In the rapidly evolving landscape of e-commerce and digital transactions, the accuracy and security of credit card validation have never been more crucial. Enter the Credit Card Validator – BIN Checker API, a cutting-edge solution that stands as a paragon of reliability and efficiency in validating credit card information. Let’s delve into the nuances of this remarkable tool and uncover the myriad benefits it offers to developers and businesses alike.

The Essence of Credit Card Validation

In the realm of online transactions, the pivotal role of credit cards cannot be overstated. However, the veracity of the provided credit card details is a perpetual concern. This is where a BIN Checker API emerges as a beacon of accuracy. The Bank Identification Number (BIN), the initial six digits of a credit card, contains a trove of information about the card issuer, card type, and even the country of origin. Harnessing the power of this data, a BIN Checker API ensures that the entered information aligns seamlessly, mitigating the risk of fraud and chargebacks.

Seamless Integration and Effortless Implementation of The Best BIN Checker API In The Market: Credit Card Validator – BIN Checker API

The beauty of the Credit Card Validator – BIN Checker API lies in its simplicity of integration. Developers can seamlessly incorporate this API into their applications, websites, or platforms with minimal effort. Its robust documentation and developer-friendly approach mean that even those with limited technical expertise can harness its power without breaking a sweat. By automating the validation process, developers save invaluable time and resources, allowing them to focus on core functionalities and user experience. Also, you will get more benefits like:

Precision Redefined:

Precision is the cornerstone of any credit card validation service, and this BIN Checker API embodies this principle with finesse. Its comprehensive database, regularly updated to encompass the latest card information, ensures that every card detail entered is cross-referenced with accurate data. Credit Card Validator – BIN Checker API‘s ability to detect nuances such as card type, issuer authenticity, and potential restrictions sets it apart from conventional validation methods.

Reduced Friction, Enhanced Customer Experience:

In the realm of digital transactions, a smooth and hassle-free experience is paramount. The Credit Card Validator – BIN Checker API contributes significantly to enhancing customer experience by minimizing friction during the checkout process. With real-time validation, users are promptly notified about the validity of their card details, saving them from the frustration of failed transactions and enhancing their trust in the platform.

Staying Ahead of Fraudulent Activities:

In the ever-evolving landscape of online security threats, staying ahead of fraudulent activities is a constant battle. The Credit Card Validator – BIN Checker API emerges as a stalwart ally in this fight, enabling businesses to fortify their defenses. By swiftly identifying discrepancies and irregularities in credit card information, this API acts as a robust barrier against potential fraud, safeguarding both businesses and their customers.

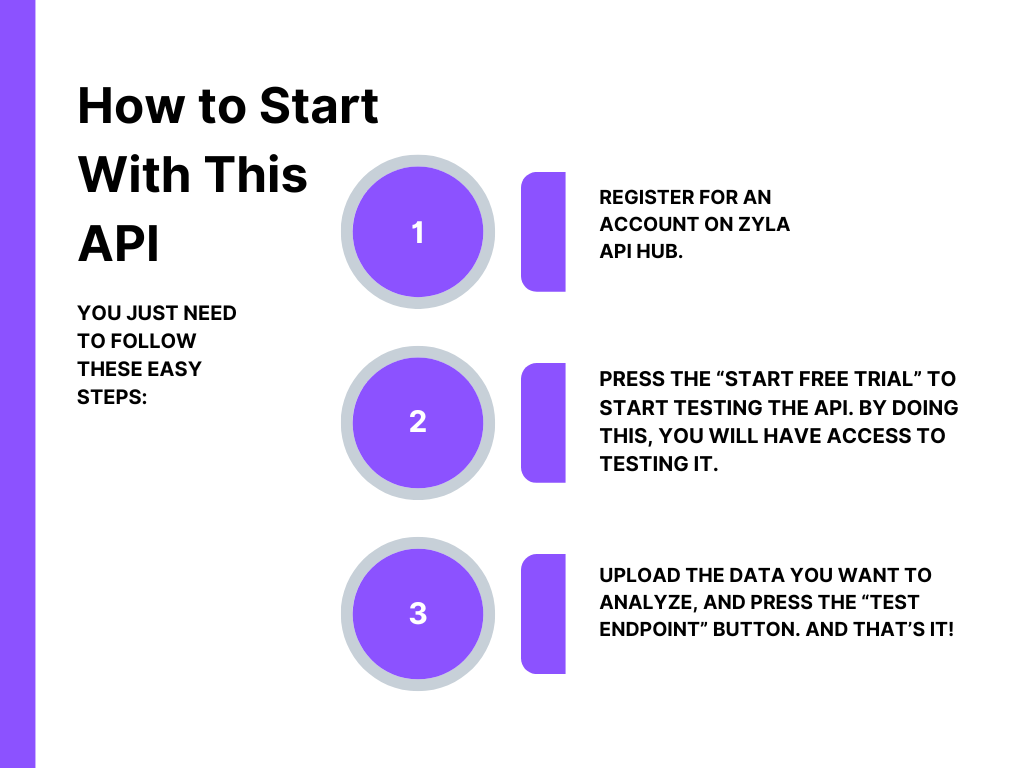

See The Following Steps To Start To Use Credit Card Validator – BIN Checker API

After entering the card’s BIN, 448590, into the test endpoint, the following response displays the country code, IP city, card type, and even category:

In the dynamic world of digital transactions, the Credit Card Validator – BIN Checker API stands as a testament to innovation and reliability. With its seamless integration, precise validation, and multifaceted benefits, developers and businesses can elevate their operations to unprecedented levels of efficiency and security. As technology continues its inexorable march forward, embracing solutions like the BIN Checker API is not just an option; it’s a necessity for thriving in the digital economy.