Traders rely on timely, accurate information to execute their strategies efficiently. One tool that can significantly enhance a trader’s ability to stay ahead of the market is the Dow Jones Price API. This powerful API provides access to the most up-to-date stock market data, including critical indices like the Dow Jones, offering users accurate and real-time price information.

How to Use the Dow Jones Price API

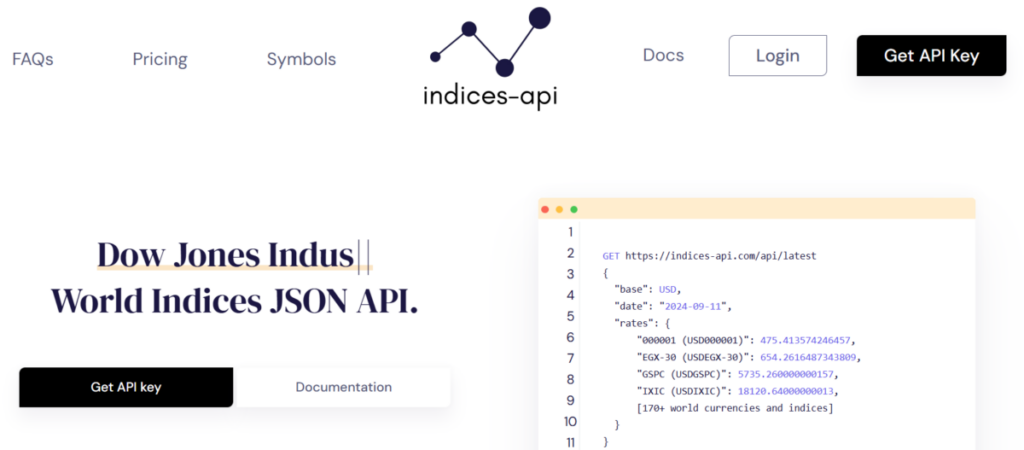

The Dow Jones Price API is designed to be user-friendly and accessible to both novice and experienced traders. Once integrated into your trading platform, it allows you to retrieve real-time data for the Dow Jones index and other major indices. Here’s a simple breakdown of how to use the API:

Sign up and Get Access: First, create an account with the API provider. After registration, you’ll receive an API key to access real-time data.

Integrate the API: Using the provided documentation, you can easily integrate the API into your trading software or platform. This integration will allow you to access real-time Dow Jones price data, historical charts, and other relevant market information.

Access Data: With the API in place, you can make requests for real-time data, including the latest price of the Dow Jones index, to be displayed directly in your dashboard or platform.

Implement in Trading Strategies: With live data at your fingertips, you can now implement the Dow Jones Price API into your trading strategies, executing buy or sell orders based on the most recent market trends.

Benefits of Using the Dow Jones Price API for Traders

The Dow Jones Price API offers several benefits that can help traders improve their decision-making and gain a competitive edge in the market. Here’s how it can enhance trading strategies:

Real-Time Data Accuracy

The most significant advantage of using the Dow Jones Price API is access to real-time market data. Trading decisions made on outdated or delayed information can be costly. This API ensures that traders always have access to the most accurate and current market prices, enabling them to react quickly to market fluctuations and make timely trades.

Comprehensive Market Coverage

While the Dow Jones Price APIs focuses on the Dow Jones index, it also provides data on other indices like the S&P 500, NASDAQ, and more. This comprehensive coverage allows traders to compare movements across multiple indices and assess the broader market trends before executing trades.

Speed and Efficiency

In fast-moving markets, speed is critical. The Dow Jones Price APIs delivers lightning-fast responses, ensuring that traders can access the latest information in real-time without delays. Whether you are tracking minute-by-minute price changes or monitoring hourly trends, the API ensures you’re always up to date.

Customizable Alerts

Many trading platforms integrated with the Dow Jones Price APIs offer customizable alerts based on specific price thresholds or market movements. Traders can set up notifications for when the Dow Jones index hits a certain price, ensuring they never miss important market events. This feature adds an extra layer of automation and convenience for active traders.

How the Dow Jones Price APIs Improves Trading Strategies

For traders, the ability to make informed decisions is crucial. The Dow Jones Price APIs enables real-time access to market data, allowing traders to refine their strategies based on the most current market conditions. Here’s how:

Technical Analysis: Traders use indices data to perform technical analysis, identifying trends and predicting future price movements. The API’s real-time data ensures that technical indicators such as moving averages and relative strength indices (RSI) are based on the latest information.

Market Sentiment: Indices like the Dow Jones are often used as a barometer for overall market sentiment. By integrating this data into trading platforms, the API helps traders gauge whether the market is bullish or bearish, which can guide buying and selling decisions.

Risk Management: Traders can incorporate real-time data into their risk management strategies. By monitoring live price changes, they can set stop-loss orders or adjust their positions based on real-time information, helping to minimize potential losses.

Conclusion

The Dow Jones Price API is an essential tool for anyone serious about staying competitive in the fast-paced world of stock trading. By providing real-time, accurate market data, it empowers traders to make better-informed decisions, optimize their strategies, and stay ahead of market trends. Whether you’re a seasoned professional or just starting, integrating the Dow Jones Price APIs into your trading platform can give you the edge you need to succeed in today’s volatile markets.