In the ever-evolving landscape of online transactions, credit card fraud has become a persistent concern for businesses and consumers alike. Ensuring the validity of credit card information is crucial not only to protect businesses from potential losses but also to establish trust with customers. This is where the Credit Card Validator BIN Checker API emerges as an indispensable tool, offering a robust solution to validate credit card authenticity and mitigate the risks associated with fraudulent transactions.

The rise of e-commerce and online payments has transformed the way people shop and conduct financial transactions. While this convenience has brought immense benefits, it has also given rise to increasingly sophisticated methods of credit card fraud. From stolen card details to identity theft, businesses face a constant threat that can undermine their operations and damage their reputation. Customers, on the other hand, demand security and reliability when sharing their payment information online.

The Main Star In The Show: Credit Card Validator – BIN Checker API

The Credit Card Validator BIN Checker API steps in as a game-changer by offering a comprehensive approach to credit card validation. At its core, this BIN Checker API employs the Bank Identification Number (BIN) to authenticate credit card information. The BIN, the first six digits of a credit card number, holds vital information about the issuing bank and other card attributes. By cross-referencing the BIN with a vast and up-to-date database, the API can instantly verify the legitimacy of the card.

One of the primary advantages of the Credit Card Validator BIN Checker API is its speed and accuracy. In a matter of milliseconds, businesses can receive real-time feedback on the validity of a credit card. This seamless integration allows for instant validation during the checkout process, minimizing friction for the customer and reducing the chances of abandoned carts. By ensuring that customers use valid credit cards, businesses can avoid unnecessary chargebacks and revenue losses stemming from fraudulent transactions.

Moreover, the API offers a multi-layered approach to validation. It not only checks the card number’s validity but also assesses additional information such as the card’s expiration date and the issuing country. This comprehensive validation process adds an extra layer of security, giving businesses confidence in the legitimacy of each transaction. Such thorough validation is especially valuable for high-value transactions where the risks associated with fraud are considerably higher.

This BIN Checker API isn’t just a shield against fraudulent activities; it’s also a tool to enhance customer satisfaction. When customers feel secure while making online purchases, they are more likely to become repeat buyers and recommend the platform to others. The API’s role in creating a trustworthy environment is invaluable in cultivating long-term customer relationships and fostering brand loyalty.

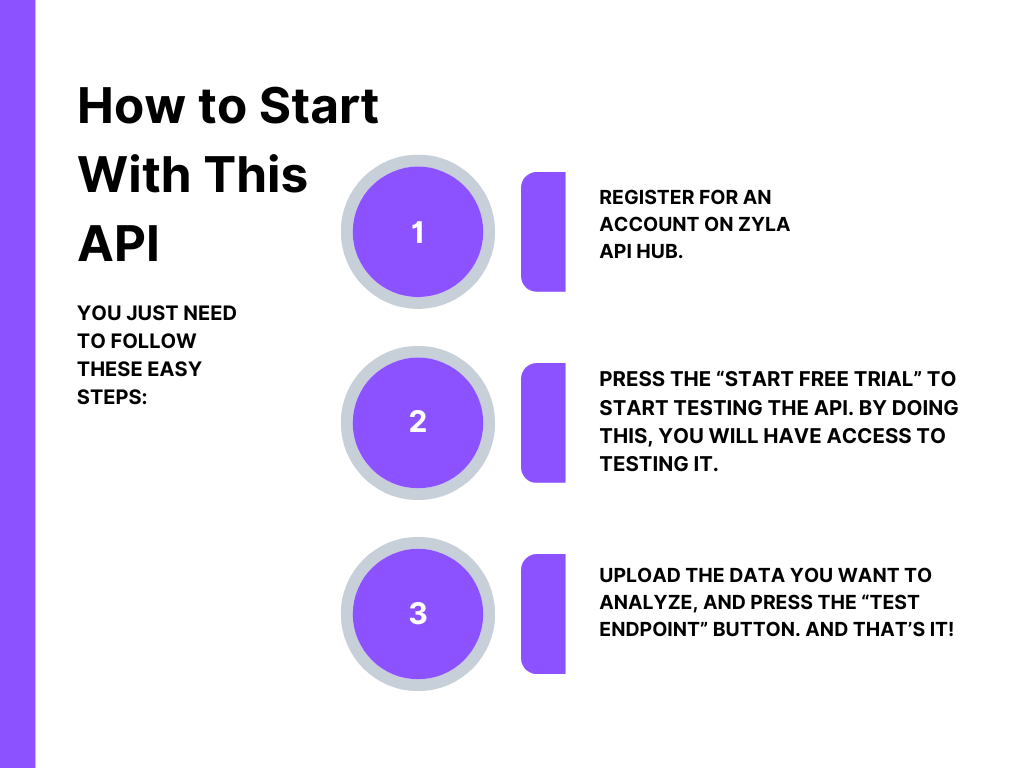

Follow These Steps To Start To Use This API

You can see the country code, IP city, the kind of the card, and even its category in the response after entering the card’s BIN, which is 448590, in the test endpoint.

In conclusion, the Credit Card Validation API, particularly the standout Credit Card Validator BIN Checker API, is the answer to the modern-day challenge of credit card fraud and validation. By leveraging the power of the BIN, businesses can effortlessly verify the authenticity of credit card information in real-time. This not only protects them from financial losses but also nurtures a secure and trustworthy shopping environment for customers.