Are you the developer for an auto insurance company? Well in that case, we have excellent news for you! There is an amazing Vehicle Damage API, which will help you get amazing benefits for a car insurance company. If you want to know more, read this post.

Car insurance companies provide coverage for vehicles in case of accidents, theft, or other damages. They offer policies that protect drivers and their vehicles. These companies assess risks, calculate premiums, and process claims to ensure policyholders receive the necessary financial assistance.

Car insurance companies determine premiums based on factors like the driver’s age, driving history, and the type of vehicle. They utilize advanced technology and data analysis to assess risks accurately. When policyholders file a claim, the company evaluates the damage, verifies coverage, and reimburses the necessary expenses promptly. Insurance companies often offer various coverage options, such as liability, comprehensive, and collision insurance.

Many auto insurance companies are using APIs to make their job easier. For example, using AI, they could automate damage detection and thus simplify the insurance process. In this way, they could save time and money. One of the APIs that we most recommend to perform this task is the Vehicle Damage Detector API. We will talk about this API below:

The Best API For Car Insurance Companies Is Vehicle Damage Detector API

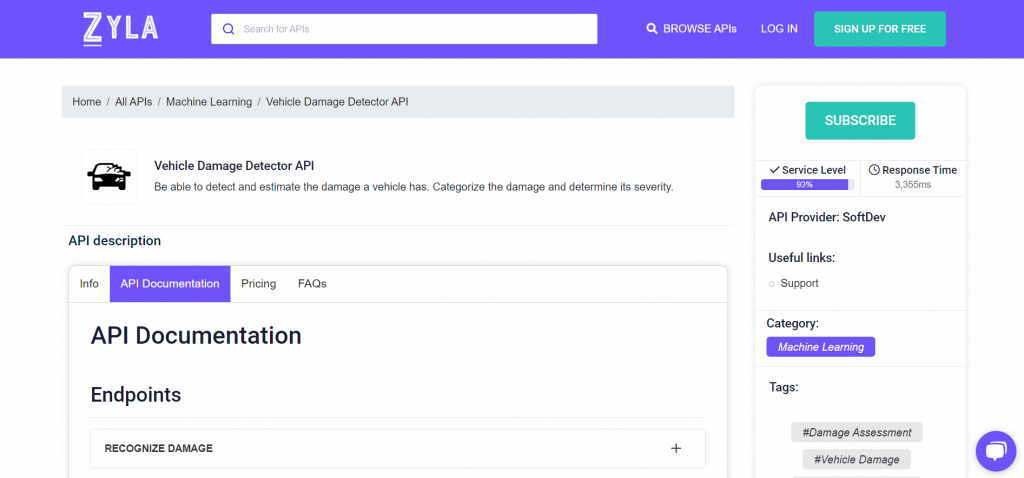

This powerful tool offers several advantages that enhance the operations and effectiveness of car insurance companies. The Vehicle Damage Detector API utilizes advanced computer vision technology to accurately assess and detect damages to vehicles. By integrating this API into their systems, insurance companies can streamline their claims process and reduce manual inspection efforts. This not only saves time but also improves the accuracy of damage evaluation, leading to fair and efficient claim settlements.

One of the key benefits of the Vehicle Damage Detector API is its ability to automate the damage assessment process. Instead of relying solely on human judgment, the API can analyze images or videos of damaged vehicles and provide objective assessments. This reduces the potential for human error and ensures consistent evaluations across different claims. Insurance companies can leverage this technology to expedite the claims process, leading to faster resolutions and improved customer satisfaction.

Moreover, the Vehicle Damage Detector API from Zyla Labs enhances the fraud detection capabilities of car insurance companies. By quickly identifying fraudulent claims through advanced image analysis, the API helps insurers prevent losses due to false or exaggerated damage reports. This not only safeguards the financial interests of insurance companies but also helps in maintaining affordable premiums for honest policyholders.

Also, this API is easy to integrate. If you are a developer, you will be happy to know that we recorded this video making an API call:

In conclusion, the Vehicle Damage Detector API from Zyla Labs offers numerous benefits to car insurance companies. By automating damage assessments, improving fraud detection, and providing valuable data insights, this API enhances the efficiency, accuracy, and overall performance of insurance operations.