OCR (Optical Character Recognition) technology allows to extract text and information from images, including credit card data. With the wealth of transactions and payments with credit cards it´s essential for all enterprises to count on a tool like Credit Card OCR API to automate processes.

To find a credit card OCR API with enterprise plans, there are some general steps so as to guarantee efficiency and accuracy.

Developers do their job in devising applications for their clients. They customize tools to ensure efficiency and accuracy. At the same time it´s necessary to guarantee that the customers´ data are kept confidential, so as to prevent phishing and scamming. Developers choose the most robust tool on the market for their developments: Credit Card OCR API.

What To Consider When Choosing An OCR API

After researching on OCR API providers that offer credit card OCR as part of their services, check what the enterprise plans are for affordability. Compare features and pricing to determine which one best suits your specific requirements. Pay attention to factors such as accuracy, speed, language support, and data security. If you have any doubts, contact the sales team.s

You must test and evaluate the software before committing to a provider. It´s crucial to review terms and conditions to ensure they align with your business needs and regulatory obligations. Consider consulting with your organization’s legal and IT teams to ensure compliance with relevant regulations when handling credit card data.

Benefits To Using A Credit Card OCR API

Using a Credit Card OCR (Optical Character Recognition) API can offer several benefits, especially in financial and e-commerce applications. Here are some of the key advantages:

Credit Card OCR allows for quick and accurate extraction of credit card information, such as cardholder name, card number, expiration date, and CVV code, from images or scanned documents. This reduces the need for manual data entry, minimizing errors and saving time.

In e-commerce and mobile payment applications, users can easily scan their credit cards using their device’s camera instead of manually typing in their card details. This streamlines the checkout process, making it more convenient and user-friendly.

OCR technology has become highly accurate, minimizing the risk of typographical errors associated with manual data entry. This can help prevent payment processing errors and reduce fraud risks.

Credit Card scanning APIs can integrate seamlessly into automated workflows, allowing for clean payment processing and financial transactions without human intervention. This is particularly valuable for businesses dealing with high transaction volumes.

How An OCR API Boosts Transactions And Operations

By reducing the need for manual data entry and associated labor costs, organizations can achieve cost savings and operational efficiency. In turn, OCR-enabled credit card scanning speeds up the payment process, leading to shorter checkout times for customers. This can improve the overall shopping experience and increase conversion rates.

OCR technology can help ensure that credit card data is accurately captured and securely processed, aiding in compliance with data security regulations such as PCI DSS (Payment Card Industry Data Security Standard). The application ensures the versatility of integrating into various systems,

Credit Card OCR APIs can handle a high volume of transactions, making them suitable for businesses of all sizes, from small startups to large enterprises. When combined with real-time verification, the software checks to ensure that the credit card is valid and has not been reported as stolen or lost.

It’s important to note that while Credit Card OCR APIs offer numerous benefits, they also come with responsibilities related to data security and compliance. Businesses must handle credit card data in accordance with industry regulations and best practices to protect both their customers and themselves from security breaches and legal liabilities.

Most Common Use Cases Of Credit Card API

Credit Card OCR APIs are used in various applications and industries to extract information from credit cards accurately and efficiently. Some of the most common use cases include:

Credit Card OCR APIs streamlines the checkout process and reduces the need for manual data entry, making online shopping more convenient. Mobile payment and digital wallet apps often incorporate Credit Card OCR to facilitate card linking and transactions. Users can add their cards to the app by scanning them, and the OCR extracts the necessary card details.

Businesses, especially in the retail and hospitality sectors, use Credit Card OCR to quickly and accurately process card payments at physical locations. This speeds up the checkout process and reduces errors associated with manual entry. Hotels and travel booking platforms use Credit Card OCR to expedite the check-in process. Guests can scan their credit cards upon arrival, reducing the time spent at the front desk. Additionally, expense tracking and receipt scanning apps use Credit Card OCR to extract credit card information from receipts, helping users monitor their expenses and manage their finances.

Banks and financial institutions use Credit Card OCR in various applications, including account opening processes, loan applications, and mobile banking apps, to extract card information securely. The software also allows KYC Verification of the identity of customers by extracting and validating their credit card information.

Extensive Use Of Credit Card API

Loyalty program apps can use Credit Card OCR to allow users to easily add their membership or loyalty cards by scanning them, ensuring accurate card data entry. In the case of parking and toll booths Credit Card OCR tools allow to read credit card information quickly for payment processing, improving traffic flow and efficiency.

Subscription-based businesses, such as streaming platforms and subscription boxes, use Credit Card OCR to facilitate the signup process for new subscribers. The software also boosts document management systems to automatically capture and index credit card information from scanned documents and images.

Credit Card OCR can be used in fraud prevention systems to verify cardholder information during transactions, reducing the risk of fraudulent activity. In industries like online gambling, where age verification is crucial, Credit Card OCR can help confirm the cardholder’s age based on the date of birth extracted from the credit card.

Last not least, this application is useful in healthcare facilities to quickly and accurately capture payment information from patients’ credit cards during billing processes. Besides, government agencies can use Credit Card OCR to facilitate online payments for services such as permit applications and tax payments.

These are just a few examples of how Credit Card OCR APIs are applied in various sectors to streamline processes, enhance user experiences, and improve accuracy and efficiency when dealing with credit card information.

For further details you can read: https://www.thestartupfounder.com/quick-guide-for-the-best-credit-card-ocr-api/

To Start Using Credit Card OCR API

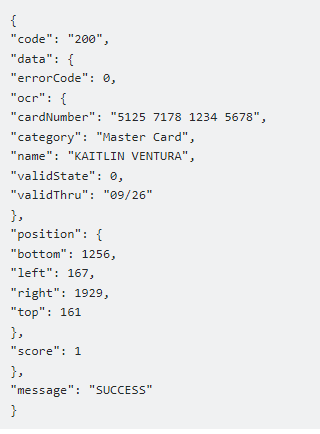

If you already have a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“ https://www.bdo.com.ph/content/dam/bdounibank/en-ph/cbg-marketing/cards/credit-and-debit/master-card/standard-mastercard/Standard_Mastercard.png” in the endpoint, the response will look like this: