The digital transformation has caused a sea change in how firms function. With the introduction of new technology, organizations can now use data to drive intelligent processes, make quicker and wiser choices, and respond to market changes in real-time. VAT Number APIs are such technology that has emerged as a game changer for firms operating in the European Union (EU).

The Obstacle: Ensuring VAT Compliance

VAT is an indirect tax levied at every step in the manufacturing and supply chain where a monetary transaction occurs. It is one of the EU’s most important general taxation schemes. Businesses must pay the right VAT to the local tax authorities and collect the tax amount from customers by modifying product/service prices. However, VATs alter from time to time, and merchants adjust their product prices correspondingly. Furthermore, in the domestic market, VAT rates range from state to state. If your company expands internationally, there are hundreds of different VAT laws and rates to consider.

Maintaining VAT compliance may be a difficult undertaking for enterprises, especially those that operate across borders. This is where a VAT Number API may help.

The Solution: Zyla API Hub’s VAT Validation API

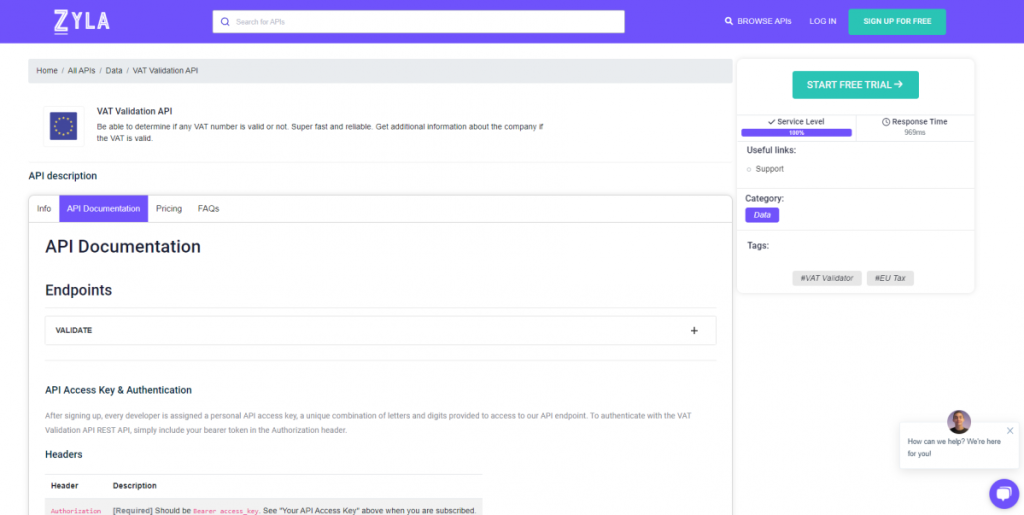

Zyla API Hub is a platform that enables organizations to discover, connect, and manage APIs using a single account, API key, and SDK. The VAT Validation API is one of the APIs featured on Zyla API Hub.

Businesses may use the VAT Validation API to rapidly and precisely validate the integrity of their customers’ VAT numbers, guaranteeing compliance with local requirements. This is especially beneficial for enterprises operating in the EU, where VAT compliance is critical.

Features And Advantages

Businesses may make use of various capabilities and benefits provided by the VAT Validation API. Some examples are:

- Before completing any transactions, the API confirms the authenticity of a particular VAT number with the Tax Authority.

- Ease of Use: The API is simple to integrate into existing systems and includes simple libraries, setup instructions, and detailed documentation.

- Security: The API includes banking-grade security features such as 256-bit SSL encryption.

In this part, we’ll provide an example to demonstrate how it works. The “VALIDATE” API endpoint will be utilized. To gain access to VAT-related information, enter the VAT number and the country code. That easy! Here’s how it works:

{

"valid": true,

"countryCode": "GB",

"vatNumber": "947785557",

"companyName": "BLUECLIFFE SERVICES LTD",

"companyAddress": "58-60 COLNEY ROAD",

"companyCity": "DARTFORD",

"companyPostCode": "DA1 1UH"

}More Info About VAT Validation API

It’s easy to get started using Zyla API Hub’s VAT Validation API. All you have to do is create an account on Zyla API Hub and get your API key. Once you have your key, you can begin utilizing the VAT Validation API to confirm your company’s VAT compliance.

- Register here: Begin by signing up for an account on the Zyla API Hub. The VAT Validation API and related resources are now available.

- The following is the API documentation: Examine the whole Zyla API Hub API documentation. More information regarding integration rules, endpoints, and parameters may be found here.

- Make a one-of-a-kind API key that will be used as your authentication credential while doing API queries.

- To connect the API to your systems, apply the integration principles. To guarantee a smooth integration process, use example code snippets and tutorials.

- Testing and deployment: To ensure optimum operation, extensive testing should be undertaken before installation in a production setting.

Finally, leveraging the capabilities of a VAT Number API may assist organizations in ensuring data correctness and redefining their approach to VAT compliance. The VAT Validation API from Zyla API Hub is a simple solution for firms operating in the EU.

Related Post: Supercharge Accuracy: Elevate Business With VAT Number APIs