Big Business-to-Business (B2B) companies are those that provide goods and services to other businesses rather than to consumers. These companies provide a wide range of products and services, including those related to the manufacturing, transportation, financial, and retail sectors. Payment traffic between them is optimized with the use of Credit Card OCR API.

These businesses are characterized by their high volume of transactions and large amounts of data. For this reason, they use all kinds of tools to process their transactions and data. One of these tools is Artificial Intelligence (AI) which allows them to automate processes and save time and money.

B2B companies have a significant role in the world economy as they are responsible for generating a significant portion of the world’s economic growth. This is due to the fact that they are constantly purchasing and furnishing products and services from other businesses. Also, they need to constantly improve their processes so that they can be more competitive in the market. This is why developers customize tools for them to use high-quality software like Credit Card OCR API and the full suite of applications that add efficiency, accuracy and flexibility to the process.

An OCR API can recognize text from images and documents. This means that businesses can use it to extract information from images like receipts and invoices, as well as contracts and cards. As a result, they can digitize all of their important documents and save them in a safe place.

Most Frequent Use Cases Of An Optical Character Recognition API

Moreover, B2B companies can use an OCR API to enhance their processes. For example, if they want to develop a new process for the sales department, they can test it with an OCR API before implementing it in the company. This way they will know if it is effective or not before actually implementing it.

Likewise, with an OCR API, B2B companies can digitize all of their receipts and invoices. As a result, they will have a clear view of the balance statement. Plus, with this information at hand, it will be easier for them to create budgets and know exactly how much money is available at any given time.

Why A Credit Card Scanning API For B2B Companies

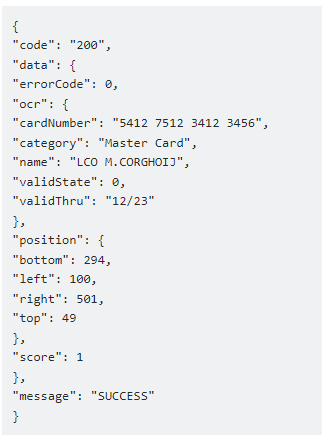

The Optical Character Recognition API works with JSON responses which are easy to understand and analyze. With this information at hand, B2B companies can easily identify the purchases made by their clients and analyze them in detail. Also, they can digitize all of their receipts and invoices and generate safe databases, which will help them save time and money.

To try The Optical Character Recognition API, all you need to do is enter the URL of any image you want to analyze into the API. Then, you will receive a JSON response with all of the information from this image in seconds!

Even though there are many types of APIs, an OCR API is one that has the ability to recognize text, even handwriting. This kind of API uses ML technology to identify characters and symbols.

Evidently, this kind of API is perfect for B2B companies that work with a lot of documents. This is due to the fact that they have to analyze and read a lot of texts, and the application can support many elements simultaneously. Consequently, an OCR API will speed up the process and facilitate their job.

B2B companies are usually larger firms that have a lot of purchasing power and are in need of constant supplies. As a result, they are constantly looking for new suppliers who can provide them with the best products and services at the most reasonable prices.

Because of this, B2B companies have a lot of data to process on a daily basis. For instance, they must take into consideration all the information that is gathered by their potential customers. Also, they must keep track of the data they receive from them. Plus, they must gather information about their own suppliers and more!

Main Features Of A Credit Card API

An OCR API has the ability to work with Sofware programs which means that it can integrate seamlessly into a company’s processes. As a result, it will be easier for companies to analyze and organize all their data in one place.

Consequently, B2B companies will have easier access to all their data. This way they can perform better analyses, create better relationships with their clients, and more!

Efficiency, accuracy, functionality, versatility, flexibility and -on top of that- affordability. Try it out on the no-cost plan, and then choose the version that best suits your needs.

The text thus obtained can be exported in different formats such as Excel or CSV. They also allow you to export it in a program language such as JavaScript or Python.

This automated data capture API works well with all types of images: jpg, jpeg, png, tiff, bmp, and more! You can export the text in different formats such as Excel or CSV, or even program languages like JavaScript or Python, as above explained.

To Start Using Credit Card OCR API

If you already count on a subscription on Zyla API Hub marketplace, just start using, connecting and managing APIs. Subscribe to Credit Card OCR API by simply clicking on the button “Start Free Trial”. Then meet the needed endpoint and simply provide the search reference. Make the API call by pressing the button “test endpoint” and see the results on display. The AI will process and retrieve an accurate report using this data.

Credit Card OCR API examines the input and processes the request using the resources available (AI and ML). In no time at all the application will retrieve an accurate response. The API has one endpoint to access the information where you insert the code for the product you need a review about.

If the input is :

“https://www.mastercard.ca/content/dam/public/mastercardcom/na/ca/en/consumers/find-a-card/other/mastercard-standard-credit-card-600×338.png” in the endpoint, the response will look like this: