In the intricate landscape of modern financial transactions, BIN Checker APIs emerge as the unsung heroes, seamlessly orchestrating the symphony of security and efficiency. At their core, these APIs are the digital gatekeepers, meticulously designed to scrutinize every digit, every nuance of a credit card number. They serve as the vigilant custodians of businesses, fortifying them against the relentless tide of fraudulent activities.

When a transaction is initiated, these BIN Checker APIs come alive, swiftly dissecting the provided card number. Through intricate algorithms and cross-referencing with vast BIN databases, they assess the card’s authenticity, pinpointing irregularities with laser precision. The real-time validation process acts as a sentinel, deflecting potential threats in milliseconds, ensuring smooth transactions, and safeguarding customer trust. In essence, these tools are the silent guardians of the digital realm, a potent amalgamation of technology, security, and vigilance, offering businesses the shield they need to navigate the world of electronic transactions with confidence and peace of mind.

Explaining the Concept of BIN Checker APIs and Their Relevance in Modern Business Operations

Think of APIs as linguistic bridges between different software systems. They allow applications to exchange data, request services, and perform functions in a standardized manner. In the realm of financial security, a BIN Checker API stands as a prime example. This type of API, endowed with the ability to scrutinize the Bank Identification Number (BIN) imprinted on credit cards, performs a crucial role in fraud prevention.

In modern business operations, APIs have transcended from mere technical tools to strategic assets. They expedite processes, enhance user experiences, and open doors to innovation. Whether it’s e-commerce transactions, mobile app interactions, or cloud-based services, APIs underpin the efficiency and agility that businesses thrive upon. In the era of interconnected systems, APIs are the invisible architects shaping the landscape of modern commerce.

Due to the efficiency of these tools, we recommend working with the best tool in the market, Credit Card Validator – BIN Checker API.

Key Features to Look for in the Credit Card Validator – BIN Checker API

In the intricate dance of digital transactions, the BIN Checker API emerges as a vigilant sentinel, poised to safeguard businesses against the relentless tide of fraud. As you navigate the landscape of credit card validation, certain key features gleam like beacons, guiding you toward the perfect API choice.

Real-time Precision: Seek this API that offers instant, real-time validation of credit card data. The ability to swiftly dissect and scrutinize Bank Identification Numbers (BINs) sets the foundation for effective fraud prevention.

Comprehensive BIN Database: Opt for Credit Card Validator – BIN Checker API armed with an extensive, up-to-date BIN database. This repository acts as the compass, helping you navigate the labyrinth of card issuers, schemes, and regions.

Customization Flexibility: Every business has its unique contours. This robust API empowers you to tailor the validation process to fit your specific needs, from setting validation rules to adjusting response formats.

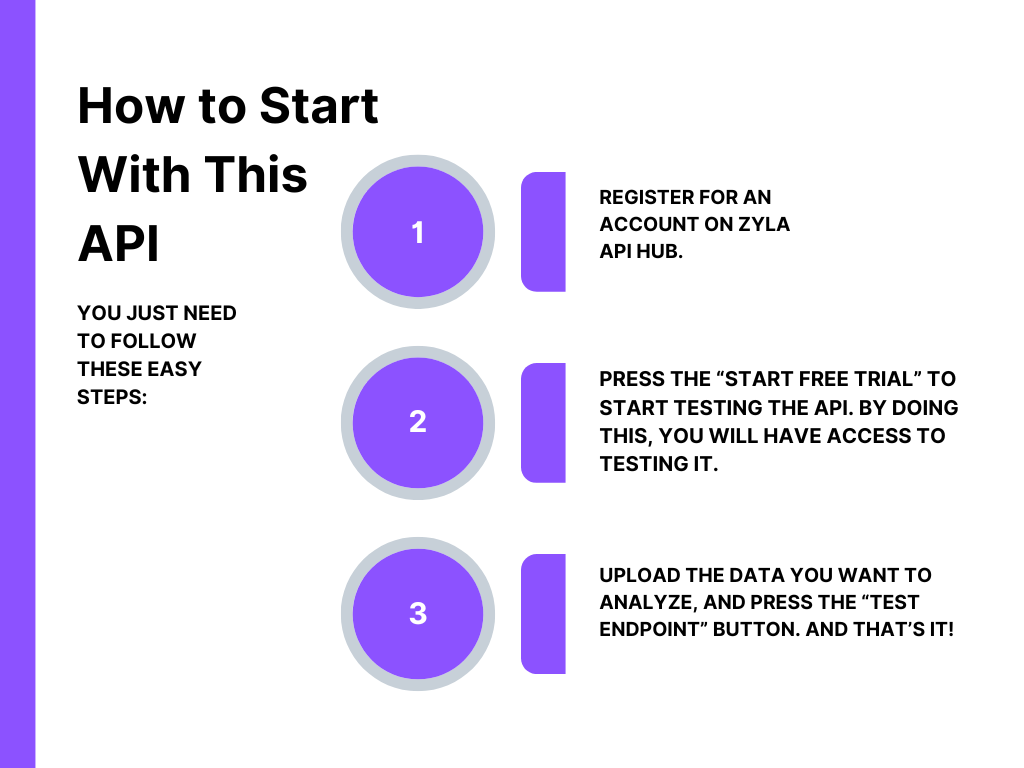

Follow These Steps To Use This API

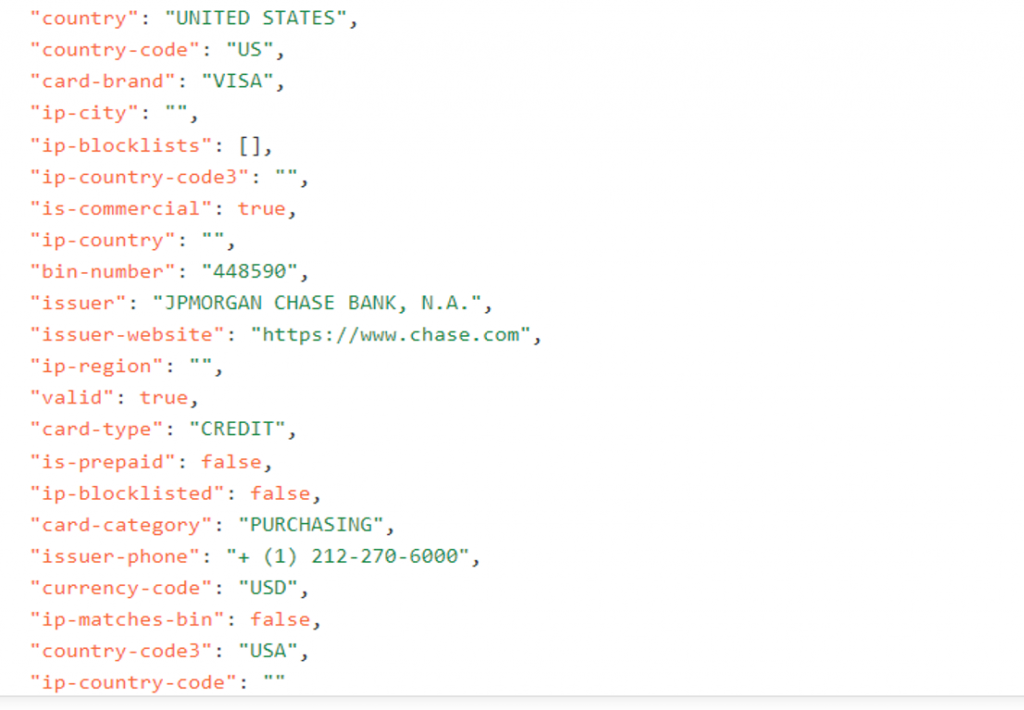

You can see the country code, IP city, kind of card, and even category in the response after entering the card’s BIN, which is 448590, in the test endpoint:

The Credit Card Validator – BIN Checker API emerges as an indispensable tool in the realm of financial transactions. Its ability to swiftly and accurately validate credit card information through the analysis of Bank Identification Numbers (BINs) underscores its significance in fraud prevention and transaction security. By harnessing this API, businesses can enhance customer trust, streamline payment processes, and reduce the risk of fraudulent activities. As the digital landscape continues to evolve, integrating the Credit Card Validator – BIN Checker API stands not only as a testament to technological advancement but also as a safeguard for the integrity of financial interactions.