If you want to invest in the metals industry, you undoubtedly want to have access to the most dependable sources of information regarding price behavior. We’ll go over an API that gathers data from Fastmarkets in this article.

Steel is a combination of iron and carbon, as well as other components such as magnesium, phosphorus, and sulfur. Steel has high tensile strength and a low production cost, which makes it a vital component in the construction of structures, infrastructure, equipment, cars, heavy machinery, and armament, among other things. Iron is the principal metal used in steel manufacture.

Iron is frequently generated as an ore, generally, iron oxide and iron is removed from its ore by the smelting process (removal of oxides from the ore). Iron has more carbon after smelting than is ideal for steel production.

As a consequence, surplus carbon is extracted from the ore and used in steel production. The raw steel object is then cast into ingots or billets, which are held until they are needed in following refining operations to produce the finished piece.

All advanced economies throughout the globe were essentially shaped by the strength of their steel industry during their early years of development. Steel is crucial in major economies and complicated manufacturing machinery such as vehicles, trains, and airplanes, as well as innumerable products used by people in their everyday lives ranging from flatware to automobiles. Steel is also used to build structures.

If you’re thinking about investing in steel, you should maintain track of metal prices. It is necessary to stay current on the most important retail prices from reliable sources such as Fastmakers.

What Are Fastmarkets?

Fastmarkets is the most dependable cross-commodity price reporting agency (PRA) in agricultural, forest products, metals and mining, and energy transition markets. Their pricing data, projections, and market analyses provide a strategic edge to their customers in complicated, volatile, and sometimes opaque markets. Euromoney Institutional Investor PLC, which is traded on the London Stock Exchange, owns Fastmarkets. Euromoney’s institutional shareholders are diversified.

You’ll need the right tools to acquire this information. As a result, we highly advise using an API that delivers both current metal prices and historical rates based on Fastmarkets data. Choose one that also includes volatility statistics so that you can consider all of the elements when selecting the optimal time to buy.

What Is An API?

A platform that links two devices or programs is known as an application programming interface (API). Finding an API is easy, but locating one that offers steel prices in Fastmarkets values is more difficult.

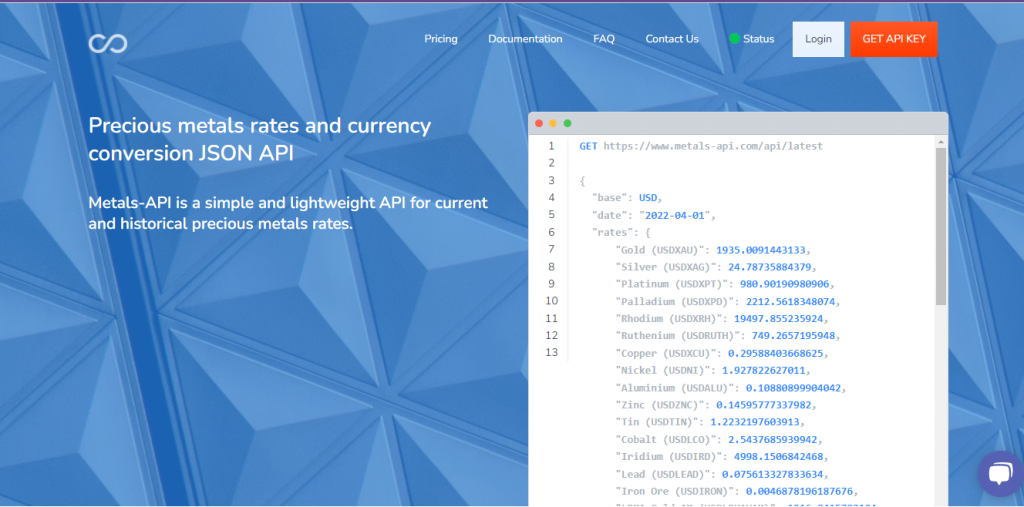

This data is compiled by Metals-API, one of the world’s largest precious metals stocks. To get current and historical rates, you may also use the API to embed it into your website or app, as well as the plugins on this site.

Why Metals-API?

Metals-API is software that provides real-time metal pricing data. At these conversion rates, over 170 currencies, including the US dollar, euro, and digital currencies, are available. You may view historical rates as well as spot rates. It is a New York rates API too, as well as rates from other institutions. To incorporate the data into your website or app, you may utilize a variety of computer technologies, including PHP, JSON, and Python.