If you need to watch the closing price of iron, this is possible thanks to an API. You will always observe it up-to-date with this technology. Here we say how.

Steel is a crucial component of many human businesses. In construction purposes people utilize it as well as the manufacture of many different tools and mechanical components.

Steel’s composition, or the chemical components that are alloyed inside, affects the material’s qualities. Iron appears practically everywhere in our daily lives in a variety of ways. They utilize this metal to create things like vehicles, farm equipment, military weaponry, and electronics. Additionally as the framework and framework of railways, rails, armored vehicles, and ships.

Also containing it are welds, screws, nuts, rivets, stamped sheets, valve springs, hammers, keys, screwdrivers, and culinary utensils, among many other things. It is also crucial to the building sector.

Iron Scenario Worldwide

Prices for iron ore may drop to their lowest point in three to four years by the end of 2022. With China and Europe lowering steel output as new supply pressure increases, they will probably stagnate again the following year.

By the end of the year, forecasted prices for the essential component of steel vary from roughly $90 per tonne to a high of $115. Since the 2019 number of $93 per tonne, which was itself of the much lower 2018 level of $72.60, year-end prices have not been in this range.

The slump in the real estate market and COVID-19 are still having an impact on China’s demand for steel. Because of poor demand, high inflation, and worries about a recession, prices in Western nations will stay low for the remainder of the year.

Spot prices for ore bound for China, which produces about half of the world’s steel, have decreased by approximately 40%. This is from their peak of more than $160 in March of this year. It struggles with liquidity issues and low demand. It’s since it adheres to the severe limits of Covid-19 in the real estate industry.

The world’s largest producer of the commodity, Australia, has predicted that global steel output will fall by 0.6% this year to 1.947 million tonnes, accounting for declines of 2% and 7.1% in China and the European Union, respectively.

Nearly two-thirds of the seaborne iron ore that China imports come from Australia. The effects of the crisis in Ukraine are still being felt as ore supplies are depleted and steel production in Europe is being hampered by mounting energy constraints. Contrary to the global tightening trend, China is seeking to support its economy through stimulus measures.

China buys almost 70% of its seaborne iron ore, about two-thirds of which is supplied by Australia. The fallout from the Ukrainian conflict continues to hurt markets as it depletes ore supplies while growing energy shortages hamper steel production in Europe. However, China is trying to prop up its economy with stimulus measures, in contrast to the global tightening trend.

Use An API To Get the Iron Closing Price

Many people are constantly looking at the dynamics of the iron market since it is the kick-off of very important industries. It is for this reason that if you are an investor or assist several of them so that they do well investing in this metal, you can look at the updated price.

In this way, if you continually look at the value of this metal, you will be able to define its highs and lows and evaluate what is the best time to buy, effectively. Here we want to help you with cutting-edge technology, betting on building a great investment at the right time.

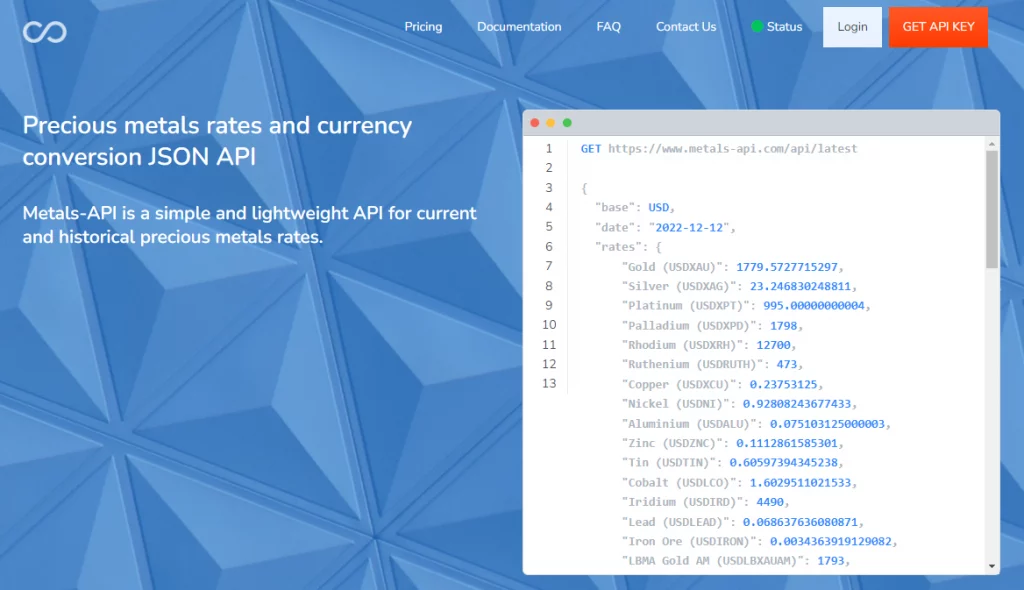

You can waste a lot of time searching everyday prices by price, making comparisons, and more. So here we will make it easier for you with Metals-API. With it, you will receive all the updated data from the most important metal financial authorities. Here you can see a generic example of the API response:

About Metals-API

Metals-API is a favorite among programmers since it obtains a large amount of information in seconds. You can include it in your websites and applications with the programming language that you like.

You can juxtapose different data such as current prices, past prices, and fluctuation data. With it, you can also show the prices in different currencies, and compare them with other metals. In this way, market research and reports can be carried out that are backed by legitimate data.