If you want to get the best commodity data API for portfolio optimization, keep reading this post.

Commodities, as fundamental items, are an important part of the economic structure and a people’s way of life, because scarcity or plenty in the production of goods, as well as changes in their pricing, impact numerous productive sectors. Furthermore, many individuals use raw commodities as investment assets.

Products are still used in financial and economic transactions today. Profit margins in this market might be unstable since they are goods that are dependent on external factors, transactions, and high returns. As a result, there exist to spot and future contracts in the global trade of basic items that attempt to build an understanding of the general status of the market.

Optimize Your Portfolio

In particular, inflationary pressures and market indicators need the development of financial procedures to assure a better rise and, in general, to optimize fiscal, tax, and commercial performance.

As a result, in times of recession, financial instability, or economic calamity, commodities become an investment choice. They do, however, have a different investing nature because they are products.

There are marketplaces or cash desks that provide raw material investment portfolios. As a result, you can invest directly in the item, purchase shares in firms that create raw materials, or buy shares in raw material markets.

However, it is crucial to comprehend how to collect and store the items, manage logistics, and, if you want to sell at this time, evaluate the conditions and a consumer. Portfolios enable a person’s investments to be optimized since they give detailed information on each prospective asset.

When dealing in natural resources, take into account that their degree of activity is high because they serve as an ingredient in the production of all sorts of goods and services, making them appealing to all types of investors and customers.

Make Use Of An API

Commodity market information can be valuable in a variety of financial contexts. As previously said, it is critical to be able to predict commodity activity to determine their active condition. In this manner, you may provide a variety of goods to your consumers to invest and safeguard their money in such a turbulent globe.

An API is required for this and other investigations. This is a tool that refreshes a large amount of data in a matter of seconds. That is why programmers use it to build websites and applications. They don’t have to waste time updating the information every day because the API handles it for them.

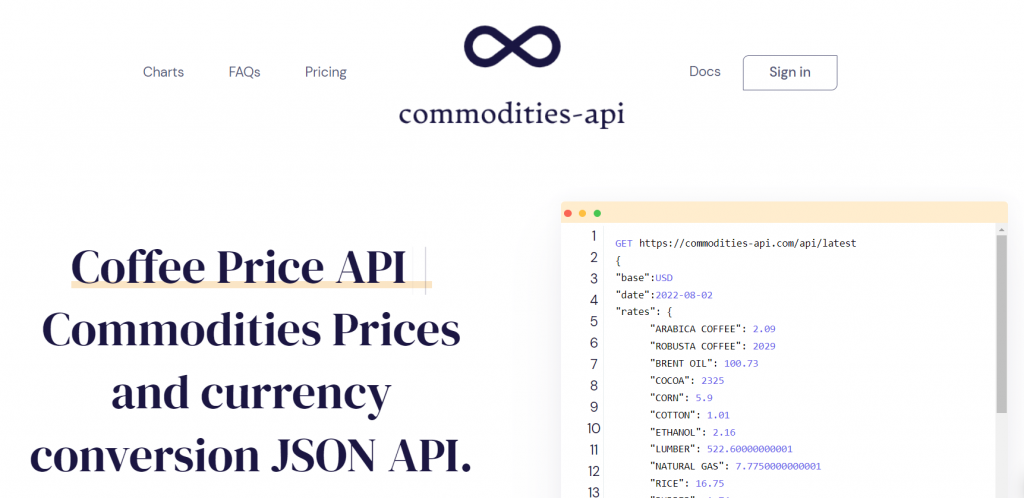

In this scenario, we propose that you use the Commodities-API, which is the most comprehensive in terms of commodities. You will discover a large variety of them, as well as cash and futures contracts, and you will be able to witness how different markets increase and collapse.

About Commodities-API

Commodities-API will provide you with a thorough insight into the worldwide natural resource sector. You will be able to examine how prices change and compare current rates to past rates. All pricing may be viewed in several worldwide currencies and used in many computer languages.