In the fast-paced world of stock trading, having access to real-time market data is crucial. The DJI Price API offers traders automated insights, enabling them to make informed decisions quickly. This powerful tool provides accurate data on market indices, enhancing trading strategies and allowing users to respond to market fluctuations in real time.

How to Use the DJI Price API

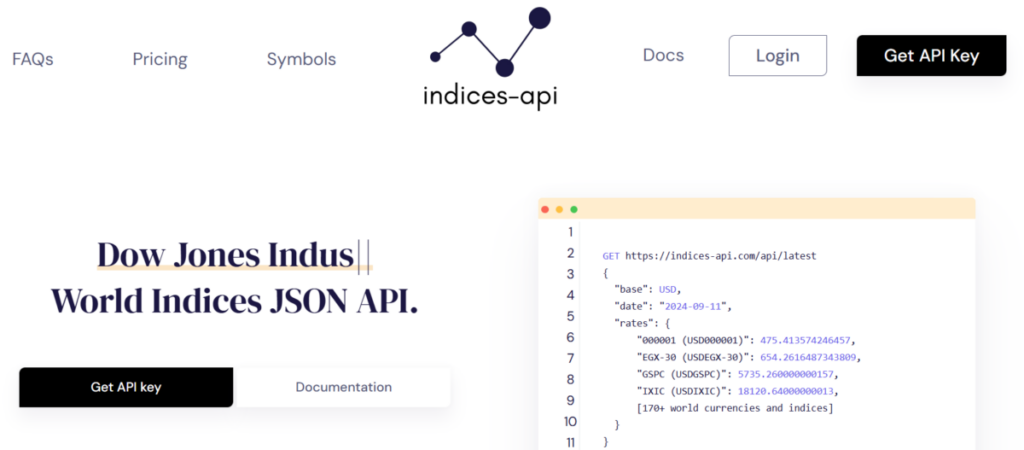

Using the DJI Price API is straightforward, making it accessible for traders at all skill levels. First, users need to sign up for an account with the API provider. Once registered, they will receive an API key, which allows them to access market data securely.

After obtaining the API key, traders can start making requests to retrieve real-time data. The API supports various endpoints that provide information on different indices, including the Dow Jones Industrial Average (DJI), S&P 500, and others. By integrating the API into trading platforms or applications, users can automate the retrieval of market data, reducing the time spent on manual analysis.

To enhance their trading strategies, users can implement algorithms that utilize the API data. For instance, traders can set up alerts for significant market changes or trends based on the indices retrieved through the DJI Price API. This automation not only increases efficiency but also ensures that traders can act swiftly on valuable insights.

The Importance of Real-Time Market Data for Traders

Real-time market data is essential for traders looking to stay competitive. Stock markets can be volatile, with prices fluctuating rapidly based on economic news, earnings reports, and other factors. Traders need immediate access to accurate data to make timely decisions. Without real-time information, they risk missing opportunities or incurring losses.

The DJI Price API plays a vital role in providing this necessary data. By offering real-time updates on market indices, the API enables traders to analyze trends and make informed decisions based on the most current information available. This immediacy can significantly impact the success of trading strategies.

Benefits of the Indices API

In addition to the DJI Price API, the Indices API offers even broader insights into market performance. The Indices API provides comprehensive data across multiple indices, including historical data and performance metrics. This allows traders to conduct in-depth analyses and backtesting, helping them refine their strategies over time.

One of the key benefits of the Indices API is its ability to deliver accurate indices, which are crucial for tracking market performance. Traders can easily compare different indices, identify trends, and adjust their strategies accordingly. This level of detail and accuracy ensures that traders are always working with the best information available.

Furthermore, the Indices API can be seamlessly integrated into trading platforms, allowing for a more streamlined trading experience. Users can customize their dashboards to display the indices and data most relevant to their trading strategies, enabling them to monitor their portfolios and market movements in real time.

Conclusion

In conclusion, the DJI Price API is an essential tool for traders looking to automate their stock market insights. By providing real-time data and easy integration with trading platforms, this API enhances decision-making processes and trading strategies. Coupled with the benefits of the Indices API, traders can access a wealth of information to navigate the complexities of the market confidently. Embracing these tools not only keeps traders informed but also empowers them to seize opportunities and minimize risks effectively.