Looking for a Taxes API that offers Enterprise Plans? Well, in that case, we have good news for you! There is a tool that will help you calculate taxes in a simple and easy way. If you want to know more about it, just read this informative article.

The IRS, or Internal Revenue Service, is the federal agency responsible for administering and enforcing tax laws in the United States. Its primary role is to collect taxes and ensure compliance with tax regulations. Paying taxes is of utmost importance for several reasons. Firstly, taxes fund essential government functions such as national defense, public infrastructure, education, healthcare, and social welfare programs.

Secondly, tax revenue is vital for maintaining economic stability and funding public services that benefit society as a whole. Fulfilling tax obligations ensures a fair and equitable distribution of resources, reducing income disparities and supporting vulnerable populations. Additionally, tax evasion can lead to severe legal consequences, including fines and imprisonment. By paying taxes responsibly, individuals and businesses contribute to the well-being and progress of the nation, fostering a thriving and prosperous society for everyone.

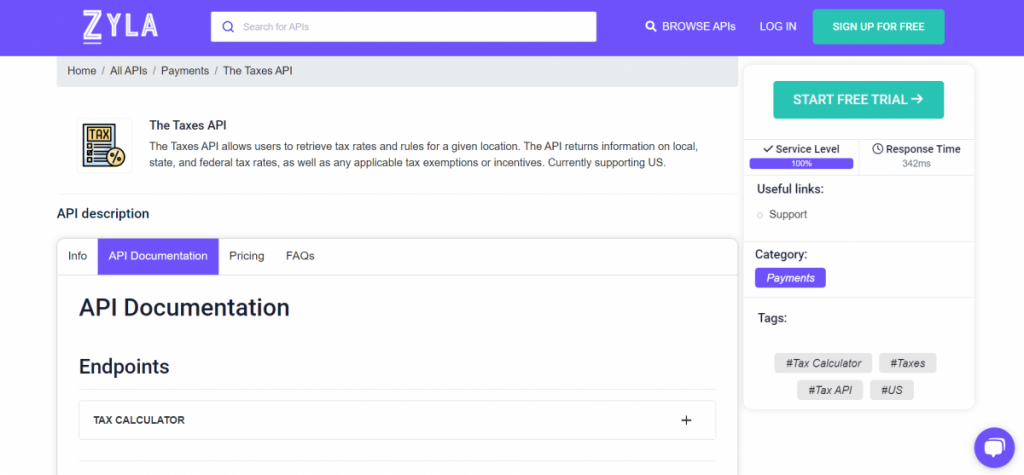

To avoid problems with the IRS, a safe and effective option is to use an API. There are many APIs available on the web but one of the best is The Taxes API. The API returns information on local, state, and federal tax rates, as well as any applicable tax exemptions or incentives. In addition, it includes Enterprise Plans for companies.

The Taxes API Includes Enterprise Plans!

The Taxes API from Zyla Labs is a powerful tool that allows developers to retrieve tax rates and rules for a given location. The API returns information on local, state, and federal tax rates, as well as any applicable tax exemptions or incentives. The Taxes API is currently supporting the United States. To use this API, developers must first create an account and obtain an API key. Once they have an API key, they can use it to make requests to the API. Requests are made using the HTTP GET method.

Here are some of the benefits of using The Taxes API:

-Accurate and up-to-date tax information: The Taxes API provides accurate and up-to-date tax information for the United States. This ensures that developers can calculate taxes accurately.

-Easy to use: This tool is easy to use. Developers can make requests to the API using the HTTP GET method.

-Scalable: Also, It is scalable. Developers can use the API to calculate taxes for a large number of transactions.

-Reliable: Even, the API is reliable. The API is backed by a team of experienced engineers who are committed to providing reliable service.

Watch this video and find out how to use this API:

Finally, you should know that this API offers enterprise plans for companies. You just have to book a call and that’s it! In conclusion, The Taxes API is a powerful tool that can be used in a variety of applications. If you need to calculate taxes accurately, then you should consider using this tool.

Read this post: Top Rated Tax Calculator API With Cheap Plans