Do you want to invest in gold and be updated on its movements? Keep reading and find out how to use a precious metals API!

One of the quintessential “shelter values” is gold. An investment that will serve as protection for you through times of stress and price increases like the one we are now experiencing. Gold is one of the most popular materials in the world of jewelry since it is a sign of worth and prosperity. This material is the ideal complement to all designs, being able to express exclusivity and elegance due to its capacity to adapt to changing trends.

Even though yellow gold is the most common, goldsmith businesses also work with other metals to blend with yellow gold to create various hues.

Yellow gold: Since it has this colour when it is harvested from nature, yellow gold is the standard color for gold. Its hue does not deteriorate over time since oxidation has no impact on the substance, which is also referred to as noble gold.

White gold: White metals like rhodium, zinc, or nickel are combined with yellow gold to create this sort of gold. Because of this, the traits and attributes of this kind will vary according on the combination of metals it contains.

Rose gold: This variety of gold has just lately become popular in the jewelry industry. Its pink hue results from the combination of rose gold and copper; therefore, the more copper a piece has, the more pink it will seem.

Gold that has been plated with rhodium to give it a brighter sheen is called rhodium-plated gold. This form of gold is made by electrolytically dipping white gold or platinum in rhodium.

According to a research by the World Gold Council, gold has traditionally fared well during periods of high inflation. It has returned an average of 15% during periods of inflation above 3% and 6% during periods of low inflation.

When times are really difficult and inflation rises, gold is the shining underlying. A portion of the money in commodities or gold should be included in every properly diversified investment portfolio to help mitigate losses during adverse economic periods. Therefore, if you’re interested in investing in this metal, we advise using Metals-API.

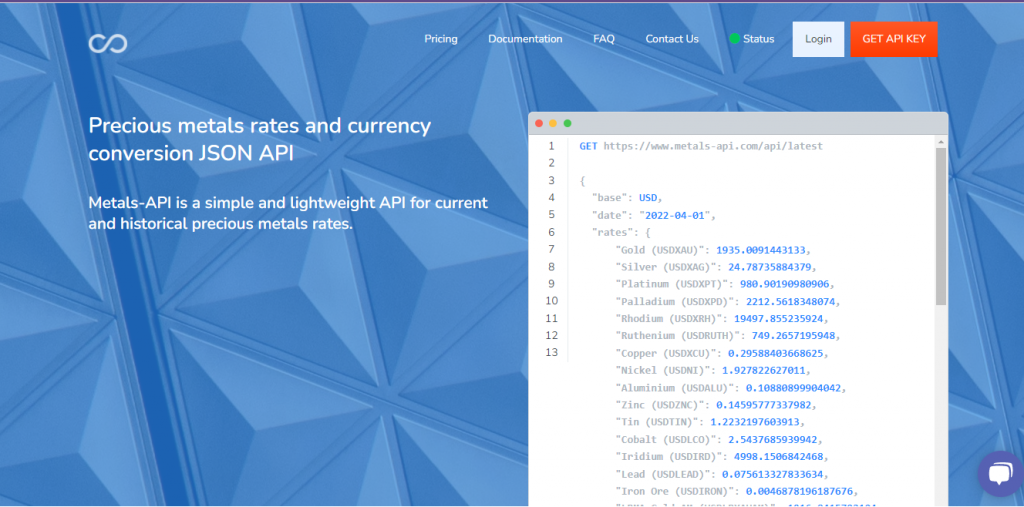

So What Is Metals-API?

Metals-API you can view the most recent and previous precious metals pricing from banks using this small piece of software, which has a straightforward user interface. Thanks to its robust back-end architecture, the Metals-API can provide rates for the exchange of precious metals, convert between different currencies

What Steps Are Taken During Registration?

Metals-API It is simple to use. Now all you have to do is adhere to the guidelines listed below:

- Log in the website.

- Generate an API key.

- Choose the metal and currency of your choosing.

- Use the panel to submit an API request, and the software will respond with an API response.

Has It Offered Solid Statistics?

In order to achieve the highest level of coverage and accuracy, the system of Metals-API also provides each data source a centralized priority. This also aids in preventing inconsistencies by giving precise spot translation rates to six decimal places for the vast majority of currencies.

Is The Content Secure?

Metals-API obtains monetary information from organizations and financial data providers, such as the European Central Bank. Since the connection is secured with 256-bit SSL encryption of the highest order, it is as confidential as a bank.