In today’s fast-paced financial world, staying ahead of market trends is crucial for developers and traders alike. Access to reliable and up-to-date market data is indispensable for making informed decisions. This is where Commodities-API comes into play, offering a robust solution for real-time commodity pricing. Among its diverse offerings, the Dubai Crude Oil Financial Futures API stands out, providing essential data for one of the most critical markets in the oil industry.

Understanding Commodities-API

Commodities-API is a leading provider of real-time commodity price data, serving a broad spectrum of users, from individual developers to large enterprises. This API aggregates and delivers accurate market pricing for a wide range of commodities, including metals, energy, and agricultural products. By utilizing advanced technology and reliable data sources, Commodities-API ensures users receive precise and timely information to support their market strategies.

The Importance of Accurate Market Pricing

For developers and financial analysts, access to accurate market pricing is paramount. It influences trading decisions, risk management, and strategic planning. Commodities-API excels in providing this critical data, ensuring users can trust the information they base their decisions on. This reliability is especially vital in volatile markets like crude oil, where prices can fluctuate significantly within short periods.

Introducing the Dubai Crude Oil Financial Futures API

Among the various tools offered by Commodities-API, the Dubai Crude Oil Financial Futures API is particularly noteworthy. This API focuses on delivering real-time pricing data for Dubai Crude Oil, a benchmark for oil pricing in the Middle East. Given the region’s significance in the global oil market, having access to precise pricing data for Dubai Crude Oil is essential for developers and traders who focus on this commodity.

Key Features of the Dubai Crude Oil Financial Futures API

The API provides up-to-the-minute pricing information, ensuring users have the latest data at their fingertips. In addition to current prices, the API offers historical data, allowing users to analyze market trends and make data-driven decisions.

While specializing in Dubai Crude Oil, the API also provides data for other related commodities, offering a holistic view of the market. Designed with developers in mind, the API is easy to integrate into various applications, enabling seamless access to market data. Backed by reputable data sources, the API guarantees high accuracy, which is critical for financial applications.

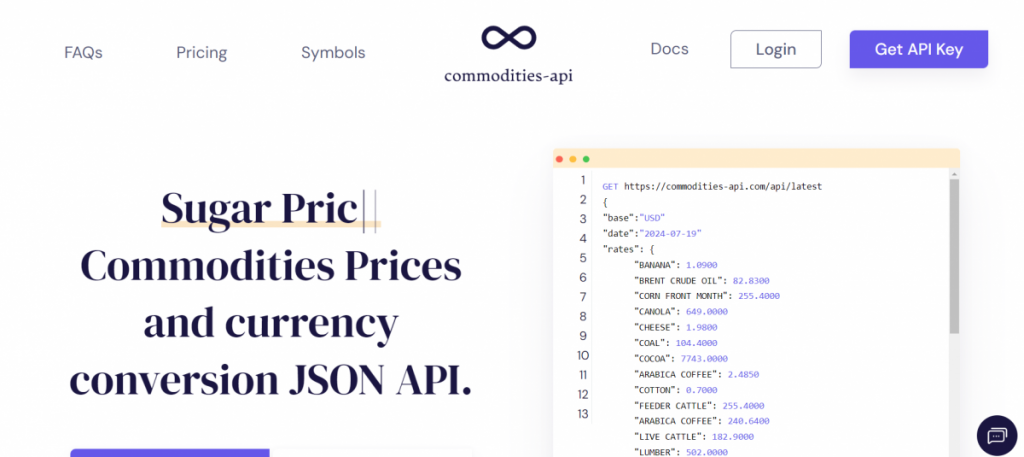

{

"base":"USD"

"date":"2024-07-19"

"rates": {

"BANANA": 1.0900

"BRENT CRUDE OIL": 82.8300

"CORN FRONT MONTH": 255.4000

"CANOLA": 649.0000

"CHEESE": 1.9800

"COAL": 104.4000

"COCOA": 7743.0000

"ARABICA COFFEE": 2.4850

"COTTON": 0.7000

Conclusion

In conclusion, the Dubai Crude Oil Financial Futures API by Commodities-API is an invaluable tool for developers and financial professionals. Its ability to provide accurate, real-time market pricing makes it indispensable for those looking to gain a competitive edge in the volatile oil market. By integrating this API into their applications, users can ensure they have the most reliable data to inform their trading strategies and financial decisions. Whether you are a developer building the next big trading platform or a financial analyst seeking precise market data, Commodities-API is your go-to solution for accurate market pricing. For more info, you can visit the Commodities-API website!