Are you a developer looking for a Taxes API to calculate taxes? Well, in that case, there is an easy-to-integrate API that will help you with what you are looking for. It is perfect for any developer. If you want to know more information, check out this informative article.

Taxes in the United States are compulsory financial contributions collected by the government. They fund public services and programs, such as education, healthcare, infrastructure, and defense. There are various types of taxes, including income tax, which individuals and businesses pay based on their earnings. Sales tax is imposed on goods and services purchased, while property tax applies to real estate ownership.

Corporations are subject to corporate income tax. Additionally, there are payroll taxes for Social Security and Medicare. The Internal Revenue Service (IRS) is the federal agency responsible for tax collection and enforcement. Understanding and complying with tax obligations is crucial for individuals and businesses to avoid penalties and legal consequences.

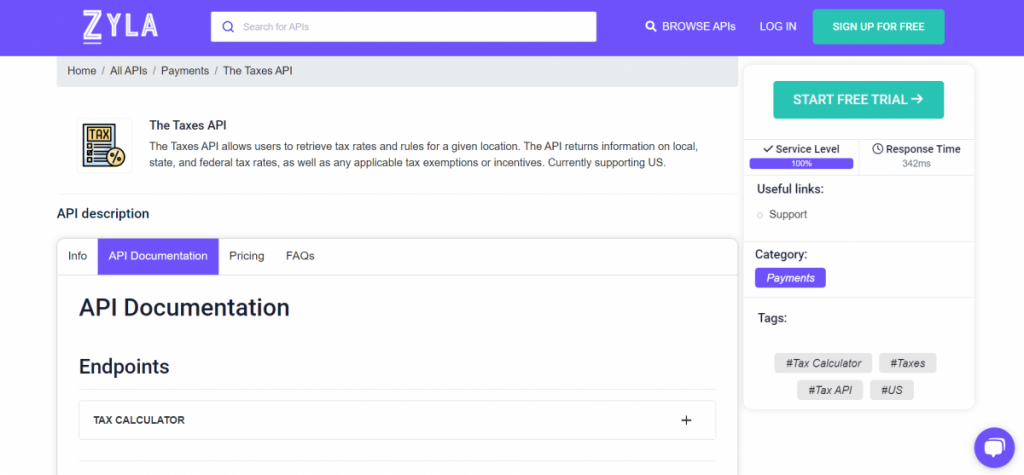

Many companies must correctly calculate their taxes to avoid problems with the IRS (Internal Revenue Service). A useful and interesting tool is to use an API. Developers can integrate an API to calculate taxes correctly. For example, The Taxes API is a platform recommended by Worldwide Developers. This API is available on the Zyla API Hub (API Marketplace). This API is very useful for companies in the United States!

The Best Tool For Worldwide Developers Is The Taxes API!

The Taxes API is a RESTful API that provides real-time tax calculations for transactions across tens of thousands of jurisdictions all over the world. It is a powerful tool for businesses that need to collect accurate sales tax, VAT, and other taxes. This incredible tool is very easy to use. You simply need to provide the API with the customer’s location, the product or service being sold, the quantity being sold, and shipping. The API will then return the correct tax amount.

The Taxes API is also highly accurate. It is updated regularly with the latest tax rates and rules. This ensures that you are always collecting the correct amount of tax. In addition to accuracy, this incredible platform is also scalable. It can handle high volumes of transactions without any performance degradation. This makes it ideal for businesses of all sizes.

Here are some examples of how The Taxes API can be used:

E-commerce: E-commerce businesses can collect accurate sales tax on online purchases.

Subscriptions: Businesses that offer subscription services to collect accurate VAT on recurring payments.

Shipping: Businesses that ship products can collect accurate sales tax on the shipping charges.

Tax reporting: Also, It can generate accurate tax reports for compliance purposes.

If you want more information about how it works, just take a look at this video:

The Taxes API is a powerful tool that can help businesses collect accurate taxes across the globe. It is easy to use, scalable, and highly accurate. If you are looking for a way to collect accurate taxes, then this platform is a great option!

Read this post: Why Do Companies Use The Tax Calculator API In 2024