Do you want to get the best gold price per ounce calculator of the year? It can be found in this Metals API that we propose here!

2022 has gotten off to a strong start for gold. Its price has soared to new all-time highs as a result of various variables that we shall discuss later. Because they are aware that the value of gold would always be preserved, families have utilized it as a means of wealth preservation and transfer for millennia. The dollar might lose value when compared to other currencies while being one of the world’s most significant reserve currencies at the moment. When this occurs, the cost of gold soars.

The price of gold often rises along with the expense of living. Investors have witnessed rising gold prices during periods of high inflation while stock markets have fallen. This is because gold is priced in those currency units and appreciates when the cost of living rises, but fiat money loses buying power during periods of severe inflation. On the other hand, during a deflation, individuals tend to hoard gold instead of cash, which increases gold’s buying power.

People acquire gold when international tensions increase in addition to hoarding it during economic downturns. Although the supply of gold won’t run out, as we’ve already said, there are still several variables that restrict its creation. Since 2000, less fresh gold has been extracted from mines. A new gold mine may take 5 to 10 years to establish, so as mines close, prices may increase.

How Is Gold Performing Right Now?

For investors, COVID undoubtedly provided a “golden” opportunity. The Federal Reserve decided to lower interest rates to just over zero in March 2020, and they also agreed to purchase bonds worth hundreds of billions of dollars on top of that.

Due to the decline in rates in the fixed-income markets, investors began to purchase gold. The price rose in tandem with the rise in demand. Similar to how its price declined in 2021 despite rising by almost 22% in 2020.

The decline in physical demand is one of its causes. In 2020, central banks’ annual gold purchases will drop by 60%. Many central banks dipped into the rising reserve portfolios due to gold’s performance during the worst of the epidemic and acquired liquidity.

Currently, an ounce of gold costs about 1900 dollars. The commodity had a 10% increase since last February 24, 2022—the day the war in Russia and Ukraine officially began—which it has since adjusted downward. In August 2020, the “haven asset” hit its highest value of $2,130 per ounce. This is an increase of 11.32% above the price at the moment.

Get Gold Price Per Ounce

You’ll notice that the metal’s destiny is rather complicated. That is why a lot of individuals want investing in it or keeping it as an investment. Several of them wish to apply it to their respective fields. This necessitates that they continuously monitor gold prices.

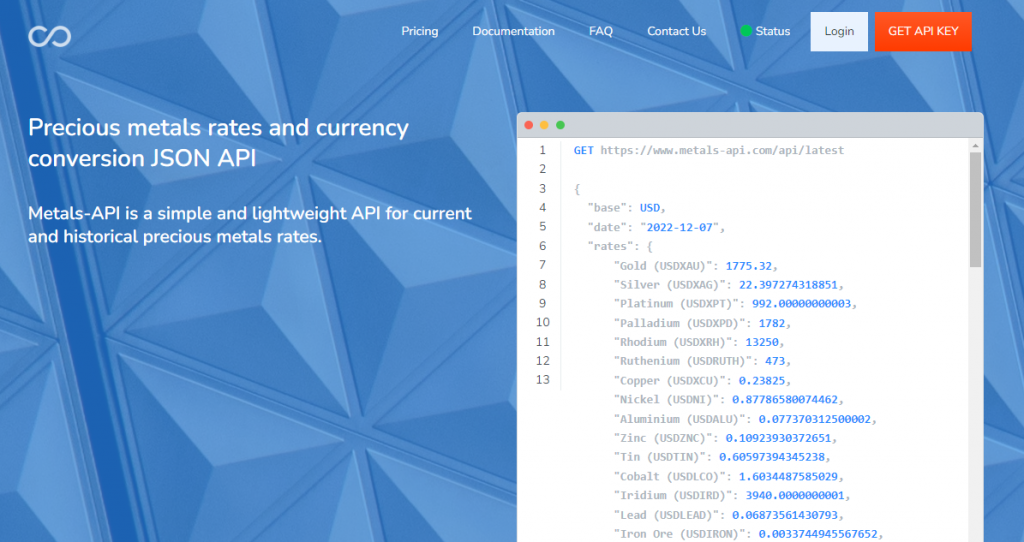

However, it is not the sole factor. They should also regularly monitor pricing changes, how they might differ from nation to nation, and what variables affect the market, for instance, if the nation imposes specific limitations on the buying of goods. Being at the leading edge of the digital era means using an API like Metals-API to get a complete picture of the industry. Below is an example of an API response:

Why Metals-API?

Update values of different metals in real-time using the Metals-API. In the denomination of your selection, you may view both recent and historical values there. It is incredibly simple to include in programs and websites.

You can create excellent material for your networks thanks to this. Attract more visitors with this method because individuals will flock to you since you have the most detailed data. Any business that wants to provide financial assistance to its metal investor clients must include this API. Additionally, because it originates from major financial institutions, all the data is trustworthy.