In the realm of digital transactions, where every nanosecond counts, an API emerges as a hidden champion. But what exactly is this enigmatic tool, and why is it a quiet revolution for businesses across sectors? In this article, we’ll delve into the intricacies of the API, exploring its multifaceted benefits with a keen focus on affordability.

The Bank Identification Number (BIN) found on credit and debit cards is a mysterious string of digits, and a Bank API is a powerful tool designed to decode it. This seemingly innocuous sequence offers the key to a multitude of knowledge, including the card’s kind, issuer, and even the cardholder’s location. Its strategic as well as technological significance makes it a pillar for companies that rely on safe transactions.

The Crucial Role of BIN Checkers

For businesses navigating the complex landscape of online transactions, these APIs are akin to a reliable compass. These APIs enable rapid and accurate verification of card information, thwarting fraudulent activities and fostering trust between merchants and customers. The rise of digital payments amplifies the significance of verification, emphasizing the indispensability of such APIs for robust operations.

From E-commerce platforms streamlining their online transactions to Financial institutions verifying cardholders and preventing fraud, the applications of BIN Checker APIs span industries. Subscription services find solace in managing recurring payments seamlessly, while travel and hospitality elevate customer experiences during bookings. Each sector benefits uniquely from this unassuming yet powerful tool.

Credit Card Validator – BIN Checker API

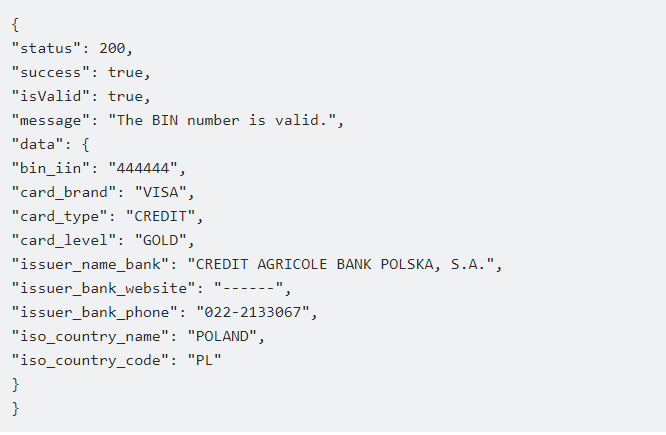

Using this API, you can spot fraudulent credit card transactions. Start looking for each piece of information on credit and debit cards using BIN numbers. The user needs to input the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card in order to view all the information.

You need to provide a BIN (Bank Identification Number), which is the first six numbers on a credit or debit card, in order to access all of this BIN/IIN information in JSON format. The card’s type (Visa or MasterCard), expiration date, bank, and issue location will all be disclosed to you.

You will have access to the customer’s credit card details, including the issuing bank, the issuing institution (AMEX, VISA, MC), the card’s location, and whether or not it is a legitimate credit card.

having access to a credit card’s BIN number’s first six digits in order to validate any credit card. The Credit Card, CC Issuer, Card Type, Card Level, Card Brand, Issuer Country, and more information will be sent to you. This API simply takes into account the authenticity of the credit card in addition to the bank and business information when deciding whether to approve the payment or run a promotion. Following your API call, the “BIN Checker” endpoint will respond to your inquiry with the following statement:

Watch the video below to learn more about using the API!

This CC Checker API makes it easier to identify the issuing bank or institution. So, whether or not you have special arrangements with a certain bank may or may not have an impact on your ability to authorize the transaction.