Do you want to check if the payment information is correct? Read this article to find out how to do it!

BINs are a sequence of numbers between 01 and 99 that are assigned by a financial institution to each of its cards. A BIN is a unique identifier for each card in the same way that a social security number identifies an individual.

It’s simple to check if a number is authentic or not, but you need to use an API. In other words, you need a software interface that allows you to access data from various databases and use it in your digital platforms. This can be done by using an BIN Database Lookup API (Application Programming Interface), which allows you to access data from various databases and use it in your digital platforms.

The first thing to understand about the BIN is that it is a unique code assigned to each financial institution by their national numbering authority. This code is used to identify individual financial institutions on transactions and statements.

The second thing to understand about the BIN is that it is used by merchants and processors to identify the financial institution on transactions and statements. This aids in matching transactions to the correct financial institution for settlement.

An IP address, or Internet Protocol address, is a unique set of numbers assigned to each device (e.g., smartphones, tablets, computers) connected to the Internet. An IP address can be used to identify a specific location or user. By checking an IP address, you can see where a website or service is hosted. You can also see what country a website or service is hosted in. You can also use an IP address to track down specific users or devices.

BIN IP Checker

Webmasters that want to carefully review credit/debit card transactions that occur on their websites can use this API, which was created with their needs in mind. It is an obvious example of how risky the transactions are. However, as long as they abide by the API’s standards, anyone is free to utilize this API on any platform in accordance with their preferences and the conditions of their membership. Everyone can find a plan to meet their needs, even one that is free for a set amount of requests every day. To avoid service abuse, this plan does have a rate cap in place.

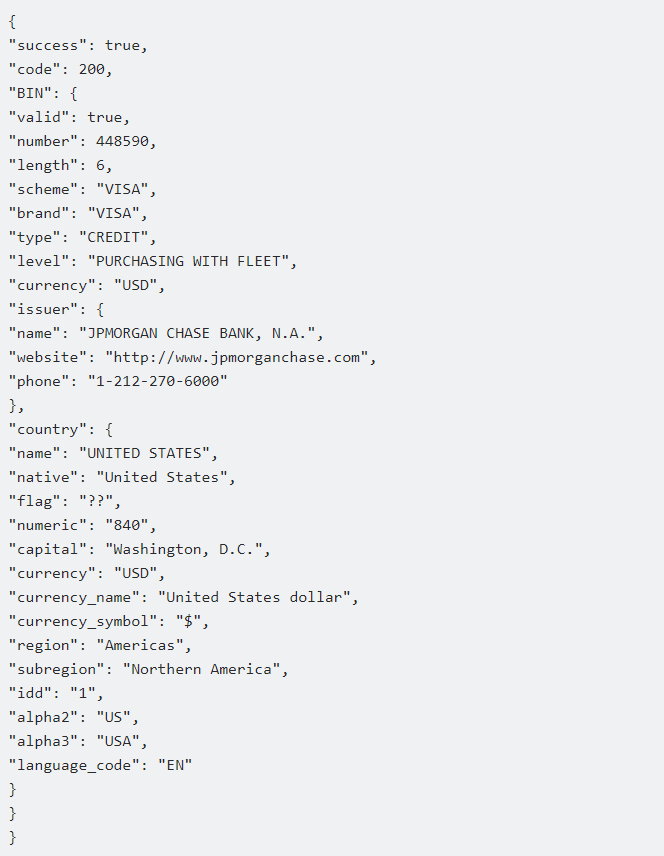

The BIN of the credit card and the user’s IP address who made the request will both be verified by this API. It will evaluate whether the nation of the IP address and the card’s BIN match by comparing the BIN and IP information. This is a fantastic approach to thwart fraudulent transactions at the source. The following is an example of the type of response you will get from this API:

How can I use this BIN Validation API to stop fraud? The user can obtain all of the BIN’s details by entering the BIN number. The system will return the whole data of the BIN and the IP address’s attributes, together with a risk score, if the user enters both the BIN and the IP address of his client.

Will there be a “Pay per Request” option? Of course, you can use it and only pay for it when you actually use it. There is no time limit on the credit. What specific purpose would it serve in my project, exactly? For practically all programming languages, RapidAPI offers an extensive selection of integration techniques. You can use these codes to interact with your project as needed.