The tools used to navigate the complexities of the digital world are also changing as the digital environment does. These developments will strengthen the already impressive capabilities, allowing companies to keep ahead of new security concerns and guaranteeing the long-term viability of safe online transactions.

The horizon of possibilities with a Bank API extends beyond the basics. The addition of geolocation data adds an extra layer of security, ensuring that transactions align with the physical location of the cardholder. Distinguishing between credit, debit, and prepaid cards through card type identification enhances precision. Moreover, these APIs stand as stalwart guardians in the realm of fraud prevention, leveraging their capabilities to mitigate risks.

Applications Across Industries

The canvas of application for a BIN Checker API spans industries, each benefiting from its prowess in distinct ways. E-commerce platforms, the bustling marketplaces of the digital era, rely on the API to ensure secure transactions, fortifying the foundation of trust between merchants and buyers. Financial institutions, entrusted with safeguarding the economic tapestry, employ the API to enhance security in services such as credit card issuance.

Subscription services find solace in its capabilities, seamlessly managing recurring payments with precision. Meanwhile, travel and hospitality ventures leverage the API to elevate user experiences during bookings, creating a smoother journey for their patrons.

In the grand tapestry of digital commerce, where every click is a potential transaction, the API emerges as a sentinel of trust. Its simplicity belies its potency, while its effectiveness is an embrace of security. As this exploration concludes, the significance of this tool becomes vivid. The role it plays in fortifying online transactions cannot be overstated. Businesses, irrespective of their nature, are beckoned to embrace the BIN Checker API. Within its capabilities lies not just security, but also the key to crafting seamless customer experiences, fostering trust, and ensuring the vitality of the digital economy.

Credit Card Validator – BIN Checker API

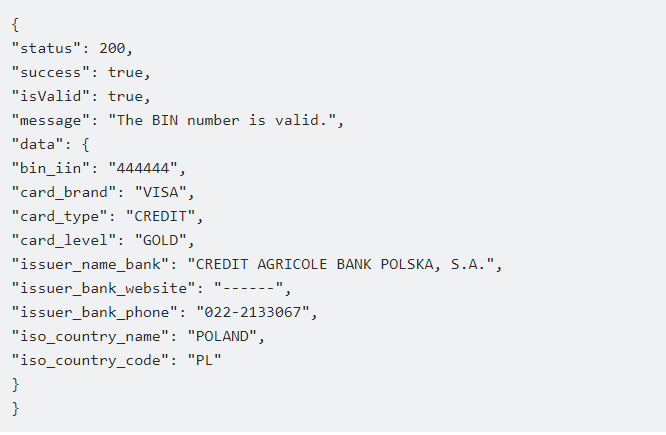

You can identify unauthorized credit card transactions by using this API. Utilizing BIN numbers, begin searching for each piece of information on credit and debit cards. To view all the information, the user must enter the BIN (Bank Identification Number) or IIN (Issuer Identification Number) of their credit or debit card.

To access all of this BIN/IIN information in JSON format, you must provide a BIN (Bank Identification Number), which is the first six numbers on a credit or debit card. You will be informed of the card’s type (Visa or MasterCard), expiration date, bank, and issue location.

The customer’s credit card information will be available to you, including the issuing bank, the issuing institution (AMEX, VISA, MC), the card’s location, and whether or not it is a valid credit card.

having access to the first six digits of a credit card’s BIN number in order to validate any credit card. You will receive more information in addition to the Credit Card, CC Issuer, Card Type, Card Level, Card Brand, and Issuer Country. When determining whether to approve the payment or run a promotion, this API only takes the validity of the credit card into account in addition to the bank and business information. The “BIN Checker” endpoint will reply to your query with the following information after receiving your API call:

Learn more about using the API by watching the video below!

It is simpler to determine the issuing bank or institution thanks to this CC Checker API. Therefore, your ability to approve the transaction may or may not depend on whether you have special arrangements with a particular bank.