If you want to get a VAT number validation API in cURL, in this post we talk about the best.

In the first place, we start with cURL. What is it? One of the oldest and most popular open source projects is cURL basic-ware. The application, whose name is derived from the client URL, is used to transfer data over computer networks. The open license allows you to use the application for any purpose. cURL is now utilized on a wide range of devices.

The cURL program is made up of two parts. The lib curl software library serves as the foundation for data transport and supports a variety of protocols. The cURL command line application, for its part, functions as a text-based interface and communicates with lib curl via the command line.

The application is useful for web development since it lets the developer speak directly with the server rather than through a browser. Process automation, debugging, and testing are all done via cURL command-based scripts.

For web development, the cURL command line software is utilized. The simplest option is to use the command line to execute the cURL instructions. Servers and APIs can be tested and debugged with the correct information.

Rather than typing instructions onto the command line, they may be incorporated into scripts. Complex activities such as uploading and downloading data, as well as scheduling form completion and copying entire websites, may be standardized and automated in this manner.

Use An API

An API is a software with which you can transfer data from one device to many others. They are like pre-programmed attributes that are incorporated into the designs of digital channels so that information is updated quickly, without the need for the human hand.

Today, APIs are the basis of programming, it would not be possible to think of developing digital media or different pages without APIs. In this way, the transparency of the tax collection process can be guaranteed, showing the validity or falsity of the VAT numbers in the European Union.

You’re presumably here because you work in a federal agency or a firm that has to validate VAT numbers to ensure the tax is paid. Through its artificial intelligence capabilities, an API may assist you in performing this task automatically and without wasting time.

That is, instead of manually evaluating the VAT number one by one, for example, by comparing it to invoices that include the location or the name of the firm, the API might accomplish it in a matter of seconds.

Only by inputting the VAT number will it identify or reject its authenticity and offer further information, such as the name of the firm and its location, in addition to the response. As a result, you should utilize the VAT Validation API, which is included in cURL.

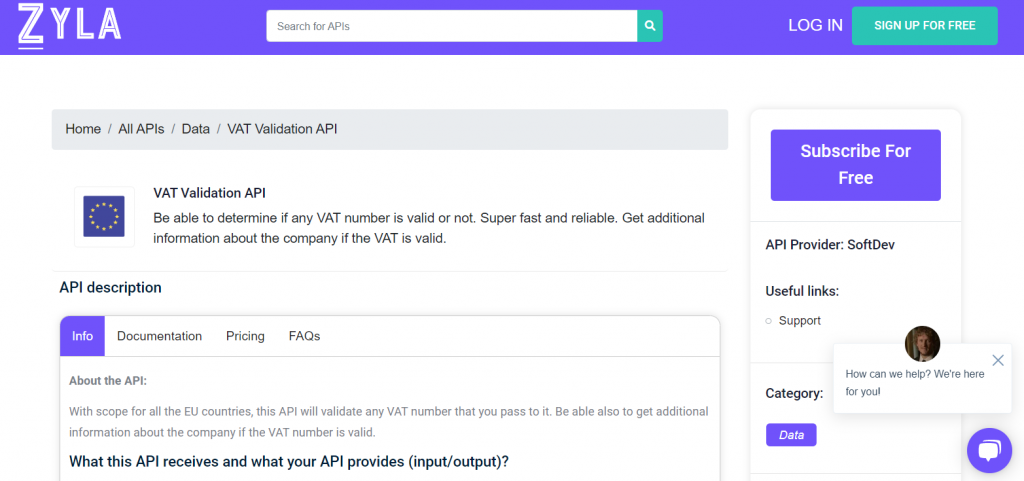

About VAT Validation API

VAT Validation API is a popular choice among developers. This is owed, first and foremost, to its efficacy in identifying numbers and ensuring that taxes are collected. However, it also works with the most various programming languages to make it easy to develop applications or websites to exchange data with other office members, businesses, or the general public. The tax procedure will become considerably more clear as a result.