Do you need to detect fraudulent credit card transactions through an API? Keep reading to know everything about it!

The world we live in is a very technological one. This is why we see a lot of new and innovative products and services come out every day. And one of the most popular ones today is payment processing.

Payment processing refers to the act of collecting, storing, and transferring funds from one party to another; usually for goods or services. This is done through a financial institution or third-party provider. And it’s a process that has become so popular that it’s used by almost everyone on a daily basis.

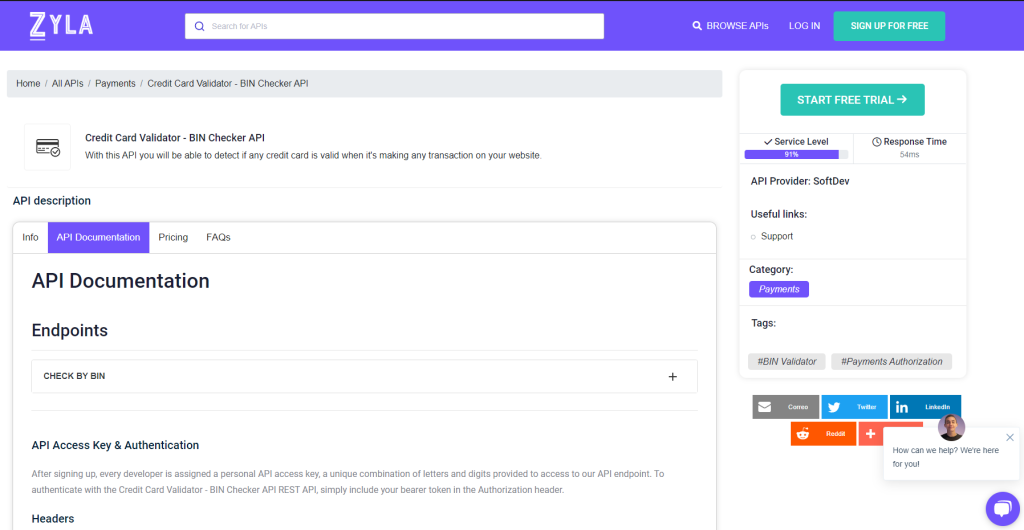

When it comes to protecting your business against fraudsters; this tool is very valuable. This is because it can help you protect your business from losing money to fraudulent transactions; while also keeping your customers’ information secure. The best API we recommend is Credit Card Validator – BIN Checker API.

How Can You Use This API To Detect Fraudulent Transactions?

Credit Card Validator – BIN Checker API allows you to detect fraudulent transactions by checking the card’s number, expiry date, and the three-digit security code on the back of the card. By doing this, you can make sure that your transactions are legit and safe for your business.

Credit Card Validator – BIN Checker API is one of the most popular APIs available due to its ease of use and accuracy. By entering some basic information such as the name of the firm and its IBAN, you may obtain all types of information about bank accounts, including their name and address, as well as their BIN number.

This way, you won’t waste time looking for this information manually or asking banks directly for it. With Credit Card Validator – BIN Checker API you’ll get all the information you need in just seconds!

How Did You Obtain This Data?

1- Navigate to Credit Card Validator – BIN Checker API and select the “Subscribe for free” button to begin utilizing the API.

2- You will be issued your unique API key after registering up in Zyla API Hub. You will be able to use, connect, and administer APIs using this one-of-a-kind combination of numbers and letters!

3- Depending on what you’re looking for, use different API endpoints.

4- You may already integrate the API in the language you require with your API key. There are numerous Code Snippets available at the aforementioned URL to help you with your integration.

Functions

- CHECK BY BIN

For instance, if you use the endpoint with the BIN number “448590,” the API will respond with the following:

{

"success": true,

"code": 200,

"BIN": {

"valid": true,

"number": 448590,

"length": 6,

"scheme": "VISA",

"brand": "VISA",

"type": "CREDIT",

"level": "PURCHASING WITH FLEET",

"currency": "USD",

"issuer": {

"name": "JPMORGAN CHASE BANK, N.A.",

"website": "http://www.jpmorganchase.com",

"phone": "1-212-270-6000"

},

"country": {

"country": "UNITED STATES",

"numeric": "840",

"capital": "Washington, D.C.",

"idd": "1",

"alpha2": "US",

"alpha3": "USA",

"language": "English",

"language_code": "EN",

"latitude": 34.05223,

"longitude": -118.24368

}

}

}Using the Credit Card Validator – BIN Checker API, developers can increase transaction acceptance rates by checking that the credit card information provided by the customer is accurate and legitimate. This can help to reduce the number of declined transactions, which can be both inconvenient and costly for both consumers and businesses.