In this post, we want to present you with an API to check the VAT Number of your invoices.

The VAT is the fiscal unique identifier necessary to do transactions with customers from other European Union countries. The EU’s planned initiative is to foster and boost trade among member countries, providing them a market edge over foreign businesses.

To get it, you should first call the Tax Agency, which will assess your application. When you obtain this VAT, your identity will be added to the Register of Intra-Community Operators, which means that you’ll be able to perform intra-community activities with it.

The primary advantage of invoices issued or exchanged with customers in the EU, when both the buyer and the provider are VAT registered, is that this charge is not applied. According to this point of view, it is extremely advantageous for both sides and, above everything, far simpler to report since no tax withholding is necessary.

Possessing VAT, on the other hand, necessitates registration in the Registry of Intra-Community Companies. But what is it precisely? It is simply a permanent document that you can use to determine whether your user’s VAT number is active.

You can check if the intra-community VAT is correct by using the VIES program or the Registry of Intra-Community Operators. To avoid problems with the Tax Agency, it is necessary to double-check this in advance.

If you are unable to locate the requested Tax invoice in the record, it is possible that it doesn’t appear, is inactive, or that the certification is incorrect. You will have multiple VAT numbers to check every day if you operate in a business and want to show the transparency of your finances, or if you operate in a tax department. We recommend that you utilize an API to expedite this procedure.

Make Use Of An API

The Application Programming Interface (API) is a set of procedures and actions that allow programs and systems to exchange data. APIs are an essential component of the application design phase.

This section of the information, however, is meant for distribution across platforms instead of by the end consumer. This hidden nature is what keeps it invisible to several individuals, except the tech community, which is the segment of experts that use them on a constant schedule.

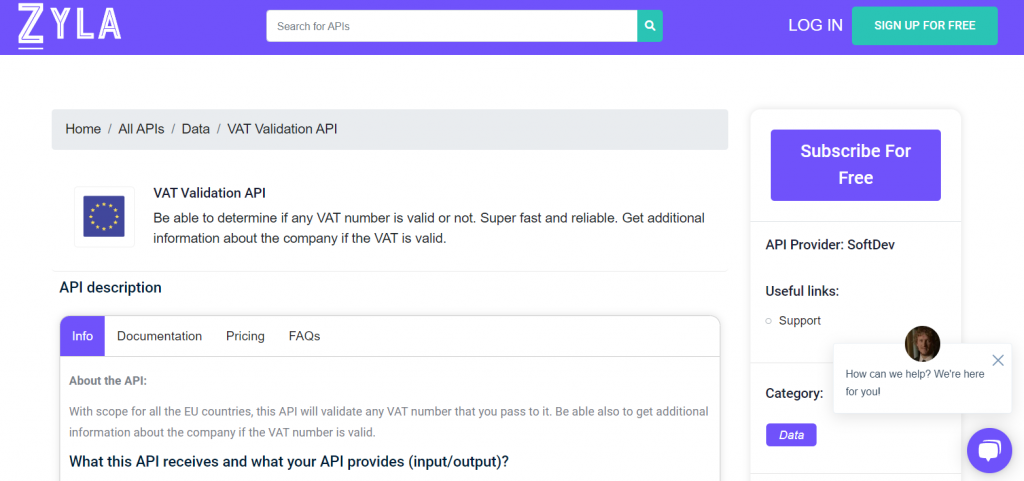

In this scenario, we’re searching for an API that will enable us to rapidly check whether or not a VAT number is acceptable in any EU area. As a result, we propose that you use the VAT Validation API to efficiently evaluate its authenticity.

Why VAT Validation API?

VAT Validation API is among the most prominent due to its rapidity in determining the validity or untruth of each figure. It will also provide you with data on the businesses to which this number is assigned.

With this API, you may ensure a smooth fiscal procedure. You can use it in the programming language that you wish such as JSON, Python, PHP, and more. With this API you will get clear finances.