Are you a developer looking to build investment apps? Well, an application like that needs many tools to attract many users. Therefore, an interesting option is to integrate a Tax Calculation API to calculate taxes. It is an interesting tool for your investment application. More info in this post.

An investment app is a mobile application that allows users to invest in financial markets easily. It provides access to a variety of investment options, such as stocks, bonds, and cryptocurrencies. Users can manage their investment portfolios and track performance in real time. Investment apps offer educational resources to help users make informed decisions. They often have user-friendly interfaces and features for automatic investing and portfolio diversification.

Some apps may offer robo-advisory services for personalized investment strategies. Users can deposit funds, execute trades, and receive market updates on the go. Security features safeguard user data and transactions. Investment apps democratize investing, making it accessible to a broader audience. They cater to both experienced investors and beginners seeking to grow their wealth through the convenience of their smartphones or tablets.

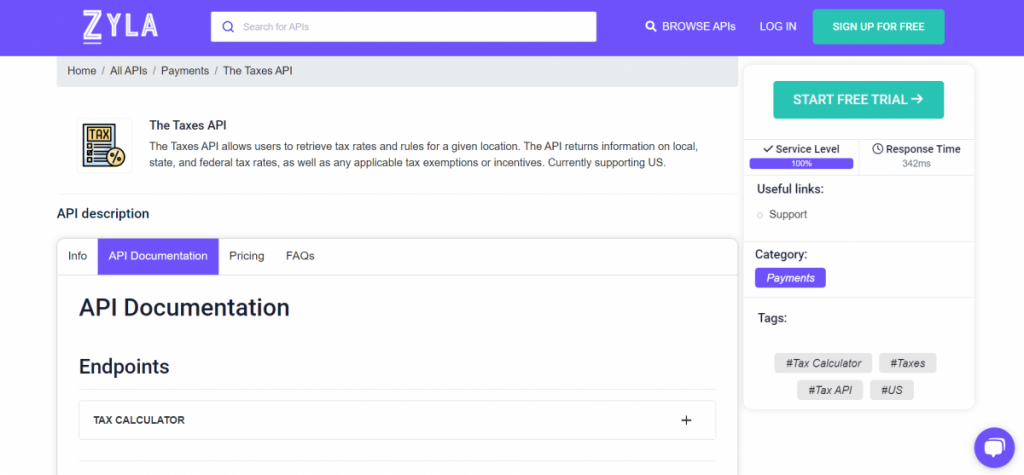

If you want your investment application to be successful, a great idea is to integrate a Tax Calculation API. These services allow any user or company to calculate taxes. You can use The Taxes API, available on the Zyla API Hub.

Create An Investment App By Using The Taxes API

The Taxes API is a powerful tool that can help investment app developers to provide their users with accurate and up-to-date tax information. The API provides access to a wide range of tax data, including tax rates, tax brackets, and tax deductions. This data can calculate the tax liability of an investment, as well as provide users with information about how to minimize their tax burden. This tool is easy to use and can be integrated into any investment app.

The API provides a simple RESTful interface that can be accessed using any programming language. The API also provides extensive documentation, making it easy to get started. The Taxes API can help you develop an investment app in a number of ways. First, the API can provide you with the data you need to calculate the tax liability of an investment. This data can be used to provide users with accurate and up-to-date information about their tax liability.

Second, The Taxes API can provide users with information about how to minimize their tax burden. The API provides information about tax deductions, tax credits, and other tax planning strategies. This information can help users to make informed decisions about their investments and to save money on taxes.

In this video, we show you how to use this platform. It’s easy to use:

The Taxes API is a powerful tool that can help investment app developers to provide their users with accurate and up-to-date tax information. The API is easy to use and you can integrate it into any investment app. If you are developing an investment app, this API is a valuable tool that you should consider using.

Read this post: Best Free Tax Calculator API For Financial Planning Websites