The Indices API is a game-changing tool for traders who want real-time access to the Dow Jones Price API . Offering accurate and timely market data, it empowers traders to make smarter decisions and refine their trading strategies with ease.

How to Use the Dow Jones Price API

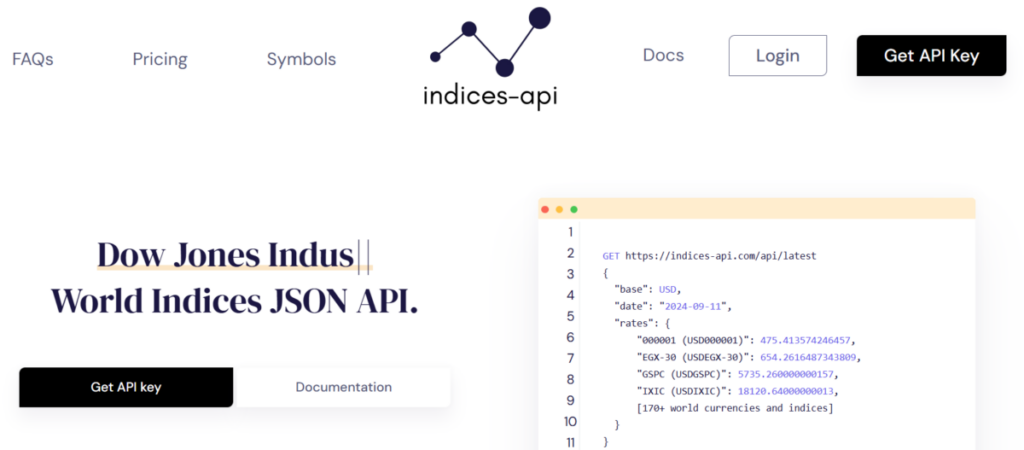

The Dow Jones Price API is simple and user-friendly, making it a perfect fit for both beginners and experienced traders. After signing up for the Indices API, you’ll get access to a set of clear and detailed endpoints, enabling you to easily retrieve up-to-the-minute data on the Dow Jones Index. This information can be integrated into trading platforms, websites, or even personal dashboards, giving you a continuous stream of real-time data to monitor and act on.

Whether you are building an automated trading system or simply keeping an eye on market trends, the Dow Jones Price API makes it seamless. Traders can use this data to monitor price fluctuations, compare trends, and adjust their strategies in real-time. With easy-to-understand documentation and helpful guides, setting up and integrating the API is a breeze, even for non-developers.

Why Real-Time Data is Crucial for Traders

For traders, having access to real-time data is not just a luxury—it’s essential. The financial markets move fast, and a delay of even a few seconds can lead to missed opportunities or significant losses. The Dow Jones Price API ensures that you stay updated with every tick of the market. This is especially crucial for those trading based on short-term fluctuations, where timing is everything.

Accurate, up-to-the-minute data allows traders to react to market changes as they happen. For instance, if the Dow Jones drops suddenly due to economic news or market events, traders can quickly adjust their positions to minimize losses or even take advantage of new opportunities. On the flip side, timely data can help traders make informed buy decisions before the market corrects itself, giving them an edge over those relying on outdated or delayed data sources.

How the Dow Jones Price API Enhances Trading Strategies

The Indices API doesn’t just provide raw data—it gives traders the tools they need to enhance their strategies. By tracking the real-time Dow Jones Price, traders can fine-tune their approach based on accurate information. For example, traders who follow technical analysis rely heavily on precise index values to identify patterns, trends, and potential turning points in the market.

The Dow Jones Price API offers high accuracy, which is crucial for strategy refinement. Traders can combine this data with other financial indicators to develop robust strategies tailored to different market conditions. Whether you prefer day trading, swing trading, or long-term investing, having up-to-date indices enables you to adapt your strategy on the fly.

Additionally, the API’s flexibility allows users to retrieve data in formats compatible with different platforms. This ensures that no matter what tools traders are using, they can access the information in a way that works best for them. This can include integrating the data into trading algorithms, dashboards, or even mobile apps for trading on the go.

Benefits of the Dow Jones Price API for Traders

The Dow Jones Price API offers several key benefits that make it a must-have for serious traders:

Real-Time Data: Stay ahead of market changes with up-to-the-second information on Dow Jones Price movements.

Accuracy: Ensure that the data you base your trades on is reliable, helping you avoid costly mistakes.

Ease of Integration: The API is designed to be simple to use, with clear documentation and support available to help at every step.

Flexible Access: Get data in multiple formats, perfect for integrating into different platforms or trading tools.

Enhanced Strategy: Use precise data to improve your trading strategy, whether you are reacting to short-term movements or planning long-term investments.

Why Choose Indices API for Dow Jones Data

The Indices API stands out for its speed, reliability, and ease of use. It provides fast access to data on key market indices like the Dow Jones, ensuring you never miss an important market move. The API is highly scalable, designed to meet the needs of individual traders and large financial institutions alike.

The real-time data it provides is not only timely but also accurate, making it a valuable resource for those serious about trading. Whether you’re a day trader looking for quick moves or a long-term investor analyzing trends, the Dow Jones Price API via the Indices API offers everything you need to make informed decisions.

With this tool, traders can gain a deeper understanding of market movements, allowing them to develop strategies with confidence. If you want to stay on top of the Dow Jones and make the most out of every trading opportunity, integrating the Dow Jones Price API into your toolkit is the smart choice.