If you’re looking for a Credit Card OCR API to integrate into a payment platform, several OCR services and providers offer this capability. Below are a few guidelines that you can consider for extracting credit card information in payment platforms.

Before choosing an OCR API for your payment platform, consider factors such as the accuracy of text extraction, security, compliance with data privacy regulations (especially if you are dealing with sensitive credit card data), pricing, and ease of integration. Additionally, ensure that the OCR solution you choose aligns with your platform’s specific requirements and can handle the expected volume of credit card scans and extractions.

Developers devise applications for payment platforms as well, so as to ensure efficiency and accuracy in the processes. They customize the tools as per their clients´ needs, on the basis of the strongest software on the market: Credit Card OCR API.

Advantages Of Using Credit Card OCR API

Integrating a Credit Card OCR (Optical Character Recognition) API into payment platforms offers several benefits, enhancing both user experience and operational efficiency. Here are the key advantages.

Credit Card OCR enables users to scan their credit cards using their device’s camera, eliminating the need for manual data entry. This streamlines the payment process, making it faster and more user-friendly. Likewise, manual data entry is prone to typographical errors. Credit Card OCR minimizes these errors, ensuring that credit card information is accurate thus reducing the risk of payment processing errors.

Providing a credit card scanning feature in your payment platform improves the user experience by simplifying the checkout process. Users appreciate the convenience of not having to type in their card details. In addition, a more straightforward and error-free payment process can lead to higher conversion rates, as it reduces friction and cart abandonment rates during the checkout process.

By automating the card data entry process, you can reduce the cost associated with manual data entry and correction, leading to cost savings over time. Besides, Credit Card OCR can integrate any system with robust security measures to protect sensitive credit card data. This includes encryption and compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard).

Some More Benefits To Using The OCR API

Furthermore, OCR APIs integrates into various payment platforms, including mobile apps, websites, and point-of-sale (POS) systems, ensuring versatility in catering to different customer needs. On top of that Credit Card API can help ensure that cardholder data is accurate and secure, aiding in compliance with data security and privacy regulations.

The software guarantees real-time verification, internationalization, it´s mobile friendly and offers competitive advantage to attract users. Moreover it can handle a high volume of transactions, making them suitable for both small startups and large enterprises.

While Credit Card OCR APIs offer numerous advantages, it’s essential to choose a reliable provider, implement robust security measures, and ensure compliance with industry regulations to protect both your business and your customers’ sensitive data.

Most Frequent Use Cases

Credit Card OCR API is a versatile tool that finds applications in various industries and use cases. Here are some of the most common use cases for the software.

The application is frequently useful for e-commerce websites and mobile apps to simplify the checkout process. Additionaly payment gateways and processors integrate Credit Card OCR to facilitate card payments. This includes online and in-person transactions to guarantee the cardholder’s data accuracy and safety.

Mobile payment apps often use it to allow users to add their credit cards to their digital wallets. Likewise retailers and businesses use it to speed up the checkout process. Furthermore, expense management apps use OCR to extract data from receipts, including credit card transactions.

Financial institutions use OCR API for customer identity verification. In hotels and travel booking platforms, an API simplifies the check-in and payment processes. On top of that subscription-based businesses use Credit Card OCR to facilitate the signup process for new subscribers.

Automated parking systems and toll booths use the software to process payments quickly. Healthcare facilities may use it to extract payment information from patients’ credit cards during billing processes. Government agencies also use Credit Card OCR to facilitate online payments for various services, such as permits, licenses, and taxes.

Identity verification processes, donations and fundraising use Credit Card OCR API to simplify the donation process. This lets donors scan their credit cards for contributions.

Event ticketing platforms may use Credit Card OCR to streamline the ticket purchasing process. This way the process is faster and more convenient for attendees. The tool is also useful for lending institutions to extract credit card data as part of the loan application process to assess applicants’ financial situations.

These are just a few examples of how Credit Card OCR APIs apply in different industries and use cases. This allows to improve efficiency, accuracy, and user experience when dealing with credit card information.

How To Start Using Credit Card OCR API

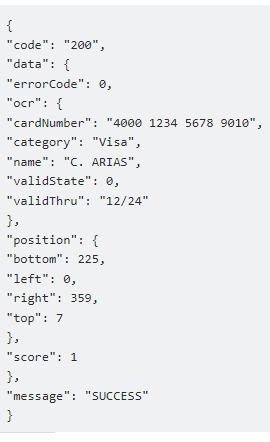

Counting on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“https://www.visa.com.ag/dam/VCOM/regional/lac/ENG/Default/Pay%20With%20Visa/Find%20a%20Card/Credit%20Cards/Classic/visaclassiccredit-400×225.jpg” in the endpoint, the response will look like this: