Do you need antimony historical prices? You should experiment with an API. In this article, we’ll go through how to get the best one.

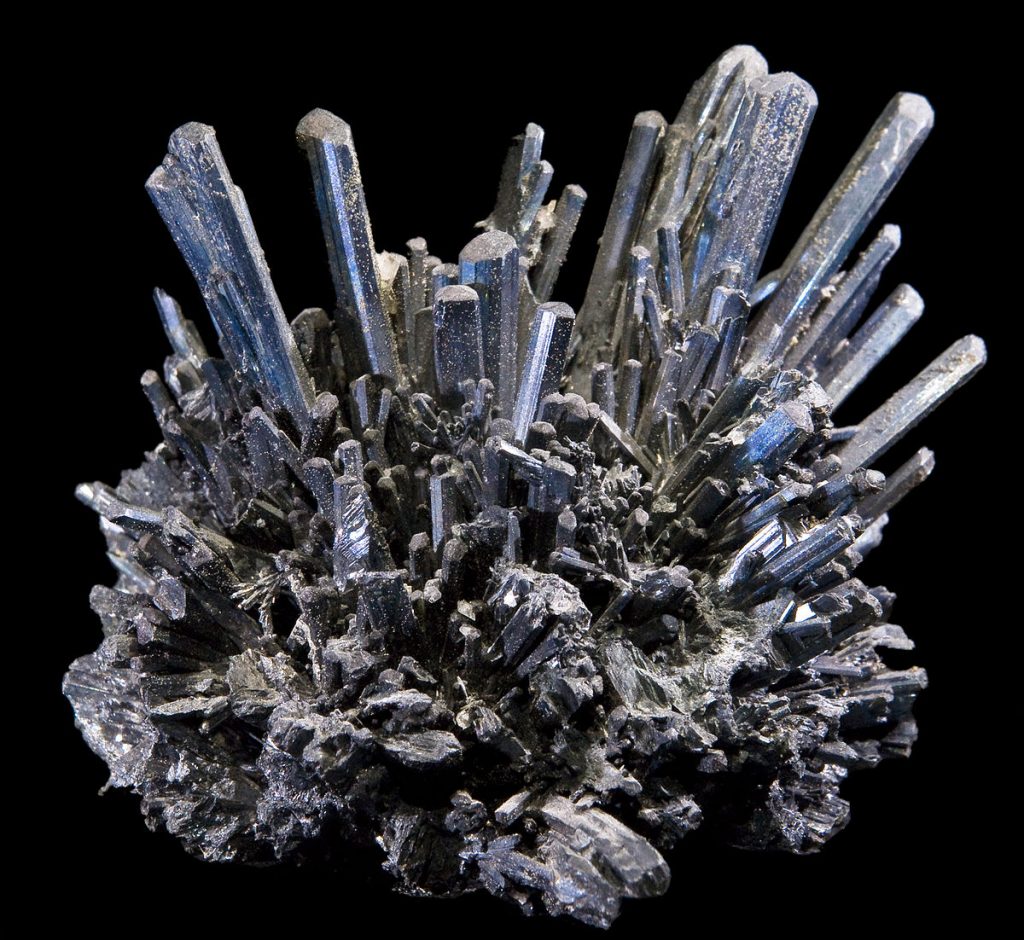

Antimony is classified as a semimetal. It is silvery, rigid, and brittle in its metallic state. This metal is used in the electronics sector to manufacture infrared sensors and diodes. To increase hardness and strength, it is alloyed with lead or other metals. Sectors of the economy use lead-antimony alloys to create batteries. Antimony alloys are used in printing machines as type metal, bullets, and cable wrapping.

To create flame-retardant materials industry use antimony compunds. They use it to create paints, enamels, glass, and ceramics. Despite this, antimony is an uncommon metal that may be found in tiny amounts in over 100 different mineral kinds. It is also present as a native component.

Market for Antimony

In 2021, the worldwide antimony ore and focus market gained for the first time since 2018, reaching $2.3 billion, correcting a two-year decline. Demand, on the other hand, did not rise between 2013 and 2021.

China used the most antimony ore and concentrate (345K tonnes), representing 60% of the total quantity. Furthermore, China’s antimony ore and concentrate usage have more than tripled that of Russia, the second-largest customer (108K tonnes). Tajikistan (43K tonnes) came in third overall, accounting for 7.4% of total demand.

Between 2007 through 2021, China’s projected annual volume growth rate was -6.1 percent. Russia and Tajikistan were the extra consuming countries with the highest average annual rates of consumption rise.

As you can see, it’s a very competitive industry. If you wish to work with this substance, you must first understand the antimony price, because its economic sectors are the newest and very dynamic. Keep a close watch on spot prices and historical values. It makes it simple to track and assess the elements influencing the price of your metal. You should utilize an API for this.

How Can I Get Antimony Historical Prices?

An API is a form of technology that enables one device in one location to transfer data to another or more devices in another location. You may observe prices and share them with your community. You can simply integrat the API answer into the design of a website or app.

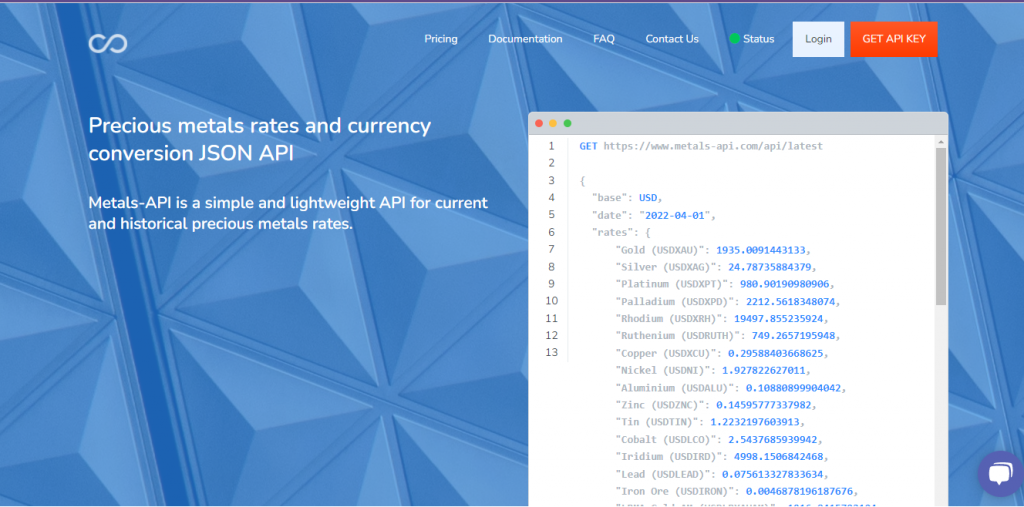

Metals investment is only possible if you have access to up-to-date information. As a consequence, they must examine its market price behavior to decide the optimum moment to invest. We recommend utilizing the Metals-API tool to retrieve this information.

About Metals-API

Metals-API is the finest API on the market. Its technique employs several precious metals, including antimony, lithium, gold, platinum, palladium, copper, and silver. All of this with up-to-date information and changes in under a minute!

That is, you will be able to determine the best moment to acquire this metal based on its properties. Metals-API, for example, will provide data from the preceding 19 years, such as the fact that palladium prices declined 17.12% in 2021. This type of knowledge might save you a significant amount of time and work.