Are you looking for the most up-to-date information on metal prices? You can find out the best API for any jewelry store and more .In this post, we present it.

In euro terms, the price of gold might reach a record high in 2019. Many investors continue to place their attention on gold in the face of the ongoing crisis in Ukraine, soaring inflation, and growing recessionary worries.

Gold

The development of the dollar will have a significant impact on gold’s price. In 2023, the US Federal Reserve’s monetary policy will probably alter little. After all, inflation probably continue to drop, and the struggling US economy will come under the monetary authorities’ scrutiny.

The price of gold may be supported if the Federal Reserve kept interest rates constant or even cut them. If the gold price responds more favorably than the dollar price to these indications, a record for gold in euro terms is extremely likely. At about 1,870 euros per troy ounce in March 2022, gold reached its previous high. There will probably be a range of $1,620 to $1,920 per troy ounce when quoted in US dollars.

Silver

A little rise in smartphone demand should support the price of silver. Sales of 5G-capable gadgets will increase by 2023, which should increase demand for silver. Additionally, in 2023, the market for photovoltaics should keep rising. On the other hand, compared to the prior year, the demand for silver jewelry should decline.

The upward potential of the silver price is constrained due to the mine’s capability for progressively increasing output. Nevertheless, if the Federal Reserve adopts the anticipated adjustment to its hawkish interest rate strategy, this should weaken the dollar’s exchange rate and boost the price of silver, much like it does gold. Possibly in the $17 to $25 per troy-ounce area.

Platinum

The commercial platinum market is predicted to have a surplus. In 2023, primary production would rise by 10%. On the other hand, a modest decline in secondary supply is anticipated. Because of the semiconductor crisis, used vehicle demand is still quite high, thus platinum recovery from catalytic converters for old cars could also slow down.

On the other hand, when more PEM electrolyzers are installed, platinum will eventually be used more often in the hydrogen economy. Per troy ounce, platinum prices range from $800 to $1,150.

Palladium

Next year, there should be a glut in the palladium market. Since the rebound in the production of light cars will be countered by the loss of market share in combustion engines for electric vehicles powered by drums, the demand in the automotive sector, which has a client base that makes up more than 80% of the market, should scarcely alter.

Platinum will replace palladium more quickly since palladium is significantly more expensive than platinum. The chemical, electrical, and dentistry industries will all see a demand reduction. About 40% of the world’s palladium supply comes from Russia, thus any penalties on it or its commodities exporters might have an impact on prices. Its price per troy ounce ranges from $1,300 to $2,250.

An API for Jewelry Stores

As you will see, these are some metals that by themselves show the different dynamics that are at work in this market. For this reason, if you want to participate in it, you must be aware of the prices and their possible changes. Really important for jewelry stores.

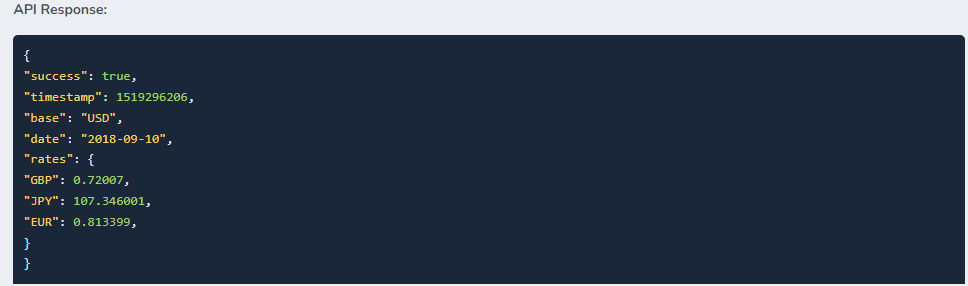

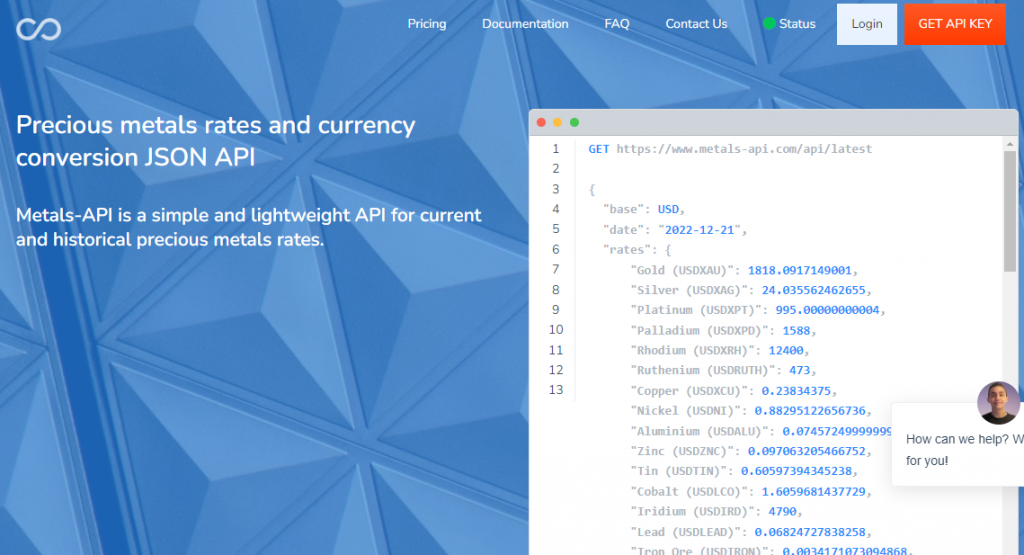

It is not easy with all the loose data that is on the internet. So you must use reliable resources to do it. Here we want to recommend an API that, in addition to having up-to-date information, you can share to advise your clients. This is Metals-API and it gives responses like this:

About Metals-API

Metals-API is characterized by providing information moment by moment. Also with it, you can incorporate into your site historical metal data and information on price fluctuations. On the other hand, you must trust this data since the API pulls it from the most important financial authorities.

You can become an investment professional by consulting it daily. With this API, you will also advise your investment clients much better since you will be able to provide them with vast information. You can find rates of these metals, but other too.