In today’s fast-paced financial world, accurate, real-time market data is essential. Thus Stock Index APIs are critical resources for accessing both real-time and historical data from leading stock indices. These APIs provide up-to-date market performance information, crucial for building financial applications. This guide will focus on Indices-API, a leading EGX 30 Index API for developers seeking robust market data.

Exploring Indices-API: A Game-Changer for EGX 30 Index Market Data

When it comes to accessing stock market data, Indices-API is among the best options available. It stands out for several reasons. Firstly, it offers a vast catalog of stock indexes. From global indexes to more niche options like the EGX 30, it provides a comprehensive range of data. This gives developers the ability to access and analyze data from a wide range of markets.

Another key feature of Indices-API is its ease of use. It supports seamless integration with existing systems, whether you’re working on a web app, mobile platform, or trading tool. The API is designed to be developer-friendly, with extensive documentation that walks developers through each step of the integration process. This reduces the time and effort needed to get the API up and running.

Moreover, Indices-API offers real-time updates. In a market where every second counts, having access to the most current data is crucial. The API ensures that developers and their users are always working with the latest figures, allowing them to make informed decisions. Additionally, its strong customer support and reliability make it a trusted partner for developers working in the financial sector.

The Importance of a EGX 30 Index API in Today’s Market

Stock index solutions are integral to financial markets today. They offer a snapshot of how a particular sector or market is performing, providing insight into trends and patterns that are otherwise difficult to capture. Stock indexes, like the EGX 30, which represents the top 30 companies on the Egyptian stock exchange, help investors gauge overall market health and drive informed decisions.

Stock Index APIs make all of this possible by enabling seamless access to this data. They power the platforms and tools that traders and analysts rely on daily, whether for creating financial dashboards or automated trading algorithms. A reliable EGX 30 Index API like Indices-API, for example, allows developers to pull data effortlessly into applications and services.

A Guide on How to Get Started

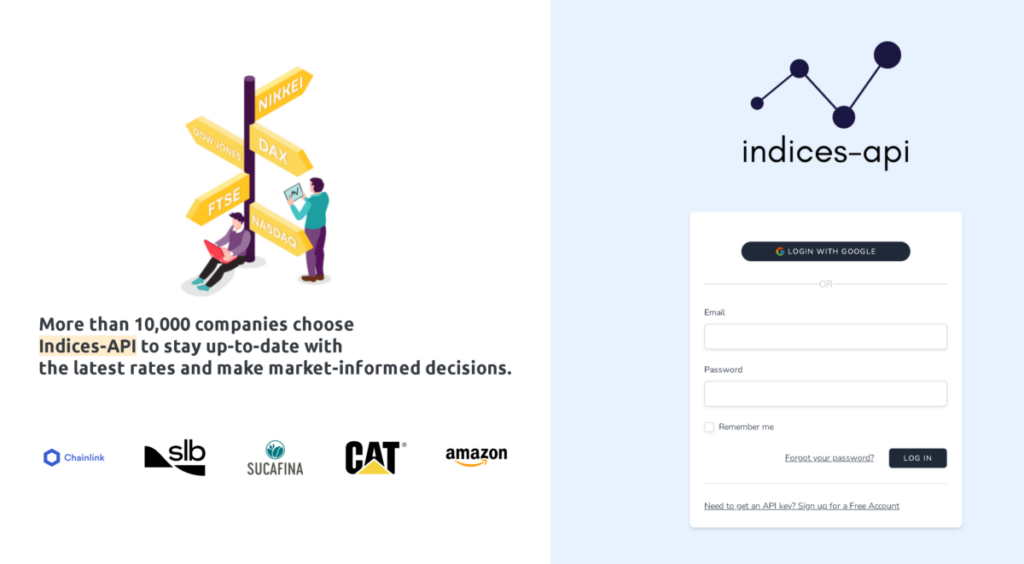

- Sign up for an Account – Visit the Indices-API website and sign up for an account. You’ll receive an API key, which you’ll need for authentication.

- Choose Your Index – Once logged in, browse the catalog of stock indexes, including the EGX 30, and select the one you need.

- Review Documentation – Access the API documentation to see the available endpoints, parameters, and responses.

- Integrate the API – Use the provided code snippets to integrate the API into your project. Whether you’re working with Python, JavaScript, or another language, Indices-API provides sample code to make integration easier.

- Test Your Implementation – Run a test to make sure the data is being pulled correctly. You can request real-time or historical data depending on your needs.

That’s it! Once integrated, you can begin leveraging the power of this EGX 30 Index API to build powerful, data-driven applications.

Indices-API‘s Role in Shaping the Future of Stock Market Development

Whether you’re tracking the EGX 30 or analyzing global markets, Indices-API ensures you have the data you need to stay ahead in an ever-changing financial environment. The future of stock market development is data-driven, and with Indices-API, developers can confidently build solutions that stand the test of time.

Related Post: Image Search for Online Stores API For Accurate Product Matching