Do you need to find the best lithium prices API for this 2023? In this article, we talk about the best API for investors in this metal! Keep reading to find out more.

The requirement to provide this metal for the competitive electromobility sector as well as the need for batteries needed for mobile phones and computers has increased the demand for lithium on a global scale.

So much so that, on the advice of Bolivia, nations like Mexico are putting together a plan to cultivate photovoltaic renewable energy, mine lithium, and produce batteries for the automobile sector in the northern state of Sonora.

Argentina offers increasing business potential; for instance, Catamarca has already declared the industrialization of lithium. Moreover, a regional committee has been established for the management of lithium in Jujuy.

In addition to being one of the lightest solid metals, this metal, sometimes known as “white gold,” is renowned for its high electrical connection and high energy density. In other words, it enables you to store a lot of energy in a small area.

The Earth’s crust has an uneven distribution of lithium. There are three separate continents where the three biggest producers of this metal are found. Australia will lead the world in lithium mining production “by far,” according to the same website and data from the United States Geological Survey, with 55,000 tons produced in 2021. Chile, which has the biggest lithium reserves in the world, estimated at 9.2 million tons. Chinese mining, with a production of 14,000 tons, is now in the third position.

As one of the top four producers of lithium, Argentina. The nation inked contracts with Bolivia to create lithium batteries and cells this year, and it produced 6,200 tons of lithium in 2021. Bolivia, which has the greatest lithium brine deposits in the world, nevertheless has some difficulties exporting this metal from the Salar Uyuni, despite the restart of its manufacturing of lithium in 2021.

Use An API

As you will see, this metal has many opportunities to develop shortly in various industries. All over the world, people require this metal. For this reason we must take into account that many investors around the world are looking at the behavior of the prices of this metal. However, they do not always find reliable sources with exact prices.

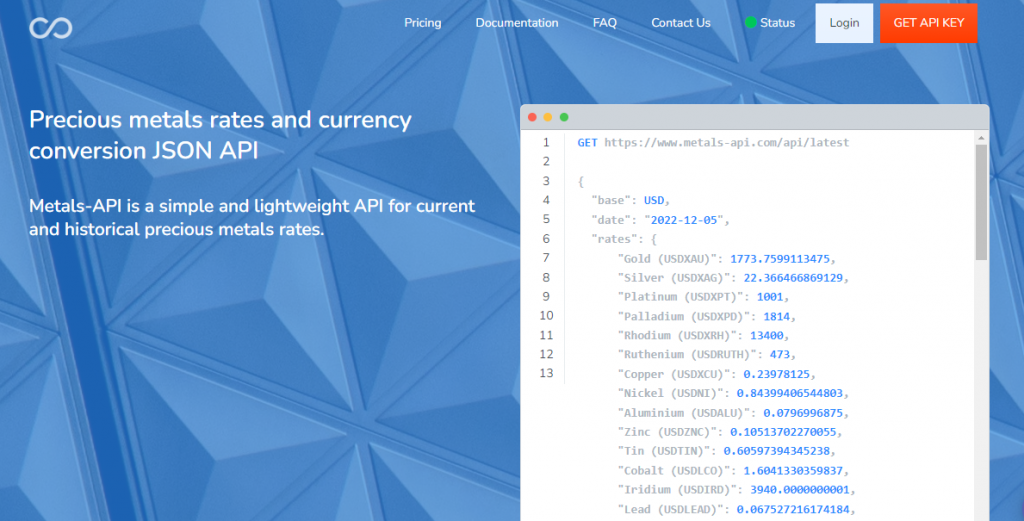

Or they have to do an exhaustive analysis of sites to see which one is giving data in real-time. Here we want to propose a solution to this problem, and this solution is Metals-API. This API updates information at all times on various metals. Here’s a kind of response to it:

About Metals-API

Metals-API is one of the most requested around the world, first of all, because of its great utility. An API that provides real-time. But also historical data helps investors to have a much more complete idea of the state of the market.

This generates the conditions to achieve better investments. It also collects your information from the most prestigious financial authorities in metals such as LBMA. That is why we say that it is an LBMA rates API. You can also integrate it into your site or app in the programming language with which you work recurrently.