The CBOE Volatility Index Price API is a powerful tool that provides precise volatility index data for traders and investors. By offering real-time market tracking, this API empowers users to enhance their trading strategies, make timely decisions, and manage risk more effectively.

How to Use the CBOE Volatility Index Price API

The CBOE Volatility Index Price API is designed to deliver real-time data related to the VIX (Volatility Index), a key indicator used to measure market volatility. It provides up-to-the-minute updates on volatility levels, which are crucial for anticipating market movements. Traders can integrate the API into their trading platforms, financial tools, or market analysis systems to receive instant updates on volatility trends.

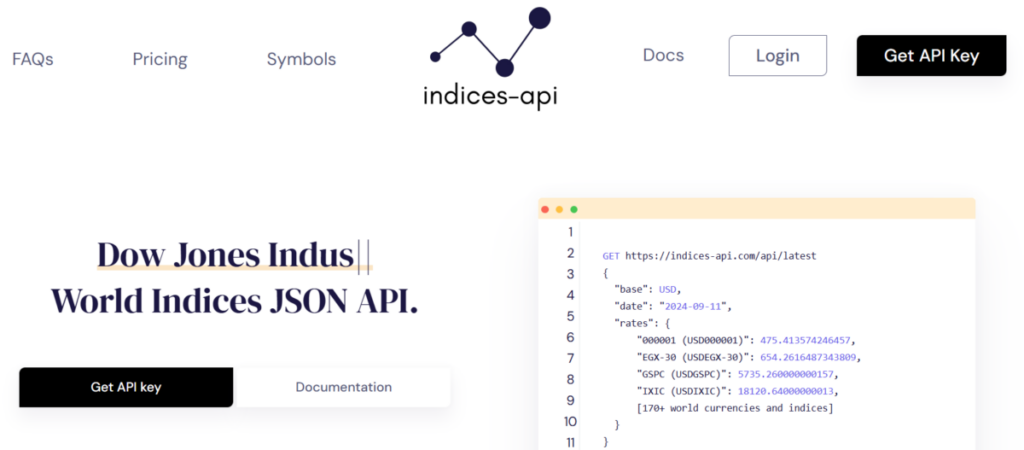

To start using the API, traders need to sign up for access, obtain an API key, and integrate it into their systems. The CBOE Volatility Index Price API is available in several formats, including JSON, which makes it easy to work with in various programming environments. Once integrated, users can query the API to get the latest volatility index prices and historical data.

Importance of Real-Time Market Data

Real-time market data is the lifeblood of modern trading. Financial markets move quickly, and any delay in receiving market information can lead to missed opportunities or costly mistakes. With accurate, up-to-date data, traders can monitor price changes, track trends, and execute trades with confidence. The CBOE Volatility Index Price API offers the level of real-time data that traders need to stay ahead of the competition.

Volatility is one of the most important factors in market analysis. The VIX, often referred to as the “fear gauge,” reflects investors’ expectations of future volatility based on options prices. By tracking the VIX, traders can gauge the level of market fear or uncertainty, which often precedes significant market movements. Using real-time data from the CBOE Volatility Index Price APIs, traders can make decisions that align with current market conditions, adjusting their strategies accordingly.

Benefits of the CBOE Volatility Index Price APIs for Trading Strategies

One of the primary benefits of using the CBOE Volatility Index Price API is the ability to incorporate volatility data into trading strategies. For example, traders who use options can benefit from VIX data to determine appropriate strike prices and expiration dates. Volatility data can also help in setting stop-loss orders or identifying entry and exit points for trades.

With the CBOE Volatility Index Price API, traders can develop more sophisticated strategies based on real-time volatility levels. Some traders may use the VIX as a contrarian indicator, buying when volatility is high and selling when it’s low. Others might use volatility data to hedge against market downturns or manage risk by diversifying their portfolios. The versatility of the API makes it a valuable tool for traders across different asset classes, from stocks to commodities.

How Accurate Indices Enhance Trading Strategies

The accuracy of the CBOE Volatility Index Price APIs is crucial for developing effective trading strategies. Inaccurate or delayed market data can lead to poor decision-making, resulting in losses. Since the VIX is a forward-looking indicator, its accuracy directly impacts how traders anticipate future market movements.

By providing highly accurate, real-time volatility indices, the API ensures that traders have the best possible information at their fingertips. Whether you’re day trading, swing trading, or long-term investing, having reliable and up-to-date data is essential for minimizing risk and maximizing profits.

Conclusion

The CBOE Volatility Index Price APIs is a game-changing tool for traders who rely on real-time data to inform their decisions. By offering accurate volatility indices, it helps traders stay ahead of market shifts, improve their trading strategies, and manage risk more effectively. Whether you’re a seasoned investor or just starting, integrating this API into your trading platform can provide the edge you need in today’s dynamic markets.