The world of investment is a realm driven by data, analysis, and timely decisions. Among the diverse financial instruments available, Exchange-Traded Notes (ETNs) have emerged as a prominent choice for investors seeking exposure to various markets. Specifically, Double Short ETNs present a unique opportunity for those looking to capitalize on market downturns. In this article, we delve into the intricacies of Double Short ETNs. We will explore the significance of accurate pricing data. Also, we will identify the best API to obtain real-time DB Gold Double Short ETN prices.

Understanding Double Short Exchange-Traded Notes (ETNs)

Exploring Exchange-Traded Notes (ETNs)

Exchange-Traded Notes, commonly known as ETNs, represent a distinct class of financial products that track various underlying assets, such as commodities, indices, or currencies. Unlike traditional exchange-traded funds (ETFs), ETNs are debt securities issued by financial institutions, promising the return of a specific index or benchmark, minus fees. Investors are exposed to the performance of the tracked index without directly owning its components.

Unveiling Double Short Strategy

The concept of Double Short ETNs introduces a compelling strategy for investors looking to profit from the decline of a specific asset. A Double Short ETN aims to provide double the inverse return of the underlying index. In simpler terms, if the tracked index experiences a 2% decrease, the Double Short ETN could potentially yield a 4% increase. This amplified strategy can be enticing for those who believe in the market’s downward movement.

Navigating the API Landscape for DB Gold Double Short ETN Prices

The Role of APIs in Financial Data Access

Application Programming Interfaces (APIs) play a pivotal role in the modern financial ecosystem by facilitating seamless access to real-time data. In the context of investment, APIs enable traders and analysts to retrieve up-to-the-minute market information, empowering them to make well-informed decisions promptly. For DB Gold Double Short ETN prices, a reliable API becomes an indispensable tool for accurate pricing insights.

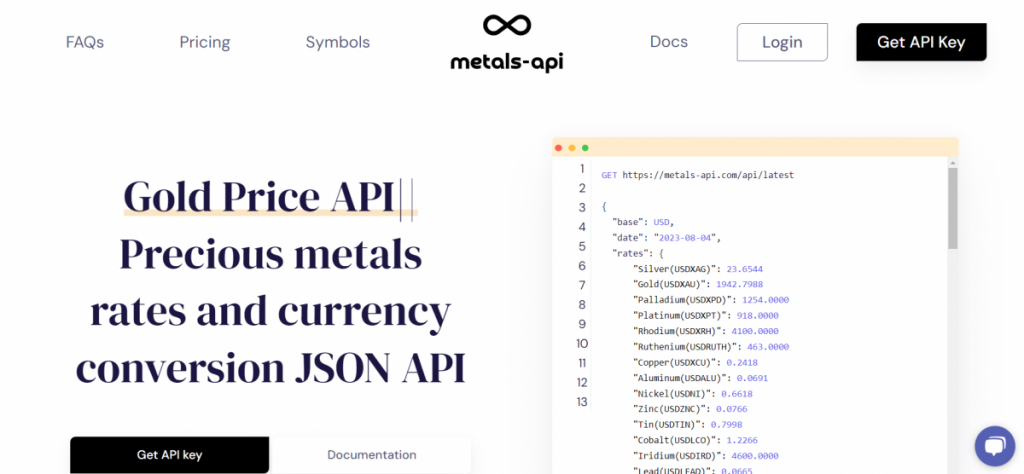

Use Metals – API To Obtain DB Gold Double Short ETN Prices

Metals-API is an open-source API that provides real-time and historical precious metals data. It can deliver exchange rates for precious metals, convert single currencies, return time-series data, fluctuation data, and the lowest and highest price of any day. To use Metals-API, you need to create an account, select a payment plan and get an API key. Once you have your API key, you can start making requests to the API. There are 10 endpoints!

The Metals-API is a powerful tool that can be used for a variety of purposes, such as:

-Building financial trading applications

-Creating price charts and visualizations

-Analyzing precious metals market data

The symbol for DB Gold Double Short ETN Prices is “DZZ”.

Watch this interesting YouTube video:

In the intricate world of investments, staying ahead of market movements is a constant challenge. Double Short ETNs offer a distinctive strategy for capitalizing on market downturns, and accurate pricing data is the key to executing successful investment decisions. The Metals – API emerges as the best choice for obtaining DB Gold Double Short ETN prices, offering real-time precision, customizable analysis, and seamless integration.

Read this post: Use This API To Get DB Gold Double Long ETN Rates