In the vast realm of industrial metals, few shine as brightly as copper. This unassuming element holds a crucial position in the intricate dance of global commerce, and its significance extends far beyond its distinctive reddish hue. Copper’s versatility is a key driver of its importance. This crucial industrial metal plays a starring role in various industries, serving as a linchpin in the machinery that powers our world. Copper Continuous Contract is as diverse as they are essential, weaving into the fabric of modern existence.

From the wires that conduct electricity with efficiency to the pipes that channel water in our homes, copper is the silent conductor of progress. Its antimicrobial properties make it a preferred choice in healthcare settings, and its malleability ensures it can be shaped to meet the demands of a myriad of applications.

Factors Influencing Copper Continuous Contract Prices

Pricing dynamics in the copper market are influenced by a multitude of factors, creating a complex interplay of forces. Geopolitical events can send shockwaves through the market, disrupting supply chains and triggering price fluctuations. The global economic climate is another potent force. Economic expansions drive demand, while contractions can lead to an oversupply, dampening prices. The delicate dance between these factors requires traders to stay vigilant and adapt to the ever-changing market landscape.

The Copper Continuous Contract introduces traders to a new aspect of commodity trading. Continuous contracts, as opposed to normal futures contracts, provide a smooth transition from one futures contract to the next. This novel method reduces the disruptions that can occur during contract rollovers. A continuous price chart that spans numerous contracts provides traders with a comprehensive perspective of historical performance and price fluctuations. This continuous flow ensures a more complete grasp of market dynamics.

Trading with continuous contracts presents a unique set of issues. Because these contracts are everlasting, traders are exposed to possible risks such as market instability and unanticipated price movements. It necessitates a strategic strategy as well as a thorough understanding of risk management.

However, with dangers come opportunities. The Copper Continuous Contract allows traders to profit on the continuous flow of information, allowing them to make more educated decisions. The ability to navigate the market with agility and respond quickly to developing trends holds potential advantages.

Commodities API

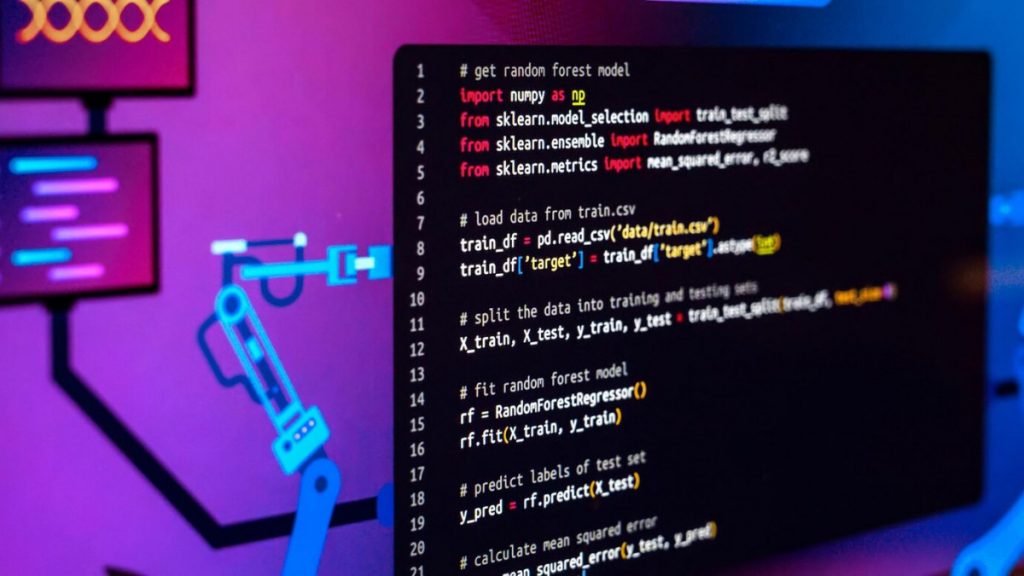

The Commodities API started off as a simple, lightweight Open-Source API providing current and historical commodity rates from banks and stock exchanges. The API can provide real-time commodities data with a 2 decimal point precision and a frequency of up to 60 seconds. We can provide exchange rates for almost any commodity, as well as convert single currencies and provide Time-Series and volatility data.

Simply give your unique Access Key as a query argument to one of the five major API Endpoints to gain access to huge amounts of data. To begin, navigate to the “Symbols” page and select the commodity code about which you wish to learn more. API calls are required for the time being. Following the processing of your inputs, you will receive a file containing the relevant data in one or more formats.

Large corporations, countless SMBs, and thousands of developers use the Commodities API on a regular basis. This API is the finest resource for learning about commodity price because of its trustworthy data sources and more than six years of experience. The commodities data made available through the API is produced by the World Bank, other institutions, and financial data sources.