Credit card recognition API and Credit Card OCR API are tools that enable developers to identify and validate credit card information from various sources, such as images, scanned documents, or user inputs.

These APIs can be used in applications for tasks like payment processing, data entry, and fraud prevention. To learn about its use cases and advantages, keep on reading.

Developers satisfy their clients´ needs by customizing automated tools that can scan and recognize data from images. They use Credit Card OCR API as the basis for their developments. The software that integrates a suite of associated APIs is efficient, accurate, functional and -above all- affordable, as it offers a no-cost plan to start trying it out, and other paid plans to meet everyone´s requirements.

What Are The Benefits Of The Tool?

The application allows to securely capture and validate credit card details in your applications. It offers client-side and server-side SDKs for easy integration.

Likewise, it´s a popular payment processing platform that offers credit card recognition and validation capabilities. It includes client libraries for various programming languages to help developers integrate payment functionality into their applications. It also supports tokenization for added security.

Developers can use this suite of tools to securely collect and verify credit card details for payments. Additionally, these automated data capture APIs support various programming languages and offer secure ways to handle credit card data.

It`s important to notice that after extracting the text, you would need to implement custom validation logic to ensure the extracted information is a valid credit card.

Considerations On Choosing The Best Credit Card OCR API

When choosing a credit card recognition API, consider factors such as security, compliance with payment industry standards (e.g., PCI DSS), ease of integration, and the availability of client libraries or SDKs for your preferred programming language. Additionally, remember to handle credit card data securely and follow best practices to protect sensitive information from potential security risks and breaches.

Moreover, ensure the affordability of the software. Credit Card OCR API and its suite of applications offers a no-cost and paid plans, so it meets all needs and budgets.

Advantages Of Using Credit Card Recognition API

This suite of applications for credit card recognition offer several benefits when integrated into applications or systems for various purposes. Here are some of the key advantages of using a credit card OCR API:

Credit card OCR APIs automate the process of entering credit card information, reducing manual data entry errors and saving time for users and businesses. In addition, OCR technology is highly accurate in recognizing and extracting text from images, including credit card numbers, expiration dates, and cardholder names.

Moreover, for e-commerce, mobile apps, and point-of-sale systems, credit card OCR APIs streamline payment processing. Besides, it improves the user experience by simplifying the input of payment details.

As regards security, OCR APIs can be designed with security in mind, ensuring that sensitive credit card data is handled securely. Furthermore, they include built-in validation checks to detect invalid or potentially fraudulent credit card numbers.

Above all, using a reputable credit card OCR API can help businesses ensure compliance with payment industry regulations and standards, such as PCI DSS, which mandates secure handling of credit card data. Further they are typically designed to be integrated into various platforms, including websites, mobile apps, and backend systems.

More Reasons For Choosing Credit Card Scanning API

Regarding Cost-Efficiency, by reducing data entry errors and improving efficiency, credit card OCR APIs can lead to cost savings for businesses, particularly in terms of time and resources spent on manual data entry and validation.

It must be highlighted that Credit card OCR APIs are useful in a wide range of industries and applications beyond payment processing, such as identity verification, document management, and financial services.

In short, the software is optimized for mobile applications, allowing users to scan their credit cards using their smartphone cameras. Finally, it supports multiple languages and can recognize credit cards issued by various financial institutions worldwide, making them suitable for international businesses.

Overall, credit card OCR APIs offer an efficient and secure way to handle credit card data, improving user experiences, reducing errors, and enhancing the capabilities of payment and financial applications. However, it’s important to choose a reputable provider and ensure proper security measures are in place when working with sensitive financial information.

How To Start With An OCR API

Once you already count on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

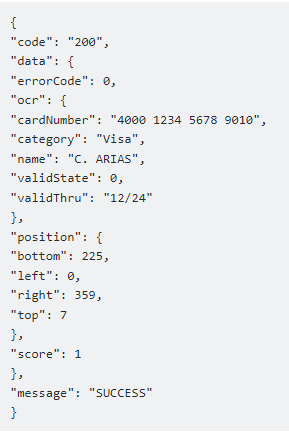

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“https://www.visa.com.ag/dam/VCOM/regional/lac/ENG/Default/Pay%20With%20Visa/Find%20a%20Card/Credit%20Cards/Classic/visaclassiccredit-400×225.jpg” in the endpoint, the response will look like this: