficult it is to combat fraud. However, with the help of this API, you will be able to quickly and easily spot any fraudulent activity in your system. Using cutting-edge algorithms, this Fraud Detection API examines a wide range of data points, including IP addresses, geolocation data, user activity, and more. These information points are also utilized to generate a risk score that can be used to determine whether a transaction is fraudulent.