In the fast-paced world of trading, having access to real-time market data is essential. The Dow Jones Industrial Avg Rates API provides traders with accurate and timely updates on market indices, empowering them to make informed decisions. This API is a powerful tool designed to enhance trading strategies by delivering up-to-the-minute information on one of the most followed stock market indicators.

How to Use the Dow Jones Industrial Avg Rates API

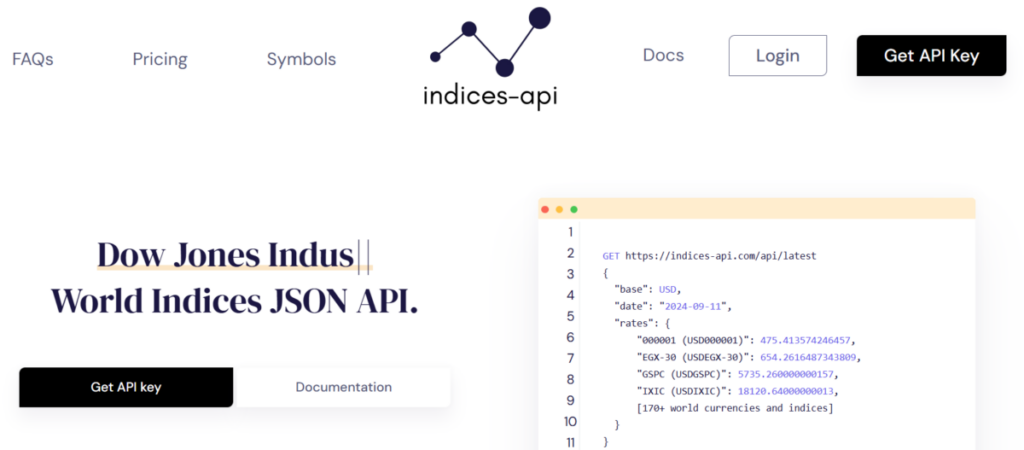

Using the Dow Jones Industrial Avg Rates API is straightforward, even for those new to trading technology. To get started, users must first sign up for an API key from the service provider. This key is crucial for authenticating requests and ensuring secure access to the data.

Once you have your API key, integration into your trading platform can begin. The API allows for easy integration with various programming languages, making it accessible whether you’re using Python, Java, or JavaScript. By sending a simple HTTP request to the API endpoint, users can retrieve real-time rates, historical data, and even specific performance metrics of the Dow Jones Industrial Average.

Traders can leverage this data for analysis, such as identifying trends, understanding market fluctuations, and optimizing their investment strategies. The response is typically delivered in a JSON format, making it easy to parse and use within your applications.

The Importance of Real-Time Market Data for Traders

Real-time market data is crucial for traders who need to react swiftly to market changes. The Dow Jones Industrial Average serves as a barometer for the overall health of the U.S. economy, and its fluctuations can have significant impacts on investment portfolios. By utilizing the Dow Jones Industrial Avg Rates API, traders gain instant access to this vital information, allowing them to adjust their strategies promptly.

In a market that operates 24/7, delays in obtaining market data can lead to missed opportunities or substantial losses. The Indices API mitigates these risks by providing accurate and timely data, ensuring that traders can make well-informed decisions. Whether you are a day trader looking to capitalize on short-term price movements or a long-term investor assessing overall market trends, this API serves as a critical resource.

Benefits of the Indices API

The Indices API offers several benefits that can significantly enhance trading strategies. First and foremost is the accuracy of the data. Real-time updates ensure that traders are operating on the most current information, which is essential in a volatile market environment.

Another key benefit is the speed of access. With rapid data retrieval capabilities, traders can execute trades more efficiently, responding to market changes as they occur. This agility can lead to increased profitability and reduced risk exposure.

Additionally, the Dow Jones Industrial Avg Rates API provides historical data, enabling traders to analyze past performance and identify patterns. This feature allows for more strategic planning, as traders can use historical trends to forecast future movements.

Conclusion

In summary, the Dow Jones Industrial Avg Rates API is a vital tool for traders seeking to navigate the complexities of the stock market. With real-time updates and accurate data, the Indices API enhances trading strategies, allowing users to react swiftly and effectively to market changes. By integrating this API into their trading practices, investors can position themselves for success in an ever-evolving financial landscape.