The merchants regularly search for tools to legitimate their business. In these circumstances, it is important to use a VAT validation API to control and protect their companies. In this post, we suggest the best one.

Every monetary transaction, such as a buy or a selling, is taxed, at least across the entire European Union’s land. This is the Value Added Tax, and it denotes a proportion of each item that individuals should earn to complete the payment.

Because these exchanges, and thus the gathering of this tax, occur at multiple moments along the supply chain, percentages collect. Regardless, all companies within the land are required to pay the tax. This also impacts the cost of the item once it has been properly confirmed to avoid losing cash.

In this context, manufacturers or solution providers frequently do not charge this tax because it is paid by the end customer, by earning a valuation that presumes the gathered cost of VAT to compensate it on their finished version.

Because VAT is earned by the entire society in each nation where it is implemented, it is usually among the most essential government financial acquisition methods. Numerous merchants in the supply chain try to forge the VAT number to avoid paying taxes, which is not innovative in nowadays’ manufacturing world.

As a result, to avoid tax restrictions, businesses must check the authenticity of VAT numbers. To prevent failure to comply with the statutes and tax avoidance, federal agencies must regulate the fiscal and financial movements of businesses. As a result, they should authenticate each item’s VAT number.

Even so, reviewing each number one at a time can be difficult for a business. When you have a task to attend to, you will lose a significant amount of time, and the exhaustion of performing the same fully automated action will cause you to commit numerous errors.

A VAT Number Validation API

APIs have evolved as data centers that transmit information from one gadget to another. However, because it is machine learning educated to acknowledge whether a number is legitimate for a particular item, this also aids in ensuring other kinds of features and functionality.

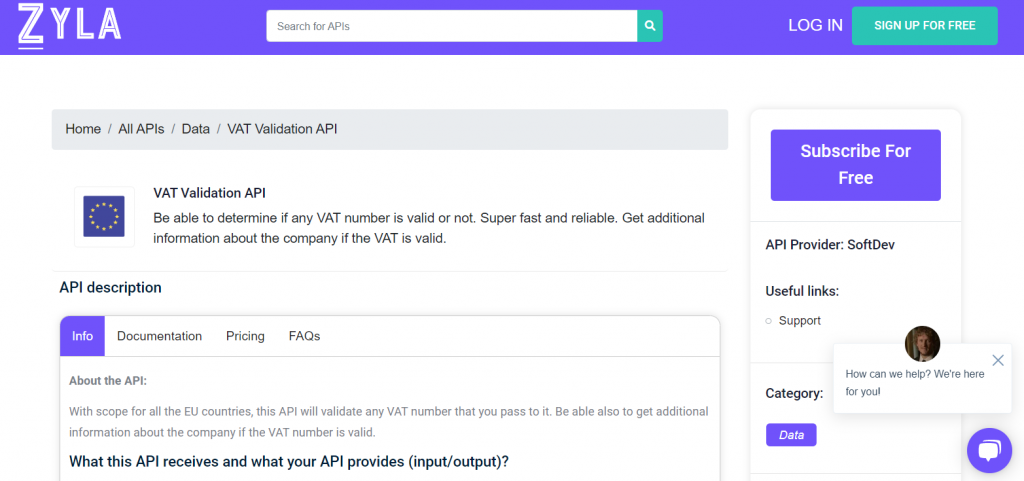

In this particular instance, an API that identifies VAT numbers will know whether it is legal or not. You might also associate the number with businesses and the flow of cash at the time. The VAT Validation API is one API that really can do all of this. It has the capability of instantly verifying these numbers, ensuring a clean government financial process. It is very simple to use, allowing you to quickly see the data as well as share it with the proper person.

Why Use VAT Validation API

This API includes the entire European Union region. With the VAT Validator, you will be capable of gathering a wealth of extra information about specific businesses based on the VAT figures given, to determine whether or not they have falsified them.

You will be allowed to see data such as the firm’s name and location. You only need to sign up and guess it depends on your membership, you will receive a different number of API solicitudes.