Are you looking for a reliable API that supports managing bank accounts? Are you trying to find an API that can help with transactions? Then carry on reading this article.

The financial services industry is evolving. Every prosperous bank has implemented a digital transformation strategy to meet the demands of knowledgeable customers for online and mobile services. An Open Banking campaign using APIs is often a key part of this plan.

The flexibility of APIs is unmatched in the banking sector. Both simplifying procedures and facilitating financial transactions can be accomplished with the use of these instruments. Your business will gain a lot from using banking APIs. You may ensure that your clients’ financial transactions are secure and straightforward by integrating them. Vendors will receive payment from a reliable bank, and buyers can show that their money are available for usage.

The primary focus of common banking APIs is validating accounts using unique identifiers like routing codes or account numbers. Anyone involved in the payment processing industry needs accurate bank routing numbers. The proper routing number entry is necessary for all transactions including sending or receiving

A routing number, also known as a routing transit number, is a nine-digit designation used to identify financial institutions in the US. It is mostly used to make it easier for financial institutions to transfer money through methods like ACH, Fedwire, cheques, etc. A check’s routing number is located at the very bottom. You can use this API to find the data contained.

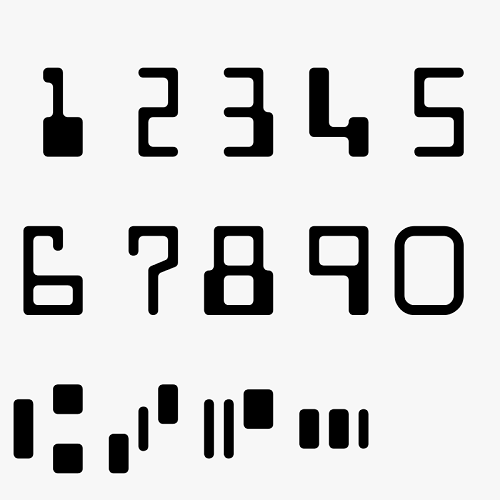

The Routing Number Chain Bank Lookup API used to connect to the system is designed to provide maximum functionality with a minimal number of requests. In the diagram below, you may follow what happens when you submit a routing number and account number to our system. Just insert the routing number and the payment method, it could be ACH or Wire Transfer and it will deliver all the bank data associated to that Routing number.

Since automation is the key to modern business process optimization, ZylaLabs has designed Routing number chain bank lookup API the service with simplicity in mind. The API can be harnessed with a few lines of code to provide bank details validation in any step of your business process. Our developers have prepared code samples which can help you to make use of the API in minutes.

By integrating this API into your company, you may prevent declined consumer payments. Verifying the provider’s routing number is helpful before completing any transactions. It also makes it possible for the bank’s identification to determine the account’s location. Finally, it will give you the option of calling the bank and using additional information to validate what you need.

As alternatives to membership, there are practical plans and a no-cost trial version accessible. In addition, if you require more than 100,000 requests each month, you can convert to a customised package.

In order to handle bank accounts and make sure that you get paid immediately away, banking information APIs can be used. A thorough search engine for routing number verification is provided by the Routing Number Bank Lookup API. Our route number validation tool is simple to use by your team. By confirming the data, they can authenticate account owners, check accounts, and check routing numbers. It is simple to verify any route number supplied by customers using this new API.